This is the fund I've bought to capitalise on US boom

The US stock market rebounded in June, so the Saltydog analyst picked this top fund to play the theme.

1st July 2019 13:06

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

The US stock market rebounded in June, so the Saltydog analyst picked this top fund to play the theme.

This year the S&P had its worst May in seven years and second worst since the 1960's; it lost 6.6%. The Dow Jones was down 6.7% and the more tech focused NASDAQ was hit hardest, dropping by 7.9%.

In contrast, we've just seen a great June. The S&P 500 reached an all-time high after the best June for decades, up 6.9%, and the best first half of the year since 1997. The Dow Jones and NASDAQ have also rebounded.

The table below shows how other markets around the world have followed suit:

The escalation in the trade war between America and China weighed heavily on the markets in May. At one point it looked as though Mexico would also get roped in, with tariffs starting at 5% in June and then being ramped up by 5% a month until they hit 25% in July – hardly ideal for global trade.

In the end, Donald Trump suspended the Mexico tariffs 'indefinitely' after it agreed to put in place measures to stop the inflow of migrants into the US.

Jerome Powell, Chair of the Federal Reserve, gave the markets a further boost saying that "as always, we will act as appropriate to sustain the expansion". This was taken as a sign that interest rate cuts would soon be on their way.

The icing on the cake came at the G20 meeting which recently took place at the Osaka International Exhibition Centre in Japan. On Saturday, President Trump had a meeting with China's president Xi Jinping and they have agreed to resume trade talks. He also said the US would not be adding tariffs on $300 billion worth of Chinese imports. Most of the Asian markets responded well overnight, and the European markets are up in response.

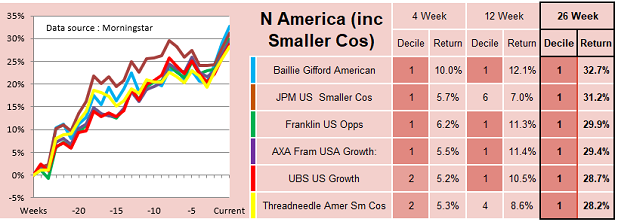

In last week's Saltydog analysis, the North America and North American Smaller Companies sector featured at the top of our 'Full Steam Ahead Developed Markets' group. The leading fund in both our four-week and 26-week tables for this sector was the Baillie Gifford American fund.

It was showing a gain of 10% in four weeks and over 30% in 26 weeks. We have added this fund to our portfolios.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.