Fevertree: Should you buy the correction or listen to alarm bells?

24th October 2018 09:13

by Alistair Strang from Trends and Targets

This AIM giant's share price has started to lose its fizz as investors worry about wider economic problems. Chartist Alistair Strang reveals what could happen next.

Fevertree (LSE:FEVR)

Last time we reviewed Fevertree a year ago, we were quite optimistic regarding its future price potentials. Thankfully, our predictions proved accurate, eventually exceeded quite nicely too. This time around, we're rather less confident and it's all to do with a single price motion.

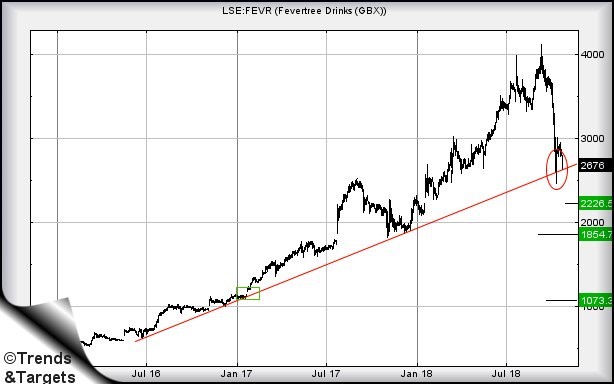

Circled on the chart, on 11 October, the share price dropped to 2,463p. To us, this immediately rung an alarm bell as it broke the extremely well defined uptrend since June 2016.

When this sort of thing happens, it can often be worth paying close attention as the market just proved a perfect uptrend can be broken. Despite the share price not closing below red, it's a warning signal, one we'd be daft to ignore.

At present, the share price is trading at around 2,675p, once again threatening red. Some fairly controlled panic appears possible should it now manage below 2,590p as reversal to 2,226p calculates as possible. If broken, secondary comes in at 1,854p.

Around the 1,854p point, things get a little scary. While visually it's almost promised any drop should bounce at such a point, the longer-term implication is quite nasty, should 1,854p break. Any scenario including this gives ultimate bottom at 1,073p!

When we give "ultimate bottoms" as part of any big picture analysis, they are only "ultimate" because we cannot calculate anything sane below such a point. It gives a reasonable expectation of a bounce, should any "ultimate" level make an appearance. At present, absolutely nothing related to this share price gives such a threat, just a Halloween scary moment on 11 October.

Oddly, the price does exhibit a manipulation gap from around the 11 quid level back in January 2017 (shown with a green box). If anyone fancies a gap covering exercise against the price, reversal to 1,073p would certainly cover the evidence and balance the books...

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.