EM equities: driving innovation and diversification for the next cycle

Emerging markets could drive global growth in the years ahead. We explore how investors can rethink equity portfolio strategy in a changing world.

27th November 2025 09:01

by Devan Kaloo from Aberdeen

What if the next decade of equity outperformance doesn’t come from Silicon Valley — but from São Paulo, Seoul or Shenzhen?

As global markets look ahead to 2026, emerging markets (EMs) are positioned to play a pivotal role in shaping the next investment cycle.

At the start of this year, EM allocations hit multi-year lows as investors chased US stocks driven by optimism around artificial intelligence (AI) and policy expectations under US president Donald Trump’s second term.

While those bets have paid off so far, they have left portfolios exposed to concentration risk and ‘priced-for-perfection’ valuations.

Against this backdrop, EMs offer a compelling alternative — supported by three structural drivers we have labelled: carry, capex and cheap.

Carry: currency tailwinds

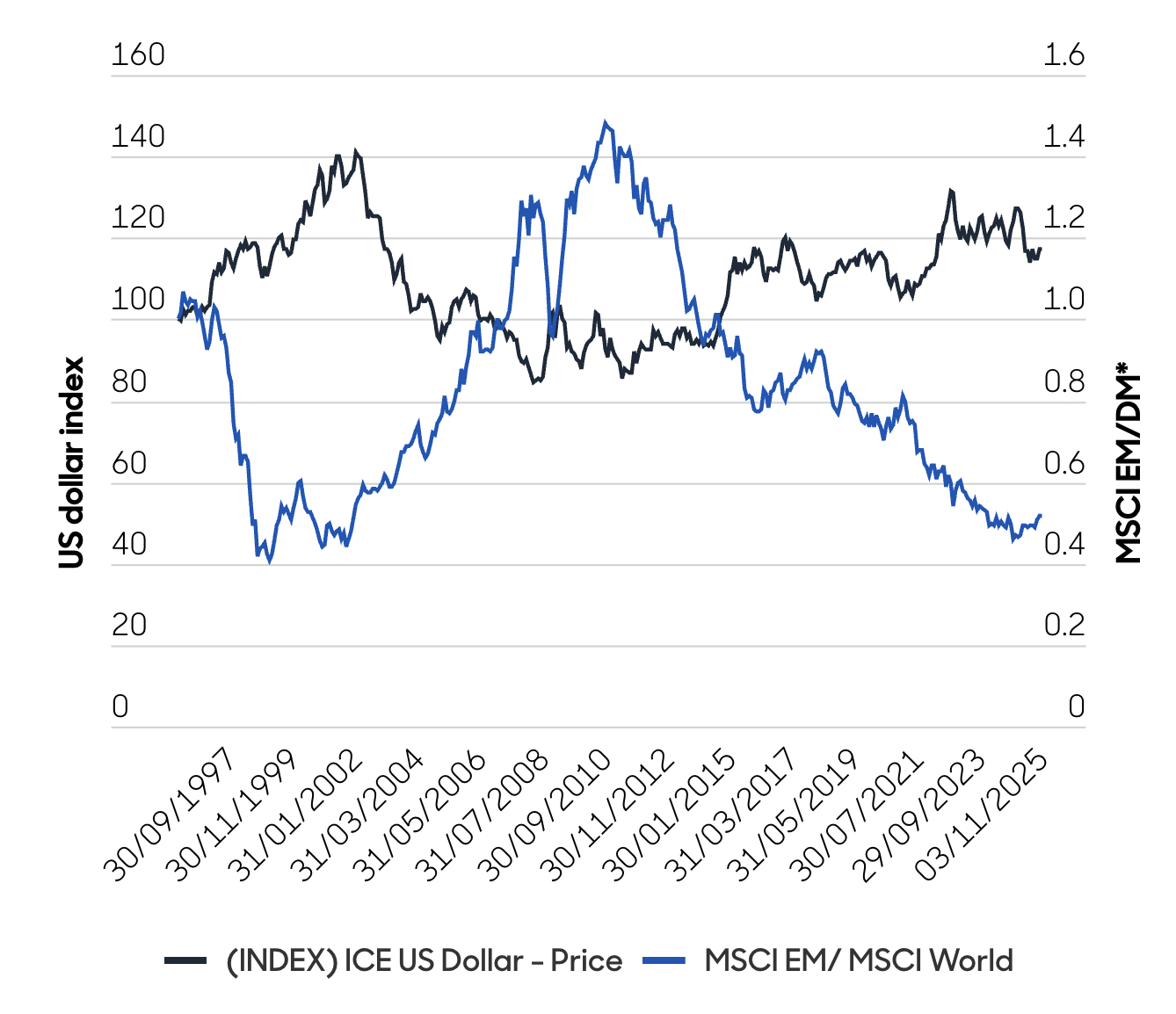

Historically, US dollar cycles — its strength and weakness relative to other currencies — have contributed to EM asset performance (see Chart 1).

Chart 1: dollar weakness means EM strength

*Relative performance of cumulative returns. Source: Aberdeen, June 2025.

‘Carry’ refers to the positive foreign exchange effects that investors in emerging market assets enjoy when the dollar weakens. Their investments, usually denominated in dollars, will gain in a weak-dollar environment.

Dollar strength is underpinned by global liquidity flows. For years, excess capital shifted to US assets, driven by the perception of Treasuries as the ultimate haven as well as the dominance of US capital markets. This dynamic supported high US valuations even as wage growth and inflation slowed.

But this liquidity regime is weakening. Trump’s fiscal stance — tax cuts, deregulation and the ‘One Big Beautiful Bill’ — is set to supercharge the US budget deficit. The US Treasury’s pivot towards short-dated debt issuance may keep liquidity flowing in the short term, but it also increases vulnerability to rising bond yields and potential shocks. In other words: live by liquidity, die by liquidity.

