Analyst turns optimistic on Saga shares

Shares in the over-50's services firm have taken a battering, so our chartist assesses odds of a rebound.

12th December 2019 09:29

by Alistair Strang from Trends and Targets

Shares in the over-50's services firm have taken a battering this year. Our chartist assesses odds of a rebound.

Saga

Recent price movements against Saga (LSE:SAGA) are not terribly encouraging, though we suspect it shall find some sort of excuse for a bounce anytime soon.

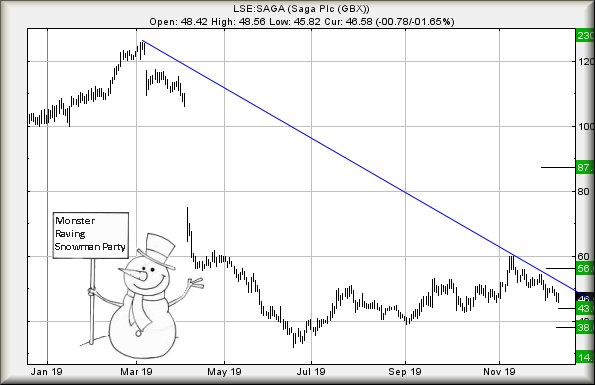

As the chart shows, price moves are carefully following the downtrend. This sort of nonsense will generally complete with a sudden spike downward, followed by a rebound.

In the case of Saga, weakness now below 45.5p suggests coming travel down to an initial 43p.

If such a level breaks, it calculates with a secondary at 38p and hopefully a proper bounce.

In the event the price manages to exceed blue on the chart (presently 52.8p) we're looking at an initial ambition of 56p with secondary, if bettered, a longer term 87p.

We strongly, very strongly, suggest holding fire on that 87p until such time the price actually closes above 56p.

In addition, there's a very obvious glass ceiling awaiting at 60p, one which shall doubtless be employed to create some hesitation.

On the "down side" of things, we'd be quite alarmed if Saga now dropped below 32p as 14p presents the lowest we can calculate.

In summary, we think this shall be worth watching for a spike down at the open in the days ahead. The visuals suggest this should be used to jump start a rising cycle.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.