Bond Boss: myth vs market reality for this high-yielding area

In his latest monthly column, Aberdeen’s Jonathan Mondillo considers the prospects for bonds listed in emerging rather than developed markets.

18th February 2026 09:05

by Jonathan Mondillo from Aberdeen

Emerging market debt (EMD) entered 2026 in great shape. Across the asset class, we are seeing a range of positive dynamics. Hard-currency sovereigns, for example, are experiencing a wave of ratings upgrades, reversing a decade-long trend of downgrades.

- Invest with ii: Investing in Bonds | Free Regular Investing | Open a SIPP

Meanwhile, the Federal Reserve is cutting interest rates, and growth expectations for emerging markets versus developed markets are widening. This should be positive for emerging market assets. Hard-currency bonds are issued by national governments that are denominated in a widely accepted currency (such as the US dollar).

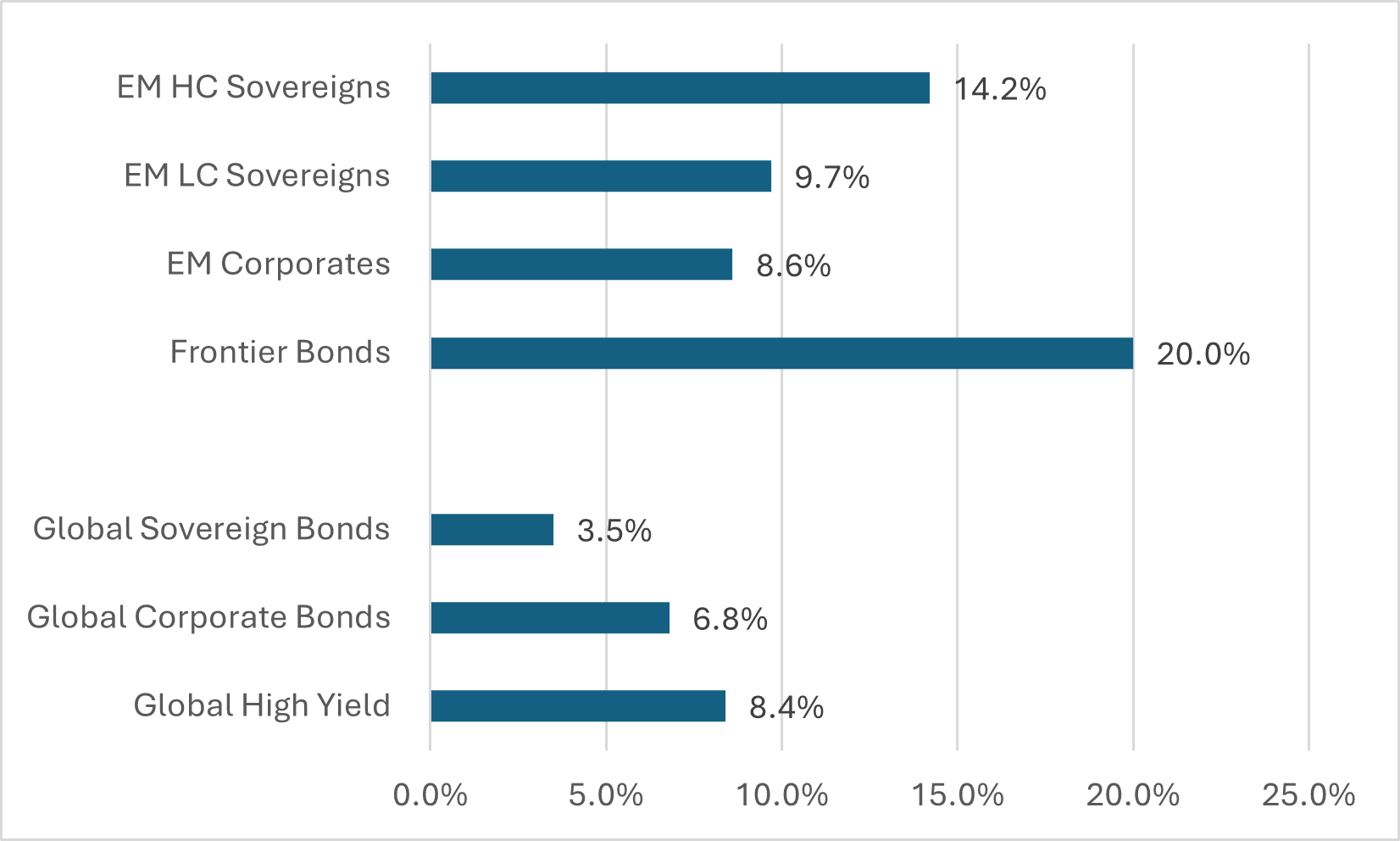

For some investors, there is still a perception that EMD is an inherently risky asset class, with less attractive returns. So, let’s look at returns in 2025 and compare those in emerging markets with those in developed markets.

