Best stocks to own after the General Election

We reveal the biggest beneficiaries of the Boris Bounce so far and gauge the market mood for more.

17th December 2019 13:04

by Graeme Evans from interactive investor

We reveal the biggest beneficiaries of the Boris Bounce so far and gauge the market mood for more.

The Boris Bounce for markets may already be fading, but that shouldn't stop investors celebrating what's been a significant pre-Christmas present for their portfolios.

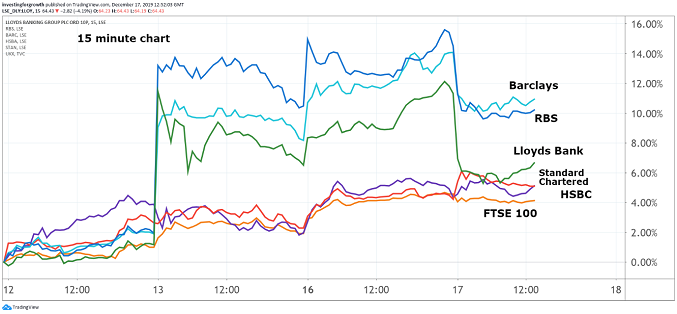

Our analysis of the biggest risers in the FTSE 350 index reveals gains since Friday morning of 10% or more for some of the UK's most widely held stocks, including beleaguered Centrica (LSE:CNA) and the banking giants Royal Bank of Scotland Group (LSE:RBS) and Barclays (LSE:BARC).

The return to favour of UK-focused stocks, after the threat of a Corbyn government was removed, has been most pronounced in the housebuilding sector following gains of 15% for heavyweight trio of Berkeley Group (LSE:BKG), Taylor Wimpey (LSE:TW.) and Barratt Developments (LSE:BDEV).

These gains even factor in a broad sell-off this morning after some of the market euphoria was burst by the resumption of ‘no deal’ Brexit fears. With the government ruling out any extension to the post-Brexit transition period beyond the end of 2020, there's clearly no respite from some of the now familiar uncertainties attached to investing in UK stocks.

That threatens more frustration for the army of Lloyds Banking Group (LSE:LLOY) investors, who seem to have missed out on much of the post-election bounce seen at RBS and Barclays. Shares were down 5% at 63.6p today, having spiked to 73.7p in the opening minutes of trading on Friday.

Source: TradingView Past performance is not a guide to future performance

Lloyds and the rest of the wider UK market have long been regarded as undervalued, which is why investors are holding on to hopes that 2020 will bring a change in fortunes.

The £100 billion added to the value of the UK's 350 biggest stocks over the past two sessions is certainly a start, with the FTSE 100 index now less than 400 points off the record high seen in May 2018 and the UK-focused FTSE 250 index trading at an all-time high.

Even with its recent gains, the price/earnings (PE) multiple for the FTSE 100 blue-chip index of 16.2 times is considerably short of the 24.8 times enjoyed by the S&P 500. Wall Street markets were again trading at record highs last night, with the mood helped by tentative signs of progress in US-China tariffs talks.

Source: TradingView Past performance is not a guide to future performance

The continuation of loose monetary policy by the major central banks and a robust US economy showing few signs of fatigue are also likely to help. As our head of markets Richard Hunter pointed out yesterday, there are good reasons to think 2020 could get off to a strong start.

The question as far as Hunter is concerned is whether this optimism reflects a reduction in the attitude to risk – or whether the risks themselves will be reducing.

- The 2020 vision: Your guide to shares, politics and the economy

- You can also invest in UK equities via ii’s Super 60 recommended funds. Click here to find out more

In the meantime, the robust election result in the UK has entirely removed one of the risks that had prompted investors to limit their exposure to certain sectors earlier in 2019.

Among a number of industries now free from the threat of a Corbyn-led programme of nationalisation, shares in the transport sector have surged sharply since Friday morning. Stagecoach (LSE:SGC) shares are currently up 23%, with rival Go-Ahead Group (LSE:GOG) ahead 11.5% and stock market newcomer Trainline (LSE:TRN) up 14.3%.

Serco (LSE:SRP) and Balfour Beatty (LSE:BBY), who rely on the UK government for some of their contracts, have risen 12.5%, while the water companies have also fared well despite yesterday's tough draft determination by industry watchdog Ofwat. South West Water owner Pennon Group (LSE:PNN) is up 14.5%, Severn Trent (LSE:SVT) 12% higher and United Utilities (LSE:UU.) up 11.5%.

Looking into the FTSE Small Cap, stocks with exposure to the UK consumer have fared well on the back of hopes that a Brexit deal will be agreed before the end of January. Beneficiaries include online fashion business N Brown (LSE:BWNG) - up 19% - and Hollywood Bowl (LSE:BOWL) after a rise of 17%.

Others on the front foot have included tool rental business Speedy Hire (LSE:SDY), which climbed 15.4%, and newspaper publisher Reach (LSE:RCH) after a rise of 13%.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.