As US fiscal credibility erodes, the dollar faces sustained pressure. But for EMs, this is a game-changer because it means:

Cheaper debt servicing for EM corporates and governments who borrow in dollars

Stronger local consumption as EM currencies appreciate

Reversal of capital flows as investors seek higher real returns outside the US.

The shift in liquidity, combined with EM central banks’ readiness to cut interest rates and their more disciplined fiscal positions, create a prolonged foreign exchange tailwind for EM investors. We think ‘carry’ will be a structural driver of returns in 2026 and beyond.

Capex: global investment flows into EM industries

Emerging markets have historically benefited from periods of elevated global capital expenditure (capex). But since 2021, that correlation has broken down due to:

China’s slowdown - property market stress, weak consumption and investor caution muted EM returns even as global investment surged.

US tech dominance - the ‘Magnificent 7’ drove strong equity gains in the US and captured investors’ attention.

Looking ahead, we see a reversal. A once-in-a-generation capex cycle is under way, driven by three structural themes: decarbonisation, digitalisation and defence. They are reshaping infrastructure, supply chains and industrial capacity- and EMs are at the core of this transformation.

China remains a strategic player in AI development and infrastructure, with competitive energy pricing and vast datasets driving innovation. Policy support could unlock earnings growth despite China’s property and consumption headwinds.

But EM strength isn’t solely dependent on China. Global capex is spreading across Asia, Latin America and Europe, with EM market leaders behind AI chips, grid upgrades and critical resources.

Meanwhile, US-China rivalry amplifies demand for EM inputs. For example, US re-industrialisation is likely to boost demand in areas such as shipping and electrical infrastructure where EM companies play a vital role in providing resources and expertise.

