Fundsmith Equity versus Fundsmith Sustainable Equity

Fundsmith Sustainable Equity's performance makes it a decent diversifier for Fundsmith Equity fans.

6th September 2019 08:40

by Andrew Pitts from interactive investor

Fundsmith Sustainable Equity's comparative performance makes it a decent diversifier for Fundsmith Equity fans.

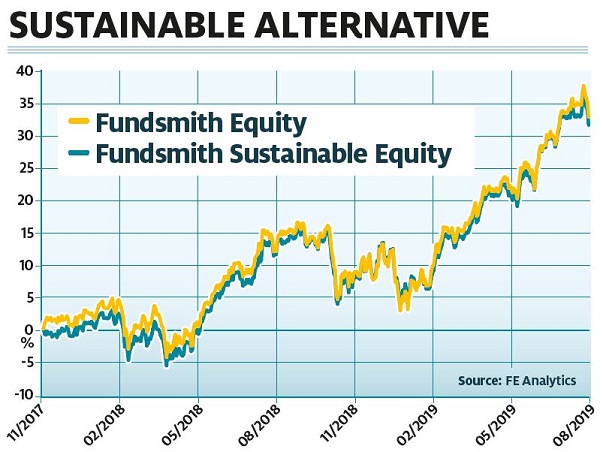

Most Money Observer readers will be familiar with the table-topping exploits of Terry Smith's global Fundsmith Equity fund, but perhaps less so with the sustainable version. Fundsmith Sustainable Equity got off to a comparatively slow start when it launched on 1 November 2017, but it has recently mirrored the performance of its much larger sister fund.

At £304 million, the sustainable fund is dwarfed by Fundsmith Equity's gargantuan £19.05 billion, but since its launch Sustainable Equity has returned 31.6%, compared with Equity's 32.8% (as at 6 August). Both funds are managed with the same unyielding underlying selection criteria.

However, the 24 stocks held in the sustainable version are not sourced from firms the factsheet describes as having "substantial interests" in sectors such as defence, gambling, mining, fossil fuels and tobacco.

It's fair to say that Fundsmith's investing tenets would exclude the mainstream equity fund from investing in many of these sectors, particularly capital-intensive sectors such as mining.

However, Fundsmith Sustainable Equity's comparative performance makes it a decent diversifier for Fundsmith Equity fans – including investors who aren’t bothered about sustainability – particularly as it is 63 times smaller, and potentially more nimble, than its giant sister.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.