FTSE for Friday: real hope for FTSE 100 plus an oil price forecast

With the FTSE 100 index moving in the right direction and oil heading the other way, independent analyst Alistair Strang updates his charts. Here's what they say.

12th September 2025 07:51

by Alistair Strang from Trends and Targets

The price of crude oil has been frustrating us this year. We always harp on about the important detail that it’s impossible to apply timeframes to the marketplace, but this is getting frustrating, every time weakness looking like it is settling into place, the world discovering an excuse to derail any fall.

- Invest with ii:Open a Stocks & Shares ISA | Top ISA Funds | Transfer your ISA to ii

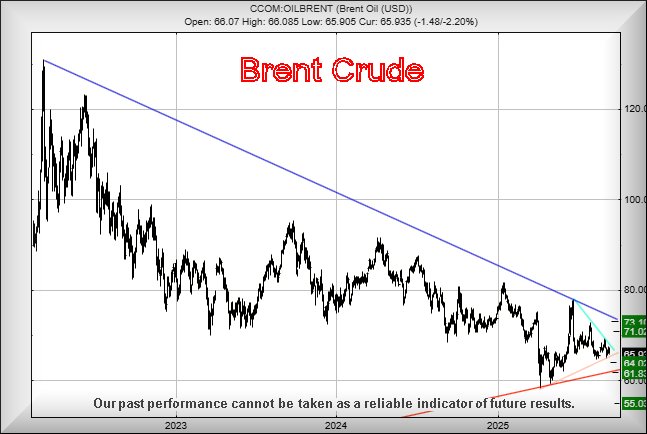

This may turn around to bite us but we’re now showing a potential $55 as a bottom, the product needing an excuse to move above $75 to escape the path and destroy our scribbled notes on a napkin.

More likely, it feels like below $65 should next trigger weakness to an initial $64 with our secondary, if (when) broken at $61.8 and a probably short-lived bounce. But, overall, should $61.8 eventually break, a visit to $55 looks probable.

Source: Trends and Targets. Past performance is not a guide to future performance.

With our FTSE for Friday, it’s the same as above, only different! We’ve a strong argument favouring movement above 9,800 points, the only fly in the ointment being the FTSE 100 has resolutely refused to co-operate with our calculations. This week there has been some early signs of proper steps in the correct direction but, realistically, we demand above 9,358 points to make things inevitable.

From a near-term perspective, there is now some real hope as above 9,298 points has the potential of triggering further FTSE movement toward an initial 9,342 points. Our secondary, considerably less likely in the near term, calculates at 9,494 points.

While we’re a little dubious about this as an immediate target, such an influence is perhaps capable of moving things above our 9,358 point trigger for the longer-term where our future 9,873 point target awaits, gleefully rubbing its hands.

But similar to Brent's failure to head down, the FTSE has thus far failed to move up solidly, but we’re not giving up hope.

If things intend to go wrong, below 9,150 points looks like a sensible point capable of triggering reversal to an initial 9,027 points with our secondary, if broken, an unlikely looking 8,919 points.

Have a good weekend.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.