How are telecoms and tobacco stocks faring in challenging times?

In his FTSE Sector Watch column, Richard Hunter considers the outlook for two sectors in light of the C…

1st July 2020 09:20

by Richard Hunter from interactive investor

In his FTSE Sector Watch column, Richard Hunter considers the outlook for two sectors in light of the Covid pandemic’s impact.

Telecoms

What has changed?

Consolidation in the sector had long been predicted, and in 2016 BT acquired EE in a deal valued at £12.5 billion. In 2019, Vodafone acquired Liberty Global’s German and Eastern European operations for £18 billion.

The latest in this power play came in May, with Liberty Global, owner of the UK’s largest cable company Virgin, and Telefónica, which owns Britain’s biggest mobile operator O2, confirming a 50-50 joint merger of their UK operations worth an estimated £31 billion. The deal was described as one creating a new ‘national champion’, taking direct aim at BT and Sky (itself now owned by US company Comcast after a £30 billion takeover in 2018) in the UK.

The new company will offer consumers competitive bundles of TV, mobile and broadband packages, and will have 46 million customers and £11 billion in revenue. BT should be well-placed to withstand such an onslaught, however, with the combined elements of its own brand, along with EE and PlusNet, providing a formidable defence.

Meanwhile, Covid-19 has also impacted the sector, affecting the outlook in several ways.

- Dividend kings: reliable income shares hit by Covid cuts

- The winners of lockdown and the firms fit for a post-Covid world

What is the outlook?

At Vodafone for example, the escalation of the epidemic has been something of a curate’s egg. On the one hand, there has been an inevitable spike in the use of data traffic, which plays into the group’s hands.

At the same time, lower international travel has impacted Vodafone’s roaming revenues, while the very real threat of cyber-attacks has also increased over the last couple of months.

BT, meanwhile, has realised that something needed to be done to mollify investors, who have seen the share price decline by 75% over the past five years. A radical overhaul of the business is under way to sharpen its prospects in an increasingly competitive arena.

However, as recently announced, if ever a dividend cut was coming, it was that from BT, and not just because of the Covid-19 crisis.

Even where BT is coming from a position of strength, such as in the profi able and higher-margin Openreach business, the price regulator Ofcom wants its pound of flesh. The requirement for more internet connections at ever-increasing speeds is a given for the UK consumer, but this also comes with expectations of lower prices.

The acquisition of Liberty Global’s assets in Germany and central Eastern Europe is already making a notable contribution to Vodafone’s performance, with the increasingly important German unit reaping the rewards of retail growth. The purchase also offers other tangible benefits, such as significant projected cost synergies and a potentially rich seam of cross-selling opportunities: retail customers using multi-product services tend to lead to improved retention.

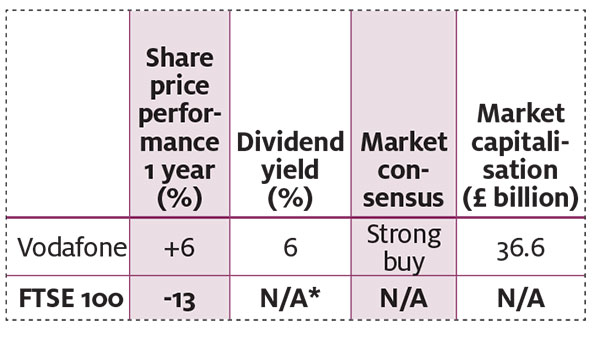

Meanwhile, the business offering is showing signs of progress as the prevalence of remote working and multi-site operations increases exponentially during the current crisis. Vodafone remains a prodigious cash-generator, and the fact that it has maintained the dividend will be a pleasant relief to increasingly starved income-seekers. The projected yield of 7%, even if partly driven by a weaker share price, is particularly attractive in light of the current interest-rate environment and the relative lack of income options elsewhere.

Vodafone

Tobacco

What has changed?

