FTSE for Friday: is the blue-chip index in holiday mode?

It’s August and many people are at the beach, but it doesn’t mean it will necessarily be a slow month, says independent analyst Alistair Strang, who reveals what his charts say about prospects for the blue-chip index.

8th August 2025 09:10

by Alistair Strang from Trends and Targets

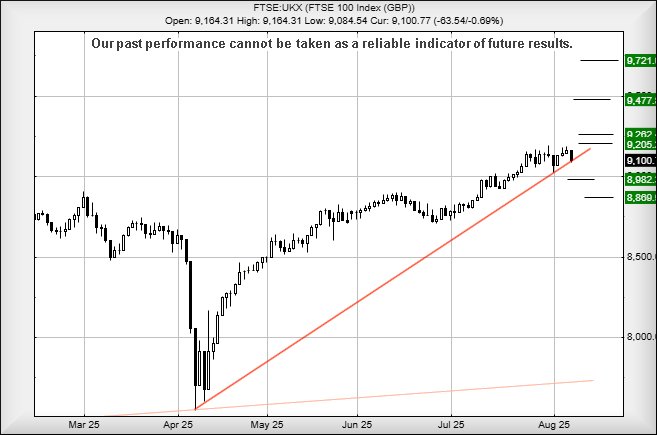

Our suspicion August has been designated as a “slow month” will prove interesting if the market wanders below 9,066 points.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

According to our software, this should present a trigger possibility for market reversals, as below such a point creates a scenario where an initial 8,982 points calculates as possible with our secondary, if broken, at 8,869 points and a probable bounce.

Should this scenario trigger within the next few days, the tightest stop loss works out at roughly 9,117.438 points, this being the level of the red trend currently. The FTSE, at 9,100 points, has already broken the uptrend since April this year and we feel the level of trend break needs to be exceeded to cancel current reversal prospects.

Source: Trends and Targets. Past performance is not a guide to future performance.

However, as it’s August, things could theoretically go the other way, although we strongly suspect the UK will avoid the path to 9,700 points until everyone is back from their holidays!

But, should the FTSE now exceed 9,176 points, it’s liable to trigger near-term growth to an initial 9,205 points with our secondary, if bettered, at 9,262 points.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.