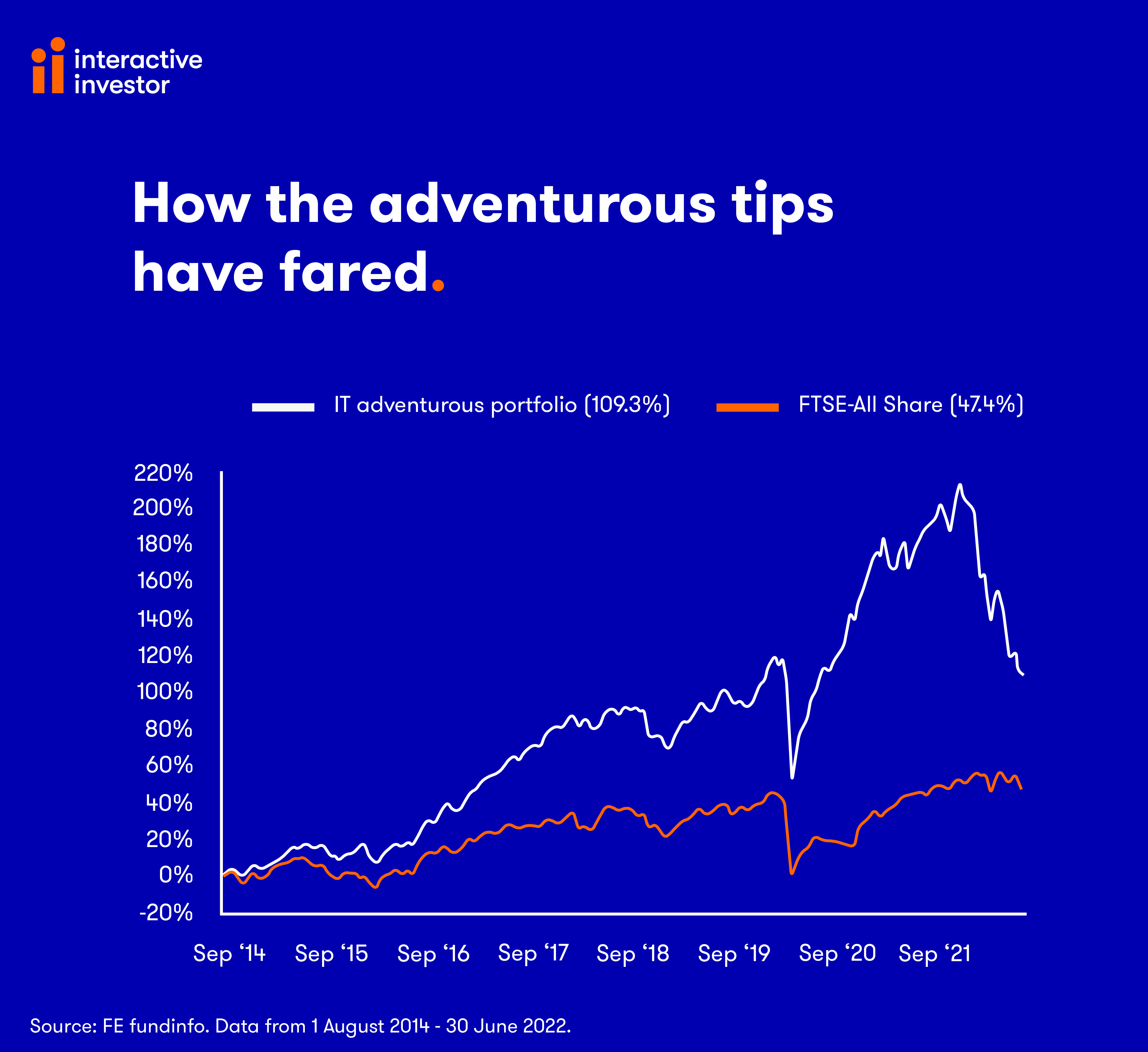

Andrew Pitts’ 10 adventurous investment trust tips: July 2022

27th July 2022 09:00

by Andrew Pitts from interactive investor

Andrew Pitts names his adventurous selections for the next 12 months across all the main equity investment trust sectors.