At the end of May, British American Tobacco’s South African unit (BATS) reported that it would relaunch an urgent legal action to challenge the country’s ban on cigarette sales. BATS, which has a market share of nearly 80% in the country, warned that the ban threatened the survival of the local tobacco industry.

This followed what had been a cautiously optimistic operational update in April, when BATS stated that following a strong operational performance in 2019, it expected to report earnings growth for 2020 despite the impact from Covid-19 being “difficult to predict”.

The company added that most of its factories had remained open at full capacity, and that it had seen a limited impact on consumer demand, pricing or the ability of consumers to access products as a result of nationwide lockdowns implemented around the world.

Meanwhile, the growth of ‘ethical’ funds has also put selling pressure on tobacco stocks in general, with an announcement in early June from the UK’s largest private sector retirement fund, the Universities Superannuation Scheme, that it would be divesting its tobacco holdings, which it said represented investments in a “financially unsuitable” sector.

- Three quality shares that should survive and prosper in a post-pandemic world

- Dividend cuts: how income investors can beat the drought

What is the outlook?

Regulation and retrospective litigation have cast long shadows on the sector over recent years, and show few signs of easing. Imperial Brands, for example, is in the firing line of the US Food and Drug Administration, where the current issue has been vapour cigarettes, especially flavoured varieties. As a result, Imperial has written down £95 million on this part of its next-generation products (NGPs). As such, NGP net revenues have recently fallen by 43%, and as a consequence, investment in these products has been reduced.

On a rather more positive note, the defensive qualities of the sector have eased the impact on dividends compared with many others during the current pandemic.

While Imperial reduced its dividend by a third, its yield remains significant (see below); further, it appears that one income stream that investors can expect to continue in the coming year is the dividend from British American Tobacco. The high-yielding (around 6.5%) blue-chip stock reaffirmed its 2020 outlook in its most recent update, with the company confident of delivering “another good year” of high single-figure earnings per share (EPS) growth.

At the end of March, Imperial stated that there had been “no material impact” on trading from the Covid-19 pandemic, but the group was forced in May to change its tune for the remainder of the financial year.

Supply chains held up reasonably well and the company saw stockpiling of some of its products in anticipation of a slowdown, but it could not accurately factor in the material effect on sales through its travel retail and duty-free lines, let alone any impact on consumer buying habits, such as trading down, given the inevitability of global recession.

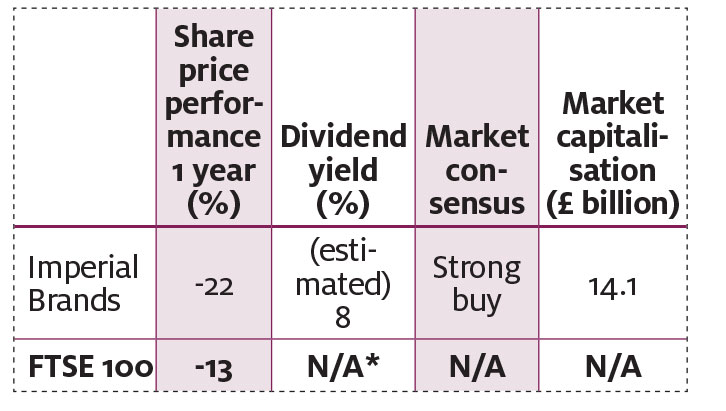

Reducing its unrelenting net debt of over £14 billion has become a key priority. This will be boosted by the sale of its Premium Cigar business for around £1 billion, the focus on cost containment, and a reduction of the dividend by a third. The implied dividend yield after the cut is around 8%, which remains a significant attraction to income-seeking investors in the current environment.

By its own admission, it has been a disappointing time of late for Imperial and the renewed focus of concentrating on its strengths is possibly overdue. Market share has been nudging higher in its main lines, and margins remain strong given lower production costs.

Imperial Brands

Share prices/figures above as at 2 June 2020 – sources ProQuote/Digital Look. *FTSE 100 dividend yield is not currently reliable because of continuing dividend cuts among constituents.

Richard Hunter is head of markets at interactive investor, Money Observer’s parent company.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.