FTSE for Friday: this should be the FTSE 100's limit

UK stocks have finally found some friends, but independent analyst Alistair Strang believes there may be a pause. Here's where he thinks the index will draw breath.

16th January 2026 07:49

by Alistair Strang from Trends and Targets

Quite a few calculations seem to be pointing at the potential for some fairly major stumbles by the mid 10,000’s. In theory, market growth should already be fairly hard pushed as our expectations, due to movements during 2025 pointing at 10,240 as a major ambition point.

- Invest with ii:Open a Stocks & Shares ISA | Top ISA Funds | Transfer your ISA to ii

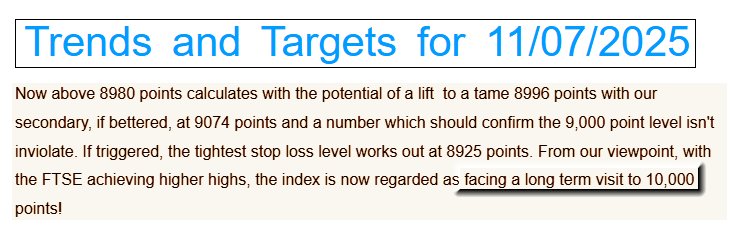

This was achieved yesterday, and despite being exceeded during the trading session, the index “only” closed at 10,239 points. It’s interesting to note our report on 11 July last year hailed the 10,000 level as a long-term interest and now, while we luxuriate in complements, we can refine our targets.

Source: Trends and Targets. Past performance is not a guide to future performance.

We’re not exactly frothing at the mouth with Big Picture hopes, currently calculating 10,497 points as a sane “top” on the current cycle. At present, above 10,255 points suggests movement continuing to 10,306 points with our secondary, if bettered, at 10,386 points.

Given the relative proximity of all these numbers, the odds appear to suggest the UK index is about to experience a period of some lethargy until something happens to springboard things into life. We’re most emphatically not suggesting a “correction” is evident, just a period where the market must almost certainly pause for thought. Perhaps the forthcoming Davos event shall give the market sufficient excuse to do something really interesting.

We shall certainly be fascinated if the FTSE 100 manages above 10,500 points anytime soon as it shall enter a similar phase to that experienced by Wall Street or the Nasdaq, when they exceeded immediate logic and just kept toddling upward while blithely ignoring world events.

Should things intend to go wrong, below 10,180 looks like providing a point at which trouble risks flaring, giving reversal potentials to an initial 10,097 with our secondary, if broken, at 10,057 points. Neither drop potential looks particularly hazardous, perhaps delineating the bottom of a future trading channel while the index is drawing breath. However, should 10,057 break, we can calculate a chance of reversals down to 9,943 points and a challenge of the uptrend since 2025.

Have a good weekend.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.