FTSE 100 and AIM: Bounce points and danger zones

21st December 2018 08:56

by Alistair Strang from Trends and Targets

FTSE 100 futures prices just hit a level technical analyst Alistair Strang has been talking about for a long while. But what will it do in the days and weeks ahead? Here's the answer.

FTSE FRIDAY & The AIM

The AIM market 'had' been behaving with a degree of integrity, despite the FTSE 100 being as certain about its trend as a politician's thoughts on Brexit. Alas, since September this has changed for the AIM, though it appears fairly confident where it hopefully shall bottom.

At present, the AIM is trading around the 850 mark with further weakness below 847 looking capable of reaching a bottom at 798, a point where some sort of bounce will make sense. There is certainly a major problem should 798 points break as it risks a cycle which hopefully will end at 625 at bottom.

Such has been the rate of managed decline, the index requires above just 900 to indicate this phase of misery is complete, allowing recovery to an initial 933.

If exceeded, secondary is at 1,030 but visually, we suspect it shall become stuck around the 933 point for a while due to prior highs.

For now, while further reversal looks possible, we hope 798 proves to be bottom.

Source: Trends and Targets. Past performance is not a reliable indicator of future results

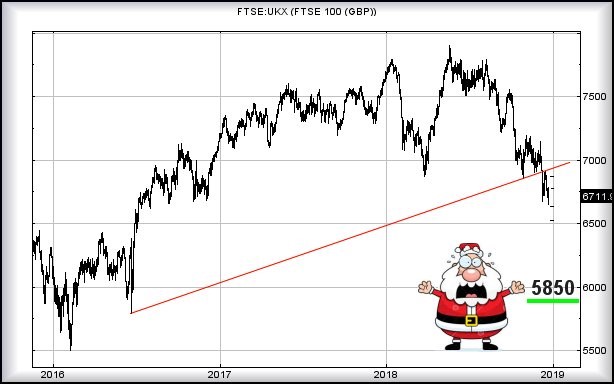

As for the FTSE for FRIDAY, we're not entirely sure what to make of it.

FTSE futures experienced a day low of 6,630, a number we've been banging on about since May. The lowest the FTSE itself achieved was 6,646 but unfortunately, we suspect the real index will express a need to hit 6,630 points.

Though the market closed Thursday at 6,717 points, it now looks like the FTSE risks a visit to 6,630, along with some sort of bounce. If risking a long, stop can be fairly tight at 6,618 points.

On the assumption the market remains in a downtrend, any bounce target looks like 6,675 points at best. Secondary does calculate at 6,570 points!

The real danger comes, should 6,617 break. Our secondary calculates at 6521 points. If taking the foregoing as gospel and choosing to enter a short anytime now, the tightest stop is at 6,792 points.

In addition, we've shown "bottom" as expected eventually on the current cycle. We fear any near-term Santa Rally shall assume the characteristics of a dead parrot bouncing.

Source: Trends and Targets. Past performance is not a reliable indicator of future results

As always, please remember we are discussing the FTSE itself, during trading hours.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.