Andrew Pitts’s trust tips (adventurous and conservative portfolios) were first introduced by Money Observer more than 20 years ago. Their performance began to be monitored as portfolios in August 2014. In July 2020, Andrew took over the portfolios. The trust tips are made by Andrew and not interactive investor.

Each portfolio contains 10 trusts split equally between geographic regions or strategies There is an editorial update of the portfolios every quarter. The annual review of the portfolios takes place every July.

Global – Monks

Monks is one of three Baillie Gifford-managed trusts held in the adventurous portfolio. That its -32.3% total return over the year under review is the best of the trio underscores how badly the long-term growth strategy employed by most of the group’s funds and investment trusts has fared over the past year.

- Invest with ii: Buy Investment Trusts | Top UK Shares | Open a Trading Account

The weakness has been most notable over the past six months as lower economic growth and higher interest rate expectations have encouraged a rotation into cyclically defensive sectors and ‘value’ stocks.

The past year’s outsized loss has destroyed its previous strong outperformance against the benchmark FTSE World Index and its 16 peers in the global trust sector over the past three years. However, for the same reasons highlighted with the annual review of the conservative portfolio, the adventurous portfolio is also not minded to follow the market’s current fashion, and so Monks (LSE:MNKS) keeps its place.

Shares in the £2.6 billion trust were at the end of June trading on a -10% discount to net asset value (NAV) compared with -2% a year ago. Gearing of 8% has compounded losses at the portfolio level but if maintained will supercharge gains when market sentiment improves.

The trust, managed by Spencer Adair and deputy manager Malcom MacColl, is highly diversified with more than 100 holdings. Ongoing charges are low at 0.4%.

Japan – Baillie Gifford Shin Nippon

Identifying and holding innovative growth companies for the long term is a common thread among Baillie Gifford-managed trusts and Shin Nippon (LSE:BGS) is no different. Its active share of 94% shows how far the portfolio differentiates from the benchmark MSCI Japan Small Cap Index, which it has now fallen behind over the past three years, with the annual loss of -38.3% doing the damage.

Investing in smaller companies, in particular, is a long-term commitment and the smaller companies team led by Praveen Kumar has a silver Morningstar Analyst Rating, which provides comfort that the investment process is robust. As does the 300% return over the past decade.

The trust’s discount to NAV continues to slip: -8% at the end of June compared with a premium to NAV of 13% in November 2020.

North America – Baillie Gifford US Growth

The 57.5% loss over the past year is the worst among the adventurous portfolio’s Baillie Gifford-managed trio and virtually all came in the first half of 2022. It is also the worst performing of all 20 trusts in both portfolios. Compounding losses at the portfolio level has been a precipitous fall in its rating – from a premium to NAV of over 10% early last year to a discount of -18% at the end of June.

The £632 million Baillie Gifford US Growth (LSE:USA) trust has substantial holdings in unlisted companies, on the grounds that many companies in the US these days remain private for longer before seeking a listing on public stock markets. Such companies, 24 of the 73 holdings, can represent up to 50% of the portfolio at the time of investment and they accounted for 37% of total assets at the end of May.

Baillie Gifford’s early investments in today’s corporate giants such as Amazon (NASDAQ:AMZN), Tencent (SEHK:700), Alibaba (NYSE:BABA) and Tesla (NASDAQ:TSLA), are an indication of the rewards that such a strategy can eventually. With that in mind, the adventurous portfolio will be hanging on in expectation that the trust will rediscover its mojo before long.

UK equity income – Dunedin Income Growth

Given its focus on quality growth companies that manager Ben Ritchie (plus Samantha Brownlee and Rebecca Maclean since February) believes have the potential to grow their dividends, Dunedin Income Growth (LSE:DIG) has performed commendably in an environment that has favoured more cyclically defensive companies.

Unfortunately, that does not mean a positive return over the year. At -9.7%, the share price total return was impacted by a slight widening of the discount from -1% a year ago to -4.6%, although the total dividend was raised for the 38th year out of 42 (having been maintained in the other four years).

Although returns have lagged the benchmark FTSE All-Share index this year, they have been more than double the benchmark over the past three and five years.

