FTSE for Friday: analysis of the blue-chip index and bitcoin

After a largely lacklustre month, independent analyst Alistair Strang gives both a short and long-term prediction for the FTSE 100 index, and shares his thoughts on the price of bitcoin.

29th August 2025 07:46

by Alistair Strang from Trends and Targets

The FTSE 100 appears to be avoiding amateur dramatics as August winds its way to a close, aside from our expectation the UK market shall discover an excuse to rewind to the level around which it started the month.

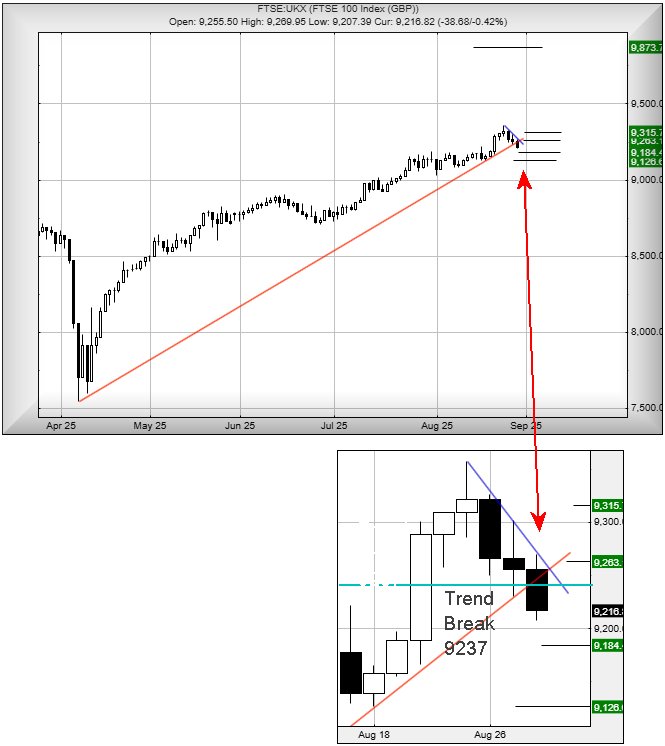

Visually, the suggestion is for the need for things to rewind to around 9,128.3 points, a drop ambition which feels almost impossible. As Friday is the last trading day of what has been a lacklustre month, it was a surprise to notice the value of the index has managed to enter a potential disaster zone.

- Invest with ii:Open a Stocks & Shares ISA | Top ISA Funds | Transfer your ISA to ii

Below just 9,207 currently holds the threat of triggering reversal to 9,184 points initially with our secondary, if broken, an amazing 9,126 points, sufficiently close to the level (9,128) at which the month started to justify a drum-role.

If this scenario triggers, the tightest stop looks like 9,237 points, the trend-break level providing an amazing stop loss potential for quite a reasonable risk/reward scenario. Even though it’s visually a bit of a free gift and thus dangerous to trust.

Our alternate game plan becomes useful if the index makes it above 9,237, as this threatens to trigger a gain in the direction of an initial 9,263 with our secondary, if bettered, at 9,315 points. The attraction with this scenario is it would emplace the index virtually matching the highs of August, while also parking the FTSE value in a zone where a distant 9,873 continues to exert an influence further down the line.

It’s absurd, both our short and long scenario making their own brand of logic appear sensible, with only a day of the month remaining to satisfy our warped arguments. Unsurprisingly, at time of writing, FTSE Futures are messing around at 9,231 points, failing to show a bias in any direction. It is going to be an interesting day.

Source: Trends and Targets. Past performance is not a guide to future performance.

As for bitcoin, at present the value is looking a little dodgy, below 110,250 risking triggering reversal to an initial 106,600. Our secondary, should such a level break, works out around 100,850 and a return to price levels not seen for 10 weeks, which isn’t even partially impressive.

We were quite chuffed bitcoin managed to attain our 120,000 target level, suggested back in June when the value was at 106,000. The impression given visually is not to be surprised if the value again tries to head up to the 120,000 level with movement above 112,670 but, similar to the FTSE attitude given above, we shall not be aghast if this heads back to its prior level around 100k. Any miracle above 120k now calculates with a longer-term “risk” of a visit to an astounding 138k.

Have a good weekend.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.