FTSE 100 forecast and CannTrust analysis

Our technical analyst predicts FTSE 100 movement and where this cannabis stock is heading.

13th September 2019 10:07

by Alistair Strang from Trends and Targets

Our technical analyst predicts FTSE 100 movement and where this cannabis stock is heading.

Firstly, CannTrust Holdings (NYSE:CTST), a cannabis focused share which is getting a fair bit of coverage in forums as a "cheap" share.

Presently trading at around $1.61, the price requires above $2 to convince us it has a reasonable future. Instead, more likely is weakness below 1.57 risking further reversal to an initial 1.04 dollars. Worse, if broken, bottom is at 0.23 dollars, this being a point we cannot calculate below.

Despite the popularity of cannabis shares, we'd prefer advocating caution with this one as it's liable to leave investors "walking funny" with the wrong sort of cannabis experience!

Source: Trends and Targets Past performance is not a guide to future performance

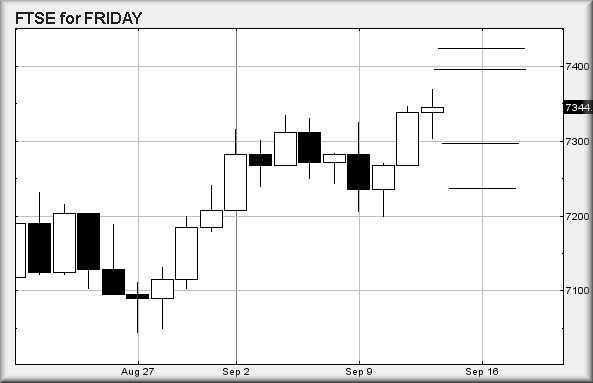

Our ever popular FTSE for FRIDAY worries us a little, because our bias is toward some upward travel. Given UK media coverage of the British PM, we appear to have a 'Trump like' character, only one without brain or charisma.

Of course, US markets flourished under the tutelage of the US president, so perhaps we shall suffer similar fate in the UK. This being the case, now above just 7,370 points calculates with an initial near term ambition of 7,398 points. If exceeded, secondary is at 7,424 points.

However, beware any triggering movement which happens with an opening second spike upward on the FTSE. If triggered, the tightest stop is wide at 7,285 points. We've a theory we're working on which suggests tighter could be safe at 7,328 points. We're cautious with this one.

Allegedly, in the event the market makes it below 7,328, we should anticipate reversal to an initial 7,297 points. If broken, our secondary comes along at 7,237 points. If triggered, stop can be 7,364 points.

Have a good weekend, even though there isn't a Grand Prix.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.