Holidaymakers warned pound could weaken further against euro

Uncertainty continues with this currency pairing, but our chartist feels comfortable with this forecast.

10th June 2019 09:04

by Alistair Strang from Trends and Targets

Uncertainty continues with this currency pairing, but our chartist feels comfortable with this forecast.

GBP:EUR Big Picture

Sometimes this pair defies any sort of logic, but, as projected last month, the relationship indeed met criteria and founders from the €1.17 level down to the €1.12 level. We suspect, given the calibre of politicians involved, this was almost like predicting rain in Scotland - inevitable.

Source: Trends and Targets Past performance is not a guide to future performance

At present, the pairing needs above €1.13 just to exceed the immediate pace of descent but we shall be more interested only if it somehow exceeds €1.14 and rises to €1.1503.

While fairly insignificant, things get a little more interesting if €1.153 is bettered. This will tend to imply some strength is present, indicating the potential of growth toward €1.169 next.

Calculating above €1.169 is a bit dodgy but the key trigger level for "proper" movement of €1.20 still appears viable.

However...

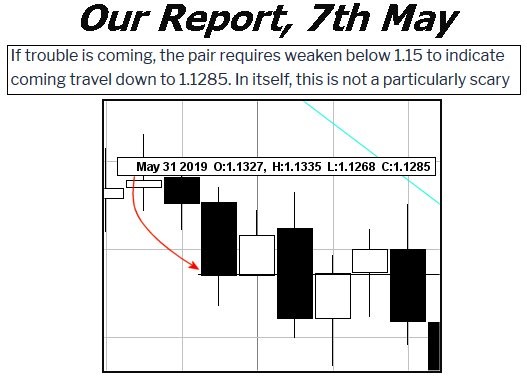

We're occasionally mentioning "on the first surge" to highlight something useful about our target levels. For instance, the graphic above highlights that on May 31, GBP:EUR achieved our $1.1285, even closing the session at exactly this level.

But, importantly, during the session, it broke below to $1.1268. In plain English, this created a scenario where regardless of what followed, our secondary drop target became viable.

The situation now is fairly plain as anything now below $1.12 looks very capable of travel down to an initial $1.1092 next.

Secondary, if (when) broken on the first surge is at a bottom, hopefully, of $1.085.

In conventional circumstances, we'd already feel comfortable assuming GBP:EUR is already heading down to the €1.085 level.

Below such a point will require another hard stir of the tea leaves.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.