The Analyst: defence – how to play the new tech sector

In the second of a series of articles discussing topical themes and investment strategies, analyst Dzmitry Lipski gives a view on the fast-growing defence industry.

20th February 2026 09:44

by Dzmitry Lipski from interactive investor

Defence has moved from being a short-term geopolitical trade to what many now view as a structural investment theme. After decades of relatively subdued military spending, governments across the US and Europe are increasing defence budgets in response to rising geopolitical tensions and more uncertain global order.

The war in Ukraine shifted investor sentiment, with some reassessing ethical exclusions and recognising defence as part of national and democratic security.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

Recent performance

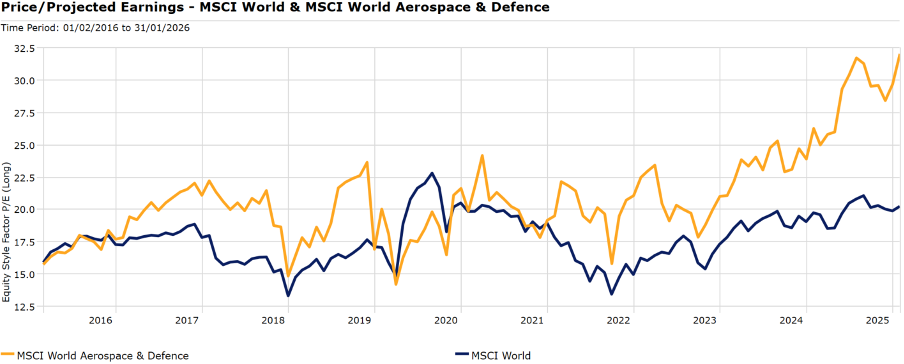

Defence stocks have performed strongly in recent years, particularly in Europe. Much of this reflects improved earnings visibility and expanding order backlogs. However, valuations for many companies now sit above their historical averages. This suggests future returns may be more dependent on earnings results than further valuation expansion. Investors should certainly expect periods of volatility, especially if geopolitical tensions ease or political priorities shift.

The below chart shows the degree to which valuations of defence companies (defined by MSCI’s Aerospace and Defence index) have risen beyond those of the wider equity market.

Source: Morningstar: MSCI Indices/Price to Projected Earnings Ratio.

Structural drivers intact

Structural demand for defence remains strong, supported by rising government budgets and ongoing geopolitical tensions. NATO members have committed to spending at least 2% of GDP on defence, with several countries now targeting 2.5% to 3% over time. In the US, annual defence spending is around $850–900 billion (£630-670 billion), while broader national security spending exceeds $1.4 trillion, providing multi-year revenue visibility and order backlogs that often extend 10 years for major contractors.

In the UK, the government committed to increasing defence spending to 2.5% of GDP by April 2027, with an ambition to reach 3% in the following Parliament. It has also outlined a longer-term goal of dedicating up to 5% of GDP to national security by 2035. At the Munich Security Conference, the prime minister suggested that progress toward these targets could be brought forward, reinforcing the direction of travel for defence expenditure.

- BAE Systems reports record-breaking year

- Ian Cowie: holding on for more after trebling money in under a year

Defence is new tech

Defence is increasingly becoming more technology focused. For some large defence companies, electronics, software and cyber systems now make up around 30% to 40% of their revenue.

Defence companies are investing heavily in new technologies to modernise how wars are fought - artificial intelligence (AI) to improve targeting and logistics, drones for surveillance and strike missions, hypersonic weapons that can travel at several times the speed of sound, and space systems such as satellites for communication and intelligence.

Here are just some examples of the listed companies forming part of the defence ecosystem:

Lockheed Martin Corp (NYSE:LMT) developing hypersonic weapons and missile-defence systems

Northrop Grumman Corp (NYSE:NOC) building satellites and space-based surveillance platforms

BAE Systems (LSE:BA.) expanding drone, cyber and electronic-warfare capabilities

Rheinmetall AG (XETRA:RHM) ramping up ammunition production to meet NATO demand.

That said, defence spending remains politically driven. These areas take a long time to develop and are supported by steady government demand. As such, changes in government, fiscal pressures and procurement delays can all affect company earnings.

The role in a portfolio

For investors who understand the risks, defence exposure can provide diversification within an equity portfolio. Historically, the sector has shown lower sensitivity to the broader economic cycle than many industrial businesses, with revenues typically declining less during downturns due to long-term government contracts.

- Gold, silver and defence: reasons to be bullish and bearish

- Defence’s running hot: is it too late to profit?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Defence has also shown relative resilience during inflationary periods. While fixed-price contracts can create short-term pressure, many long-term programmes include cost-adjustment mechanisms that help companies manage higher input costs over time.

Given the strong recent performance and current valuations, defence may be more appropriate as a satellite allocation rather than a core long-term holding.

How to gain exposure

Investors with more experience can gain exposure through individual shares, but this carries company-specific risk. For more diversification and exposure to the wider defence theme, exchange-traded funds (ETFs) may be a more practical route, but it is worth being aware that these thematic ETFs can still become quite concentrated in a relatively small number of holdings.

The VanEck Defense ETF A USD Acc GBP (LSE:DFNG) offers global exposure across aerospace, defence contractors and related technologies, with an ongoing charge of 0.55%. For investors seeking a more regional focus, the iShares Europe Defence ETF EUR Acc GBP (LSE:DFEU) provides exposure to European defence companies, with a lower ongoing charge of 0.35%.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.