Cheap: attractive entry points and diversification

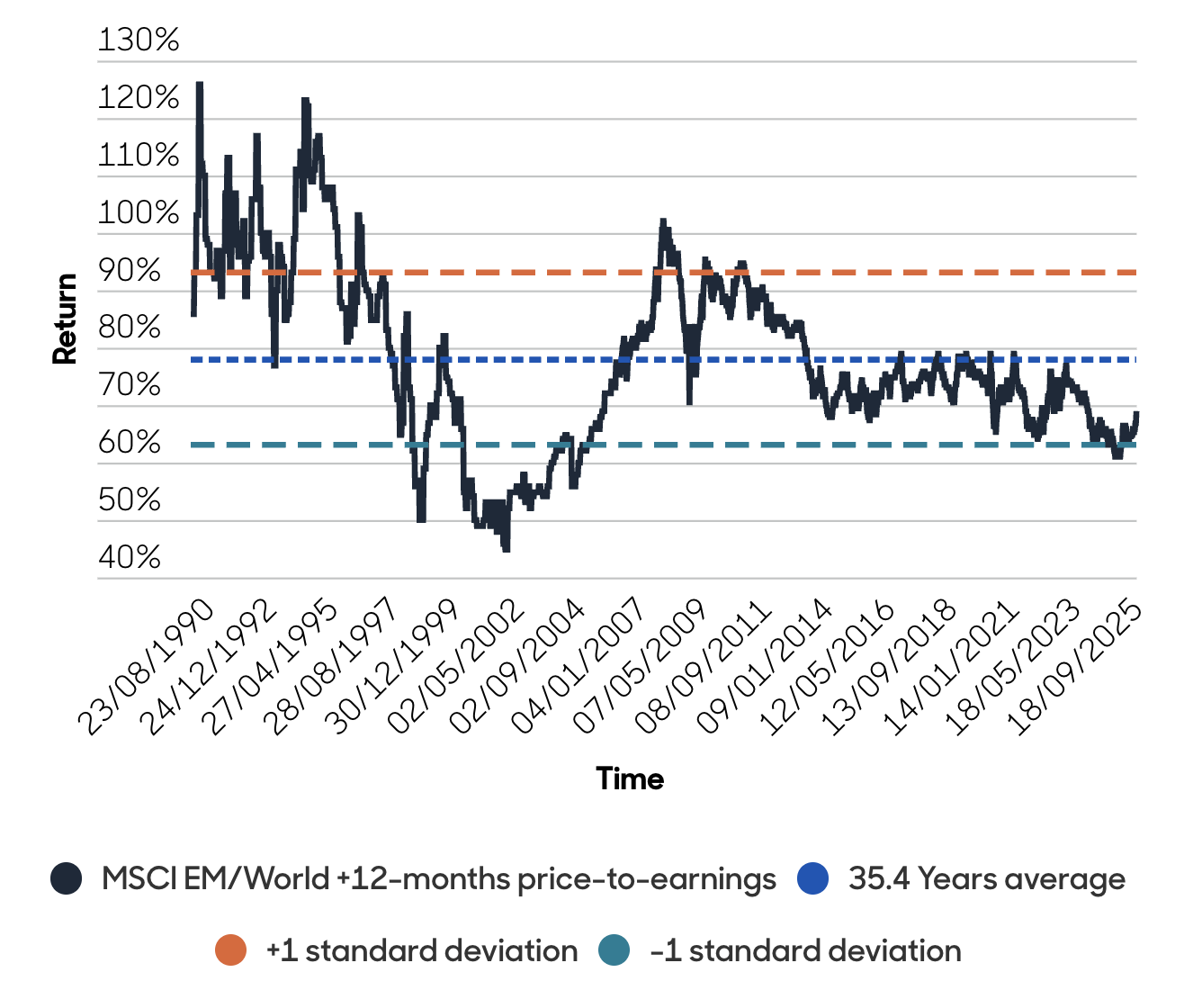

Despite a strong performance in 2025, EMs remain attractively valued relative to DMs. EMs still trade at a significant discount to long-term average earnings versus the MSCI World index (see Chart 2).

Chart 2: EMs still look cheap vs DMs

Source: CLSA, September 2025.

This valuation gap is not justified by fundamentals. EMs and DMs have converged on a volatility basis, yet EM equities remain priced as if they are structurally more volatile. This suggests a potential share price re-rating opportunity.

EMs also offer greater diversification by sector and geography. While US equity performance is increasingly concentrated in a few tech names, EMs are more diversified across industrials, healthcare, IT and materials. The asset class also includes domestic giants with strong exposure to local demand and intra-EM trade.

Consider, for instance, India. Despite the market’s underperformance in 2025 - due to limited AI exposure and tariff-related headwinds - its low correlation to AI makes it a valuable hedge against ‘priced-for-perfection’ markets elsewhere.

Moreover, India stands out as a long-term growth story, supported by strong domestic companies, scope for consumption-boosting rate cuts and a deepening domestically funded capital market.

Final thoughts

As investors position for 2026, the structural tailwinds of favourable ‘carry’ dynamics, a global capex renaissance and compelling valuations continue to support the case for sustained outperformance and a more prominent place in investors’ portfolios.

Devan Kaloo is global head of equities at Aberdeen.

ii is an Aberdeen business.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.