Can JD Sports Fashion shares bounce back?

After hitting independent analyst Alistair Strang's price target, shares in this tracksuits-to-trainers retailer have had a very bad week. Here's what he thinks might happen next.

6th November 2025 07:49

by Alistair Strang from Trends and Targets

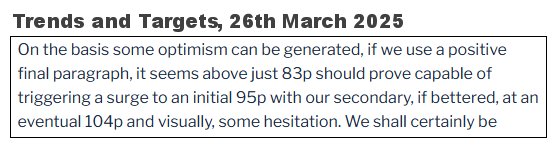

We reviewed JD Sports Fashion (LSE:JD.) in March, opting to use our usual “kiss of death” final paragraph to give an optimistic outlook. It worked out rather precisely, JD's share price closing at 104.55p on 6 October.

- Invest with ii:Open a Stocks & Shares ISA | Top ISA Funds | Transfer your ISA to ii

The share price has certainly experienced some hesitation in the weeks since, and now we’re being supplied ample ammunition for a dose of collywobbles. In this article, we shall again use our final paragraph to provide an optimistic scenario as you couldn't currently alleviate the weight of negatives with a Mounjaro jab.

Source: Trends and Targets. Past performance is not a guide to future performance.

Currently, we’re not terribly convinced about the share price future for JD Sports, with retailers, generally speaking, failing to flourish.

Below just 83p has the potential of triggering reversal to an initial 77p with our secondary, if broken, at a bottom (hopefully) of 68p. Things become seriously dangerous at such a level, the price now lurking in a zone where an ultimate bottom of 48p becomes possible, a price level below which we cannot calculate.

Our converse scenario demands the share price stumble above 93p as, from our perspective, this would mince all our drop targets and instead nudge open the door marked ‘optimism’. A movement such as this would create an initial target at 115p with our secondary, if beaten, at 118p.

Obviously, the proximity of these numbers indicates a price level where some flatlining shall probably occur, but it’s worth mentioning that closure above 118p shall imply a Big Picture 142p as exerting an influence on the price.

Here’s hoping but unfortunately, for now, it looks like some reversal is probable.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.