FTSE 100: Best and worst stocks of Q3

3rd October 2018 14:30

by Graeme Evans from interactive investor

UK markets moved sideways this summer, but that masked some massive share price moves for individual companies. Graeme Evans names the heroes and zeros.

From the M&A dollars at Sky and Whitbread to the sudden loss of altitude for easyJet shares, Q3 was pretty dramatic for many blue-chip investors.

Highlights also included AstraZeneca shares topping £60 for the first time, one of several double-digit risers or fallers in the three months to September 30.

If only the wider FTSE 100 index could match this level of excitement, having dipped 1% in the quarter to continue its tepid 2018 performance.

Fittingly for a company that stunned everyone with the sale of coffee shop Costa to Coca-Cola, Whitbread delivered the biggest Q3 rise in the FTSE 100.

Shares jumped 19% in the quarter after the £3.9 billion sale price secured by Whitbread boss Alison Brittain far exceeded the £2.7 billion slapped on the business by analysts. The valuation multiple of 16.4 times Costa's cash profit for 2018 compared with just 11.5 times in 2019 forecasts.

Shareholders of the Premier Inn owner will receive a "significant majority" of the proceeds once the deal completes in the first half of 2019.

With record levels of M&A activity continuing to support the blue-chip index, the second biggest rise of the quarter came from Sky.

Its takeover battle between Comcast and Twenty-First Century Fox finally came to a head with a rare blind auction process overseen by the UK Takeover Panel. Comcast won the day at 1,728p a share, equivalent to more than £30 billion.

Astra's rise of 13.5% in the quarter took the Cambridge-based company through another significant milestone as CEO Pascal Soriot continues to demonstrate he was right to turn down Pfizer's £55 a share approach in 2014.

The latest boost for the pharmaceuticals giant came at the end of the quarter when it reported positive results for Imfinzi, a lung cancer drug that analysts think has the potential to be another blockbuster drug.

Source: interactive investor Past performance is not a guide to future performance

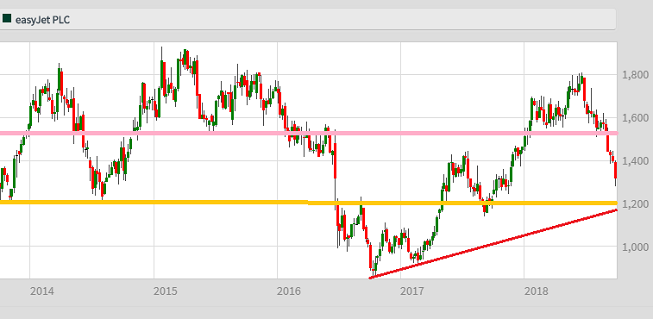

Moving in the opposite direction, low-cost airline easyJet has seen a rapid loss of confidence just weeks after shares hit near record-highs in the summer.

The pressure on easyJet is illustrated by recent broker activity, with Berenberg last weekend cutting its target price to 1,215p, while HSBC lowered the price on its 'buy' recommendation from above £20 to 1,875p.

This comes with easyJet now trading on a lowly projected price earnings (PE) multiple of 9.2x and offering a dividend yield above 5%.

Rising oil prices, Brexit uncertainty and Europe-wide industrial action are among factors causing investors to worry, even though the company said last week that profits for the year to September were at the upper end of guidance.

It's the first big test for CEO Johan Lundgren, who took over from Carolyn McCall in December. He has previously benefited from favourable conditions as the failure of rivals has helped to take capacity out of the market.

Source: interactive investor Past performance is not a guide to future performance

The 22% fall in the price of Paddy Power Betfair in the third quarter follows August's downgrade to 2018 earnings guidance as a result of tax headwinds in Australia, and the inclusion of losses from FanDuel in the United States.

Trading in its most recent update showed encouraging signs, with the scale of the share price slump partly due to the effect of its recent £500 million share buy-back, which pushed shares as high as 9,000p in the previous quarter.

The biggest faller in the FTSE 100 Index was miner Fresnillo after a quarter in which it suffered from poorly performing gold and silver prices. A recent cut to silver production guidance due to issues at its San Julian mine have also not helped.

The shares trade on a forward PE multiple of 16.4x, which could look attractive if global instability drives up the price of safe haven gold and silver.

| Company | Ticker | Price (p) | Q3 gain/loss (%) | Forward price / earnings (PE) ratio | Forward dividend yield (%) |

|---|---|---|---|---|---|

| Whitbread | WTB | 4,637 | 19.1 | 16.6 | 2.4 |

| Sky | SKY | 1,728 | 18.3 | 22.4 | 2.4 |

| AstraZeneca | AZN | 6,049 | 13.5 | 20.3 | 3.6 |

| Fresnillo | FRES | 826 | -28.2 | 16.4 | 3 |

| Paddy Power Betfair | PPB | 6,677 | -21.8 | 16.2 | 3.1 |

| easyJet | EZJ | 1,219 | -21.5 | 9.2 | 5.5 |

Source: SharePad Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.