FTSE for Friday: can blue-chip index overcome this lethargy

With the FTSE 100 flat for the week so far, independent analyst Alistair Strang runs his software again for indications as to what happens next.

10th October 2025 07:49

by Alistair Strang from Trends and Targets

When we’re getting cheesed off about how poorly many shares on the UK stock market are performing, habitually we add to our depression by running a comparison with what’s going on elsewhere.

- Invest with ii:Open a Stocks & Shares ISA | Top ISA Funds | Transfer your ISA to ii

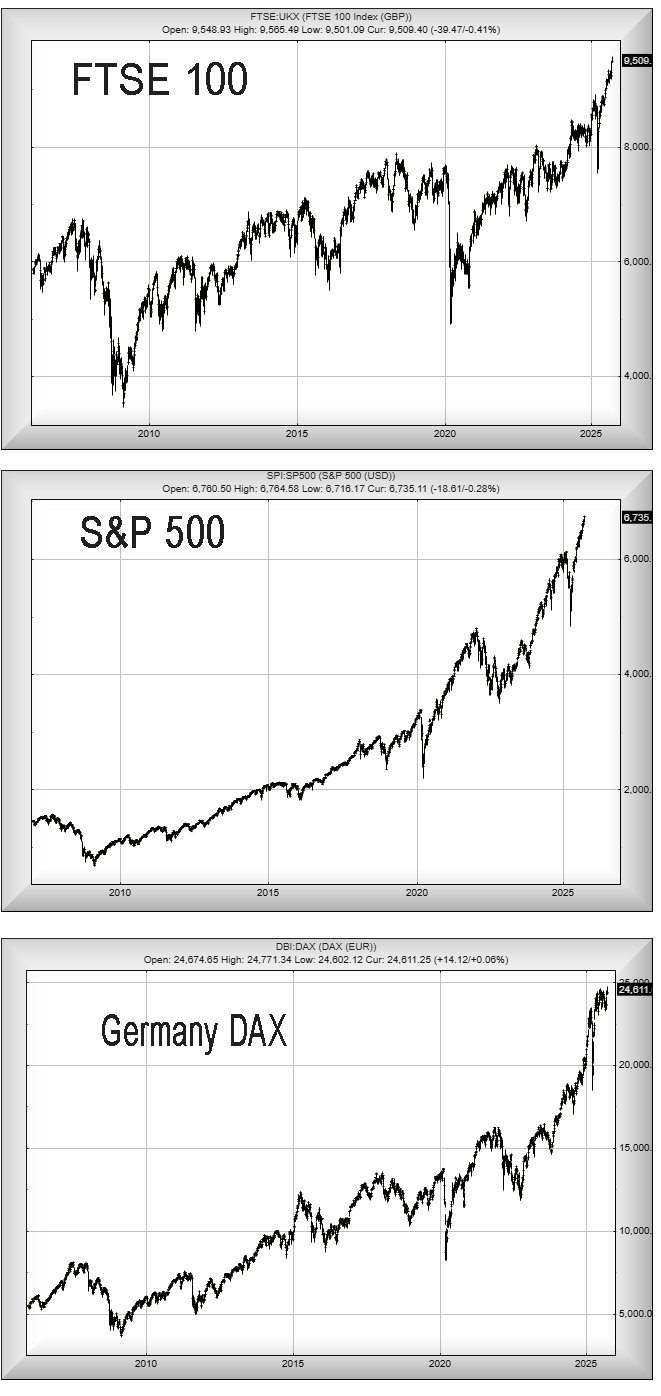

The charts below tell a story suitable for Halloween. Since 2010, the value of the UK stock market has increased by almost double. The FTSE 100 needs to be just below 12,000 points to make the rise a solid 2x fold gain.

However, the US S&P500 chart below is a bit more interesting, showing a fivefold increase for exactly the same period. And our local neighbour, Germany, is also showing a near fivefold increase.

Source: Trends and Targets. Past performance is not a guide to future performance.

As for our FTSE for Friday, there are many suggestions that the UK market should be heading upward. There has been a certain lethargy of movements this week, so hoping for a positive day on Friday may be an error.

If things intend to go wrong for the FTSE, it’s now the case where weakness below 9,501 points risks promoting reversals down to an initial 9,471 points with our longer-term secondary, if broken, at 9,436 points and hopefully a bounce point given the underlying pressure remains upward. If this scenario triggers, the tightest stop is at 9,537 points.

Should things intend to turn positive, the UK index needs wander above 9,566 points to promote the idea of gains to an initial 9,629 points with our secondary, if beaten, an unlikely (in the same day) 9,650 points. Our expectation is for a day of mild reversals while the FTSE embraces a flat spell prior to the Bank of England interest rate announcement next month.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.