Can AIM listed Faron Pharma continue its ascent?

Faron has seen its share price surge since a recent update. Our chartist examines upside potential.

25th February 2020 09:09

by Alistair Strang from Trends and Targets

Faron has seen its share price surge since a recent update. Our chartist examines upside potential.

Faron Pharma (LSE:FARN)

As we struggle through the cold and flu season, it was interesting to note those shares which proved resilient, despite market wide hysteria apparently prompted by coronavirus.

We covered Faron (LSE:FARN) last November and their share price has managed the opposite of catching a cold. Equally fascinating, reading "the common cold" is just one of the grouping covered by the word coronavirus, a respiratory term!

Of course, this means the current outbreak of sniffles in our part of Scotland is now described by schoolchildren as "coronavirus", wanting face masks and preferably some time off school too...

A quick glance at Faron's update on 6th Feb gives a potential reason for their current flamboyant share price, the word "coronavirus" popping up in the third paragraph, attracting interest like politicians round a photo opportunity.

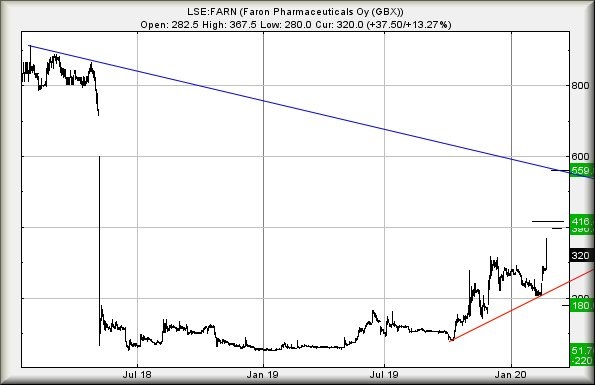

From the point at which the share closed (320p), we can calculate 396p as possible on the current cycle with secondary, if exceeded, coming in at 416p.

Obviously, the proximity of these numbers tends to suggest the potential of some stutters making themselves known. Longer-term, we can even calculate 559p as possible but, to be fair, we're on a bit of a wing and a prayer with such a price level.

Presently, the price needs to break red on the chart to spoil enthusiasm, this innocent line presently at 222p. Moves below risk a challenge of 180p with secondary, if broken, down at 51p.

We mentioned recently the dangers of wild price swings, making stop loss levels almost impossible on flamboyant shares. We need to mention, politely, the unpleasant reality of Faron as the share price is currently trending in a zone with "bottom" at 220p. It will not approach long-term safety until the price manages exceed blue on the chart.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.