FTSE 100 stocks: Winners and losers in 2019

With the FTSE 100 up 12% in 2019, we analyse the high-flyers, who’s doubled, who’s crashed and why.

19th December 2019 12:56

by Graeme Evans from interactive investor

With the FTSE 100 up 12% in 2019, we analyse the high-flyers, who’s doubled, who’s crashed and why.

With the big beasts of the FTSE 100 index continuing to flounder, 2019 has seen rich rewards for investors prepared to back the lesser known “disruptors” shaking up London's top-flight.

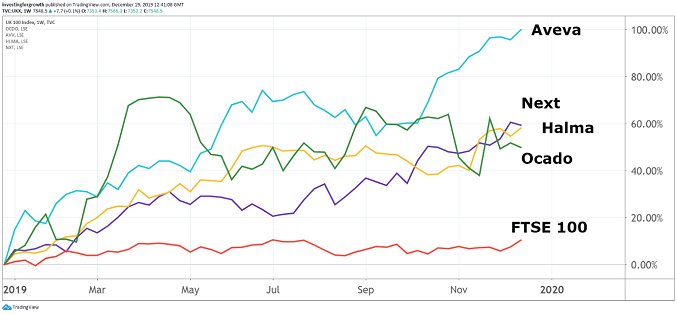

The 15 biggest risers in the FTSE 100 all achieved gains of 40% or more, with AVEVA Group (LSE:AVV), Halma (LSE:HLMA), Segro (LSE:SGRO) and Melrose Industries (LSE:MRO) among them. Turbocharged retailer JD Sports Fashion (LSE:JD.) tops the list after another remarkable year of sales growth helped it double in value in 2019.

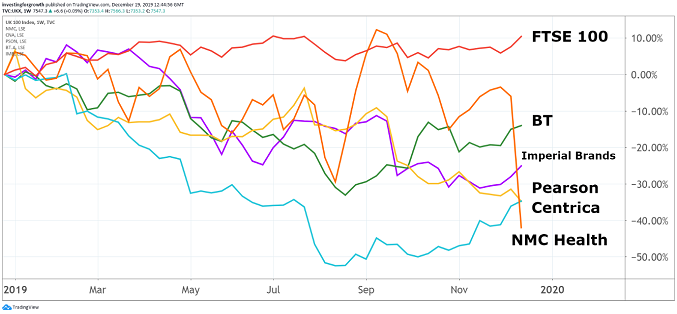

In contrast, some of the UK's most widely-held stocks dominate the list of fallers in 2019. They include British Gas owner Centrica (LSE:CNA) – down a third in the year that it cut its dividend — while BT Group (LSE:BT.A) is 15% lower on fears if may also have to sacrifice some of its shareholder payment.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

Imperial Brands (LSE:IMB), Pearson (LSE:PSON) and Sainsbury's (LSE:SBRY) are among other familiar names in the 15-strong list of biggest FTSE 100 index fallers. With Marks & Spencer (LSE:MKS) now outside the top-flight, these performances should raise more questions about the impact of more nimble competitors, advances in technology and structural changes in respective industries.

Ocado (LSE:OCDO) is one such disruptor, with shares up 55.9% in the FTSE 100 index after another strong year that has seen the launch of an online grocery joint venture with M&S. This follows the transformative Kroger deal in the United States as Ocado's cutting edge technology platform catches the eye of retailers worldwide.

FTSE 100 winners in 2019

Source: TradingView Past performance is not a guide to future performance

The greater use of technology has certainly benefited shareholders of Aveva, with the industrial internet of things, data visualisation and artificial intelligence among potential solutions propelling interest in the Cambridge-based software group.

The company only joined the top-flight in May at the expense of M&S but is now worth £7.5 billion, having trebled in value over the past three years. Aveva hasn't looked back since its transformative tie-up with part of France's Schneider Electric, which increased its presence in the key North American market and reduced dependency on the cyclical oil and gas sector.

A chunky forward price/earnings (PE) multiple of 42.9 times may put off new investors at the start of 2020, as might be the case for Halma and Segro at 36.4x and 35.9x respectively.

Halma, however, is no stranger to smashing expectations after 40 years of growing its dividend by 5% or more. The company, whose products sit inside the systems of world leading equipment manufacturers, has already proved its worth for followers of the interactive investor Consistent Winter Portfolio, with a double-digit percentage gain so far this season.

- interactive investor’s Winter Portfolio’s make best start ever!

- Why ii’s Winter Portfolios have been so successful

- You can also invest in UK equities via ii’s Super 60 recommended funds. Click here to find out more

Segro shares have also reached their highest level since the financial crisis in 2008 after a stunning run of form in which the stock has added 49% to its market value in 2019.

At a time when the wider real estate sector is under pressure, Segro's portfolio of warehouse and industrial properties in the UK and continental Europe is an attractive play on e-commerce disruption.

Its warehouses are located close to major cities and are used by customers including retailers, supermarkets and parcel delivery firms for urban distribution. The remaining third of its estate is made up of 'big box' warehouses serving national and international logistics supply chains.

JD Sports Fashion and Next (LSE:NXT) also showed in 2019 that there is life in retail stocks, with the latter up almost 80% after its trading performance proved to be much better than feared.

Store sales continue to fall but online revenues topped £1 billion in the recent half-year and exceeded the figure for retail, driven by the expansion of its Label business selling third-party ranges from brands including Adidas( XETRA:ADS), French Connection (LSE:FCCN) and Boohoo (LSE:BOO).

Next shares are now above 7,000p for the first time in almost four years, with the all-time high landmark of 8,000p in sight.

In contrast, Centrica shares spent 2019 trading at their lowest level since the company was created out of British Gas in 1997. That's despite a rally of 10% in recent days after the General Election result boosted confidence in UK-centric companies.

FTSE 100 losers in 2019

Source: TradingView Past performance is not a guide to future performance

Centrica was only spared top spot in the list of FTSE 100 fallers, however, by a late surge from UAE-based healthcare provider NMC Health (LSE:NMC).

NMC, which was promoted to the top-flight in September 2017 after a meteoric rise since listing on the London Stock Exchange in 2012, is down 37% in 2019 after short-seller Muddy Waters issued a report this week raising doubts about the company's financial statements. NMC has denied the allegations, which initially wiped more than £1.5 billion from its market value.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.