FTSE 100: when will the FTSE break its ‘horizontal trend’?

The index is trapped within a range, but it may want to drop while the rest of the world rises.

12th February 2021 08:39

by Alistair Strang from Trends and Targets

The index is trapped within a range, but it may want to drop while the rest of the world rises.

FTSE for Friday (FTSE:UKX)

It's time to talk about 'our friend, the horizontal trend'. Few folk will be unaware of the dangers of sleeping on the job, something the FTSE 100 has managed to accomplish pretty convincingly since the start of February.

Essentially, the UK index has trapped itself within a (roughly) 100-point range, creating something we're fond of calling a ‘horizontal trend’ around the 6,500 point level.

Usually, when this sort of nonsense occurs following a market high, such as the spike on 7 January, it's just a matter of patience while awaiting the market lemmings to rush over a cliff.

In the case of the FTSE, we'd normally be privately confident the index intends to shed around 500 points, eventually reversing down to the 6,000 point level, perhaps even 5,627 points if things get really serious.

Visually, certainly there's a strong argument favouring a rebound at the 5,600 level.

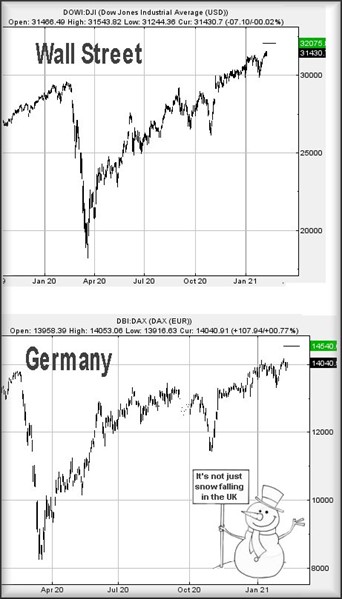

In the wider world, something else is happening. Both Germany and the US quite cheerfully created horizontal trends this year, the Dow Jones (DJIA) once residing at 31,000 points and the DAX finding favour with around 14,000 points.

- FTSE 100: why is the index running scared?

- 2020’s Dogs of the Footsie: how did they perform?

- Why reading charts can help you become a better investor

The absolutely critical difference with these markets is the horizontal trend line created generally can be thought of as a glass ceiling, a level we anticipate breaking when an upward rush occurs. For instance, once the Dow breaks free of its ceiling, an uninhibited rise to 32,000 points is expected. For Germany, we are looking for a 500-plus point rise.

Alert readers, not yet asleep due to the onslaught of numbers above, will notice the conflict. The FTSE essentially wants to drop, but the rest of the world wants to go up!

As for Friday and the FTSE, we're understandably nervous expressing any optimism. The UK index needs to exceed 6,585 points to suggest the potential of some serious gains.

Such a movement will suggest the market attempting to jump clear of the thin ice upon which it currently stands. This calculates with an initial hope of 6,634 points with secondary, if exceeded, a more inspiring 6,749 points. Perhaps positive news is needed.

Closing the session at 6,528 on Thursday, London needs to slither below 6,497 points to indicate trouble. This risks triggering reversal to an initial 6,463 points with secondary, if broken, at 6,322 points.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of interactive investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.