FTSE for Friday: a new rule and a new forecast for FTSE 100

As the blue-chip index has a pause for breath after a record-breaking run, independent analyst Alistair Strang reveals what his bespoke software says about the market's potential.

23rd January 2026 07:53

by Alistair Strang from Trends and Targets

FTSE 100 index movements since the start of 2026 brought a new rule for us to observe, something which makes little sense yet proved to be exquisitely correct. As always, our reasoning can verge on the absurd but one of our “things” has been a reliable argument which relates to glass ceilings.

- Invest with ii:Open a Stocks & Shares ISA | Top ISA Funds | Transfer your ISA to ii

We’ve now got a rule which argues accurately on the drop potentials when a glass ceiling is exceeded and a new high achieved. To most folk, this isn’t a big deal, but for us our rule book just expanded from 189 to 190 concepts of what may happen following a price movement. Our software is emphatically not AI, just a series of “if” statements designed to avoid logic loops occurring and sometimes toss out correct answers.

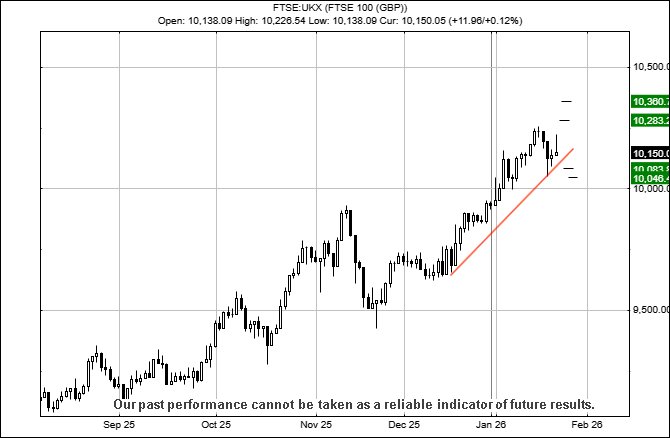

Currently, below 10,134 points indicates the potential of weakness to an initial 10,083 points with our secondary, if broken, at 10,046 points. If triggered, the tightest stop loss level looks like a fairly acceptable 10,170 points. Oddly, we suspect this game plan will probably fail as it’s almost too obvious.

Instead, above 10,196 should become of special interest, giving an initial target level at 10,283 points with our secondary, if beaten, at 10,360 points.

Have a good weekend, we’re going to sit back and hope the FTSE 100 experiences some gains.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.