Buy, Hold, Sell: The healthcare trends to invest in

3rd January 2019 09:48

by Tom Bailey from interactive investor

BB Healthcare Trust manager Paul Major tells Tom Bailey about some of the stocks he has been buying, holding and selling recently.

Across the world, the average human lifespan is increasing. However, while this is clearly good news, there are some downsides to the trend: primarily, as people live longer, their healthcare costs increase. The pressure is already being felt by governments in Europe, where healthcare spending is soaring. A similar trend is starting to be felt in rapidly developing Asian countries.

This trend, says Paul Major, manager of BB Healthcare Trust, means governments are coming under increasing pressure to make their healthcare provision more efficient. This is the starting premise for the BB Healthcare Trust.

Major says:

"We ignore benchmarks and we ignore geography. We work out what healthcare needs to look like, identify key trends and find companies that play into these trends."

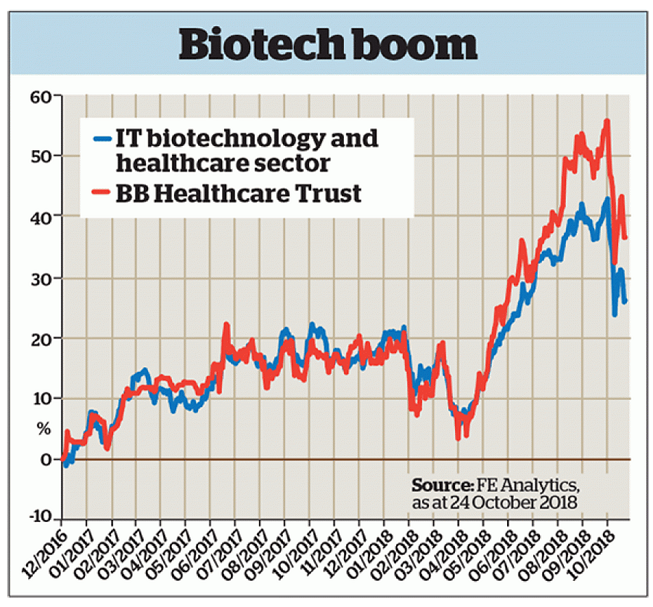

The trust, launched by Bellevue Asset Management in 2016, has produced strong performance, having returned more than 20% over the past year. As the chart shows, BB Healthcare has beaten the wider sector since launch.

According to Major, a distinctive feature of BB Healthcare is the role of the trust's board. "Boards are usually filled with retired City grandees who primarily focus on corporate governance," Major says. However, BB Healthcare's board is slightly different: it includes two eminent oncologists and two hedge fund managers who have experience in the healthcare sector. This, he says, allows the managers and board to discuss larger healthcare trends.

Past performance is not a guide to future performance

Buy: Teladoc Health

(NYSE: TDOC)

The biggest cost facing healthcare, says Major, is efficiently allocating doctors' time with patients. Readers in the UK will know how difficult it can be to get an appointment with a doctor in good time and at a good time. As a result, patients regularly miss appointments, says Major, or they opt for more expensive options such as needlessly attending A&E.

Teladoc Health, a US-listed company, is attempting to address that problem. According to Major, the company aims to "electronically triage patients".

He explains:

"If you want an appointment, you can use the app or a PC. You 'tell' the app what is wrong and it suggests a course of action, such as seeing a GP. It then lists the available GPs and allows you to judge based on speciality."

While the market for such services works best in a private healthcare system such as the US system, attempting to improve the allocation of doctor time will be an increasingly important task for healthcare providers around the world, whether public, private or somewhere in between.

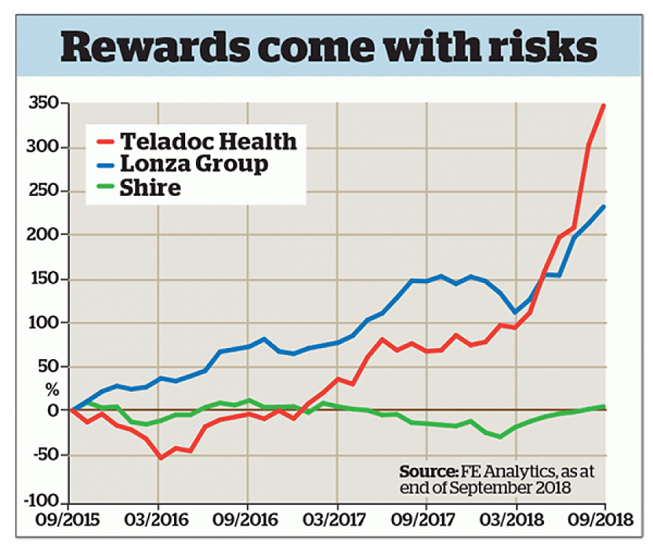

Major says he first bought the company in February of this year. However, he notes that it was hit by the market sell-off in October, leading him to ‘buy the dip’ and increase his holding. Since February 2018 the firm’s share price has gone up by more than 80%.

Hold: Lonza

(SWX: LONN)

Investing in pharmaceutical companies that carry out research and development can be very profitable, but it can be risky, as many drugs fail at the trial stage. Even industry giants can see huge share price swings when drug trials don't go as expected. A surer way to gain exposure is through the growing number of outsourced drug manufacturers such as Lonza Group.

Companies such as Lonza take care of the manufacturing process for drug development companies, which gives such companies capital and cost base advantages. Listed in Switzerland, the company has 75% of its business in contracted manufacturing.

Even a drug company with its own production facilities will often engage a contracted manufacturer as a "disaster site" to be used as a back-up should its manufacturing centre need to shut down.

Major says:

“[There is] an enormous pipeline of future business. This is a low-risk option for investing in the future of biotech. It doesn't matter which drug gets approved. Just a few drug manufacturing firms produce at scale."

BB Healthcare bought Lonza in 2017. Between June 2017 and October 2018, its share price rose by about 50%.

Past performance is not a guide to future performance

Sell: Shire

(LON: SHP)

BB Healthcare first purchased Shire in late 2016. Throughout 2017 several pressures pushed down the company's share price – unjustifiably in BB Healthcare's view. This led Major to top up his holding in the company in the first quarter of 2018.

However, soon afterwards, Japanese pharmaceutical company Takeda launched a bid for the firm. This led BB Healthcare to sell out of its position.

Major notes that while lots of analysts in Japan were talking up the prospects for the combined entity, BB Healthcare saw it as quite a bit of risk.

"The real picture isn't quite as rosy as the one we see now," says Major.

"We don't want to be caught by the backwash from earnings downgrades once the deal has completed."

BB Healthcare exited its position in Shire in September. The share price for the firm rose 15% in the year to September.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.