The abrdn-managed £468 million trust has a strong focus on sustainable and responsible investments and will only back companies that meet the board’s criteria.

- Andrew Pitts' 10 conservative investment trust tips

- Funds and trusts four professionals are buying and selling: Q3 2022

- Have claims of the death of the 60/40 portfolio been greatly exaggerated?

UK growth – BlackRock Throgmorton

The UK growth category has been expanded from UK smaller companies to include trusts that can invest in companies of all sizes, namely those in the UK all companies trust sector.

BlackRock Throgmorton Trust (LSE:THRG) has been a member of both the adventurous and conservative portfolios over the years, but its strategy is more suitable for adventurous investors.

In the past year, BlackRock Throgmorton’s performance has morphed from heroic to dastardly, with the shares down a gut-wrenching -40.3%. It is a far cry from the 67.7% gain in the previous annual review, which was the best among all 20 trusts in the two portfolios.

The loss has been magnified by a de-rating of the trust from a small premium to a discount of around 8% to NAV.

It is particularly galling as the trust can invest up to 30% of assets in both long and short contracts for difference, allowing manager Dan Whitestone, in principle, to benefit from falling and rising stock prices. Clearly that has been of little or no benefit in this year’s ‘down’ markets, but Whitestone generally prefers to use the CFD exposure to boost long positions.

The £750 million trust has been through similar rough times and the BlackRock smaller companies team has an exemplary track record so it is being reinstalled as a member of the adventurous portfolio, replacing Henderson Smaller Companies (LSE:HSL).

Henderson Smaller Companies is a very well managed trust, but BlackRock Thogmorton has a much stronger performance profile over three, five and 10 years.

Europe – Montanaro European Smaller Companies

War, the threat of recession and a subsequent rotation into defensive companies put a heavy dent in the 44.9% gain recorded by this £280 million trust in the last annual review, with the share price total return of -29.9% over the past year.

The first six months of the year have been worse for Montanaro European Smaller Companies (LSE:MTE), which favours small to mid-sized European companies with strong growth prospects, underpinned by high free cash flow and a high ESG score. The shares are down a whopping -45.3% over the period.

Manager George Cooke invests in around 50 companies you’ve likely never heard of, given that the active share for the trust is 93%, demonstrating how far it deviates from the benchmark MSCI Europe ex UK Small Cap Index.

Despite recent weakness, the share price total return of 51% over five years is nearly three times that of the benchmark and the shares trade on a discount to NAV of -14% compared with -3% a year ago.

Emerging markets – Mobius Investment Trust

The brainchild of veteran emerging market investors Mark Mobius and Carlos Hardenberg has got off to a relatively good start compared with its 10 peers since Mobius Investment Trust (LSE:MMIT) was introduced to the portfolio last year, although a loss of -18.9% is hardly going to butter any parsnips.

Since its launch in 2018 with a remit to seek out undervalued and under-researched smaller and medium-sized companies in emerging and frontier markets, the £135 million trust’s net asset value has risen by 25% compared with 18% from Morningstar’s Emerging Markets GR index. However, a reversal in the discount to NAV since the last review means the share price total return since launch is 17.7%.

Shares in the £135 million trust, a member of interactive investor’s Super 60, were at the end of June trading at a discount of -7%.

Asia Pacific – Pacific Horizon

Last July I was tempted to switch into the Baillie Gifford-managed Pacific Horizon (LSE:PHI), which had a far superior long-term record to JPMorgan Asia Growth & Income (LSE:JAGI). That inaction paid off, to an extent, as the former has underperformed the latter over the year and markedly so in 2022 as investors take higher-risk stakes off the table. I also noted that Pacific Horizon regularly trades at a premium to net assets.

Indeed, a year ago the shares were trading at a near 10% premium compared with a discount at the end of June of around 7%, which is a significant de-rating. To my mind, this represents something of a bargain and an opportunity to replace the incumbent with an overtly growth-focused trust with an outstanding record to the adventurous portfolio roster.

With total assets of £600 million, the trust has competitive ongoing charges of just 0.78% and has been managed by Roderick Snell since 2013. He invests in around 40 companies (five of which are unquoted) with more than half of the portfolio invested in China and India.

