Drax shares should bounce at this price

The shares have done badly, but our technical analyst thinks he knows when they'll find support.

9th May 2019 10:25

by Alistair Strang from Trends and Targets

The shares have been in freefall, but our technical analyst thinks he knows when they will find support.

We're not jumping on the Marvels Avengers bandwagon, despite one of their characters being 'Drax'. A Google search for 'Drax' did turn up this bonkers statistic: Just 15 ships produce more pollution than ALL cars, worldwide, but instead, people protest Drax (LSE:DRX) providing wood pellets for fires!

As for Drax's share price…

We last reviewed DRAX in August last year and pleasingly, it achieved our initial growth target.

• An energy stock burning bright

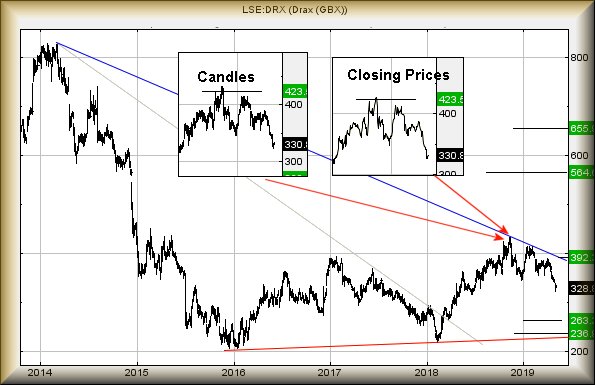

What happened was quite strange. We'd written a target of 403p in the report, yet the published chart cheerfully gave the target at 423p. Despite both the erroneous 403p AND the correct 423 being attained, our often-repeated insistence a share price actually close above a target level was highlighted clearly, when reviewing the Candles vs Closing Price charts.

Unfortunately, in this instance, we got it a little wrong, as despite the price actually closing 4p above our target level on two occasions, the price has reversed more than we would like.

However, a glance at the bigger picture tends to indicate that the threat of reversal should not prove too devastating. The immediate situation is of weakness below 322p opening the gates which permit reversal down to 263p. We would anticipate a bounce, should such a level appear.

An initial ambition, doubtless a longer term one, calculates at 392p. If bettered – definitely with closure above, our secondary is at 564p eventually.

There's the risk of a real problem if the price somehow winds its way below 263p. Our secondary, challenging the long-term uptrend, calculates at 236p.

In itself, this isn't great visual problem but unfortunately, 236p making an appearance totally fouls our upward target calculations and risks the share price becoming range-bound for a while.

For now, our suspicion is of this proving worth watching for 263p eventually making an appearance.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.