FTSE for Friday: new targets for the FTSE 100 index

8th July 2022 07:39

by Alistair Strang from Trends and Targets

The PM's resignation removed some uncertainty for markets, which investors appreciated. With that in mind, independent analyst Alistair Strang gives his latest assessment of prospects for UK shares.

With news that the UK Prime Minister was finally leaving, we’d expected the FTSE 100 to show some flamboyant behaviour, but it proved not the case.

When the PM made his announcement, the FTSE did manage to rise immediately by a fairly trivial 25 points, deciding to stabilise around the 7,200 point level for the rest of the session.

We certainly could not describe it as a wild celebration by the markets due to Boris’s less than graceful exit. If we’re honest, we still suspect the FTSE is awaiting an excuse for a bit of a bloodletting, thanks to its behaviour since the start of June.

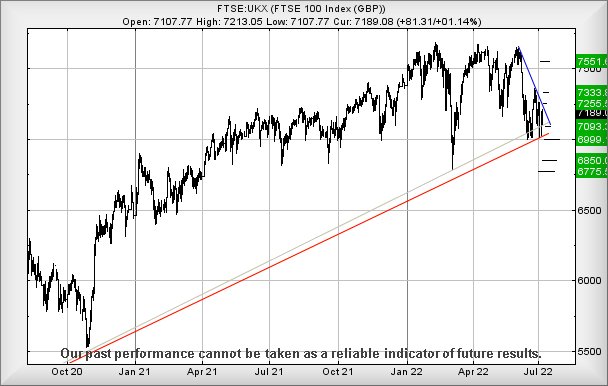

Initially, July started with the first couple of trading days showing astoundingly low volumes, making us fear the worst. However, volumes appear to have returned to “normal” levels and the FTSE now requires exceed just 7,220 points to kick its way through the immediate Blue downtrend.

Thankfully, there are some immediate potentials which suggest slight optimism may be permissible.

Past performance is not a guide to future performance.

Currently, above 7,220 should prove capable of triggering movement to an initial 7,255 points, a modest 35-point rise. If exceeded, our secondary calculates at 7,333 points, visually matching the highs of last month doubtless provoking some hesitation for this reason.

It’s important we mention our suspicion of a coming near term bloodbath recedes quite dramatically in this scenario, the FTSE proving able to break free of the suspiciously concise Blue downtrend.

For things to start going wrong for the FTSE, the index needs to flop below 7,135 points to risk triggering reversal to an initial 7,093 points.

In the event this level breaks, things risk becoming quite twitchy as our secondary works out at 6,999 points, below the Red uptrend since 2020. This represents a market level which could swiftly lose another 200 points without much effort, should the markets discover news which is perceived as bad.

Have a good weekend.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.