Although a 30% loss over the past six months might not inspire confidence, with no guarantees that the drift might soon be arrested, the trust’s outstanding long-term record inspires confidence that normal service will be resumed before long.

- Top investors spot opportunity in ‘cheap’ tech

- Where to invest in Q3 2022? Four experts have their say

Specialist – Allianz Technology

This has been the longstanding specialist selection for the adventurous portfolio and Allianz Technology (LSE:ATT) has done a fantastic job of contributing outsized gains over several years. In the past decade, investors have been rewarded with gains of more than 600%.

As to be expected given recent market conditions, it has been more of a detractor in the period under review: its loss of 29.3% over the year was heavily punctuated by a 41% fall in the first half of 2022, leaving the shares trading on a near-16% discount to NAV, compared with -5% a year ago.

With assets of just over £1 billion, the trust invests in a 50-strong range of technology-related companies, with the familiar names of Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL) and Tesla heading the roster.

Private equity – NB Private Equity Partners

There is a sense that the recent correction in public stock markets is yet to be reflected fully in private equity valuations. Shares in NB Private Equity Partners (LSE:NBPE) have proved more resilient than all bar three of the 20 other constituents of the private equity trust sector, with a return of 10.6% over the year, although they are down 18% so far in 2022.

The £1.3 billion trust is managed by private equity specialists Neuberger Berman and invests chiefly in the US, with the remainder mainly in the Asia-Pacific region. It currently holds 95 companies in its portfolio and its five full or partial sales so far in 2022 have been made at a 2.6 times multiple of their aggregate cost.

Only one new investment has been made this year, but the trust has just over £300 million in liquidity available to seek out fresh opportunities.

How the adventurous portfolio constituents have fared in the past year and beyond*

| NB Private Equity Partners | Private equity (21) | -10.27 | 3 | -18.17 | 3 | 10.63 | 1 | 48.88 | 1 | 71.68 | 1 |

| Dunedin Income Growth | UK equity income (25) | -8.39 | 3 | -14.3 | 4 | -9.66 | 3 | 13.49 | 1 | 30.75 | 1 |

| Mobius Investment | Global emg mkts (11) | -20.01 | 4 | -24.16 | 4 | -18.89 | 2 | 17.15 | 1 | ||

| JPMorgan Asia Grth & Inc † | Asia Pacific eq inc (5) | -3.34 | 1 | -16.55 | 4 | -24.56 | 4 | 11.46 | 1 | 38.55 | 1 |

| Allianz Technology | Technlgy & media (4) | -26.5 | 4 | -40.99 | 4 | -29.37 | 4 | 26.37 | 2 | 112.03 | 1 |

| Montanaro Euro Smaller Cos | European smllr cos (4) | -28.57 | 4 | -45.33 | 4 | -29.91 | 4 | 14.15 | 2 | 54.27 | 1 |

| Monks | Global (17) | -16.52 | 3 | -32.31 | 3 | -32.12 | 3 | 1.88 | 3 | 36.21 | 2 |

| Henderson Smaller Cos † | UK smaller cos (25) | -19.04 | 4 | -34.11 | 3 | -33.61 | 4 | 0.83 | 3 | 18.57 | 2 |

| Baillie Gifford Shin Nippon | Japanese smaller cos (6) | -20.22 | 4 | -35.75 | 4 | -38.26 | 4 | -22.06 | 4 | 1.79 | 2 |

| Baillie Gifford US Growth | North America (9) | -39.11 | 4 | -52.06 | 4 | -57.5 | 4 | 7 | 4 |

Notes: *Holdings ranked by one-year performance. Not all constituents were members of the portfolios over the time periods stated. † Trust name in italics indicates that a change to the portfolio has been made. See text for details. Data source: FE Analytics as at 30 June 2022.

Data sources: Association of Investment Companies (AIC), FE Analytics and company reports. Performance relates to shareholder total return unless indicated. Both performance and discount figures are as at 30 June 2022. When discussing trust size, this article has referred to total assets rather than market capitalisation and were referenced in the second week of July.

Andrew Pitts was editor of Money Observer from 1998 to 2015. He has a personal investment in Capital Gearing.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.