Chart one: total returns for emerging markets and developed markets in 2025 as a percentage (GBP hedged)

Source: JP Morgan, Bloomberg, 31 December 2025. Past performance is not a guide to future performance.

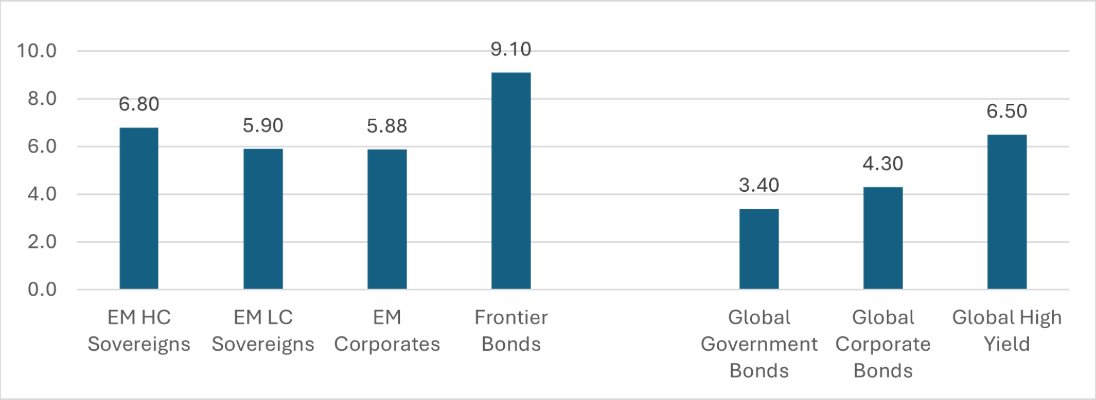

Emerging markets significantly outperformed in 2025 (see charts one and two). The good news is that we expect yields in emerging markets to keep outperforming developed markets.

Chart two: yields for emerging markets and developed markets in 2025, as a percentage

Source: JP Morgan, Bloomberg, 31 December 2025. Past performance is not a guide to future performance.

Hard-currency sovereigns: momentum building

Even though yields in emerging‑market hard‑currency bonds have tightened, they still offer more income than US high‑yield bonds. Crucially, many emerging market governments have regained access to global debt markets, and investors from across the credit spectrum (including those who usually stick to investment grade) are showing renewed interest. That combination has helped boost demand and support recent performance. We expect this positive trend to continue in 2026.

Frontier markets, a subset of the emerging market sovereign market, are showing real promise. Frontier markets comprise countries that sit between emerging markets and the lowest-income economies. Many have emerged stronger from the turbulence of the pandemic. From Ghana’s gold-driven recovery to Egypt’s reform progress, government spending has improved, foreign exchange reserves are healthier, and debt profiles are more sustainable.

Few frontier economies record large trade surpluses with the US, which means that returns are driven more by their domestic conditions. Yields on frontier bonds at an index level remain at an attractive 9.1%.

- Bond Boss: the outlook for fixed income in 2026

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Emerging market hard-currency corporate debt: steady as she goes

On the corporate side, fundamentals are robust. At an index level, the asset class boasts an average investment-grade rating. Demand for emerging market corporate debt is currently outpacing supply, which has translated into solid returns for investors. In recent years, emerging market corporate behaviour has not transitioned towards an aggressive stance. This is reflected in debt levels that are at their lowest point since 2008 and remain below that of European and US counterparts.

When investing in emerging market corporates, we prefer to hold companies that are operating in a country with a high yield rating. These companies often have stronger balance sheets than those in developed markets. Investors are compensated with a higher yield, but they’re investing in companies with better underlying fundamentals.

At an index level, yields in emerging market corporate debt have been falling and are now just below 6%. But valuations in the high-yield market look compelling compared with developed markets –emerging market corporate high yield currently has a yield of 7.5% versus 7% for US high yield.

- Is it time to move on from money market funds?

- Nine investment trusts to generate a £10,000 income in 2026

Emerging market local-currency debt: more upside to come

Despite some recent depreciation, the US dollar remains expensive, which means yields in emerging market local markets are attractive. This environment offers retail investors the potential for both income and currency appreciation – a combination that is relatively rare in today’s markets.

Within the widely followed JP Morgan EM Local Currency Index, we forecast that eight to 10 of the central banks will remain in rate-cutting mode in 2026. There is also scope for cuts in frontier countries, especially where central banks have delivered large rate hikes to fight inflation and where rates are now very high (Nigeria, Ghana, Egypt and Kazakhstan).

We remain in yield-seeking mode in our local currency portfolios. We are underweight in low-yielding countries in Asia and overweight in higher-yielding ones in Latin America, Europe, the Middle East and Africa.

Final thoughts

Emerging market debt offers investors diversification, an attractive income, and exposure to faster-growing economies. After a very strong 2025, yields remain compelling relative to developed market bonds. For retail investors looking for income and diversification beyond traditional global bonds, EMD offers a compelling opportunity.

Jonathan Mondillo is global head of fixed income at Aberdeen.

ii is an Aberdeen business.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.