The big winners in market's worst month for over six years

5th November 2018 10:29

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

After a truly horrible October, Saltydog analyst Douglas Chadwick reveals the funds and ETFs going up when the market is going down.

October was a difficult month for stockmarkets all around the world. The MSCI World Index went down by 7.4% - that's the biggest fall that we've seen since May 2012.

The largest economies have all been affected, here's how some of the leading indices have performed.

| US | Dow Jones Industrial Average | -5.1% |

| China | Shanghai Composite | -5.1% |

| Japan | Nikkei 225 | -9.1% |

| Germany | DAX | -6.5% |

| UK | FTSE 100 | -5.1% |

The only significant country bucking the trend is Brazil, where the Ibovespa (which tracks stocks traded on the São Paulo Stock Exchange) gained 10.2%.

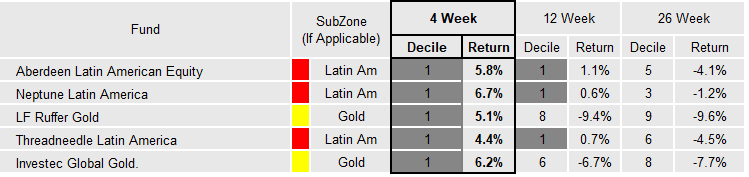

This has come through in our Unit Trust and OEIC data, where funds investing in Latin America feature in the 'Specialist' Group.

Data Source: Morningstar. Past performance is not a guide to future performance.

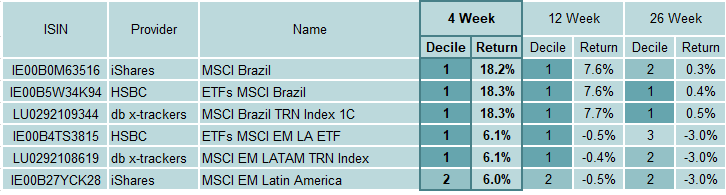

They also stand out in our Investment Trust analysis and our ETF reports. One of the advantages of the ETFs is that there are some which focus on Brazil rather than Latin America in general. These have done particularly well in recent weeks.

Data Source: Morningstar. Past performance is not a guide to future performance.

ETFs also enable investors to 'short' the market with funds like the db x-tracker FTSE100 short daily fund, XUKS. These funds have done well over the last month, when equity markets have been falling.

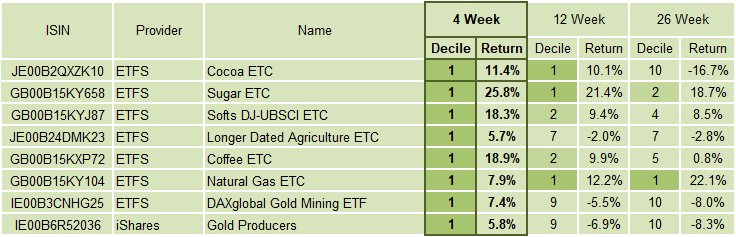

In our weekly ETF analysis, we also have a page dedicated to funds tracking commodities. These range from Gold and Silver to Soybeans and Lean Hogs.

Over the last four weeks, when most funds have been going down, more than half of the commodity funds that we track have made gains - here are a few of the best performers.

Data Source: Morningstar. Past performance is not a guide to future performance.

For more information about Saltydog Investor, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.