Here’s why these two miners should be on your radar

Both are experiencing levels they’ve not seen for a while. Our chartist looks for upside potential.

3rd December 2020 09:44

by Alistair Strang from Trends and Targets

Both are experiencing levels they’ve not seen for a while. Our chartist looks for further upside potential.

Hochschild & Rainbow Rare Earths

A glance at Hochschild’s area of operations was surprising, the map looking identical to the route taken by Euan McGregor in the recent TV show, The Long Way Up.

Essentially, film actor McGregor rode an electric bike up the left hand side of South America, the trip punctuated by constant searches for a travel plug and cable extensions.

Hochschild (LSE:HOC), describing themselves as the leading underground precious metals producer, search for gold and silver with some really big recovery numbers quoted on their website. With gold prices messing around between the $1,800 and $2,000 levels presently, the company is doubtless enjoying levels of income not seen for nine years. This detail shall perhaps prove important when we take a look at the immediate share price potentials.

Currently trading around 237p, we regard 247p with the potential of triggering some further recovery. Above this level, we can calculate an initial ambition of 271p with secondary, if bettered, at 298p.

Visually, neither aspiration is particularly interesting, especially as the big picture demands the share price close a session above 298p to provoke a return to some historical share price levels.

Closure above 298p should present 349p as a reasonable hope with secondary, if exceeded, calculating at a more useful 540p and a return to levels the share price has not witnessed for nine years.

If it all intends to go wrong, the price needs reverse below 200p as this makes swift reversal to 91p an arithmetic possibility.

Source: Trends and Targets Past performance is not a guide to future performance

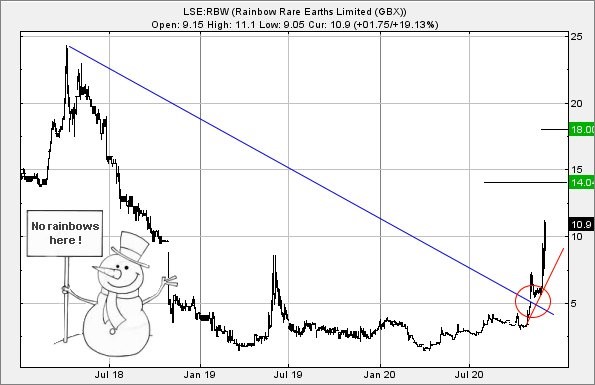

Rainbow Rare Earths (LSE:RBW)

From the corporate website, their business strategy reads as:

"... to become a globally significant producer of rare earth metals, with a particular focus on NdPr, a fundamental building block in the global green technology revolution. As a key component of permanent magnets, required in the construction of motors and turbines, analysts are predicting demand for these rare earth oxides to grow substantially over the coming years, tipping into a supply deficit."

At time of writing, Rainbow (LSE:RBW) are trading around the 11p mark, needing only trades above 11.2p to suggest coming price recovery to an initial 14p with secondary, if bettered, calculating at 18p.

If we chose to accept the closing price as a sensible signal, the share already allows considerable optimism for the future.

Presently, the share price needs to sink below 6p to provoke panic for the future, but we're fairly impressed at the strength of movement since the start of November and the forced "gap" up in price. The market clearly has an idea of what it wants.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.