How to invest...for an early retirement

3rd February 2022 10:02

by Faith Glasgow from interactive investor

Giving up paid employment early is a dream that can only be realised with some serious advance pension planning. Do these eight things to help you do it.

Do you dream of stepping out of the rat race and hanging up your briefcase at the earliest opportunity, with decades of hopefully fit and healthy life ahead of you to do something completely different? Perhaps you have a travel ambition, hobby or volunteering interest you want to pursue more energetically, or maybe you simply want to live life at a slower pace.

Whatever your reasoning, for all but the wealthiest, most entrepreneurial or most speculative individuals, giving up paid employment early is a dream that can only be realised with some serious advance pension planning. So what should you bear in mind when contemplating it?

- Top 10 jobs for pensions

- 10 shares to give you a £10,000 annual income in 2022

- How much is enough in retirement?

- Is a million pounds enough to retire on?

Be realistic

You may be planning to make an early fortune through canny trading in cryptocurrency, tech stocks or real estate, in which case good luck. Some of the below may be relevant to you, but the chances are that you won’t be reliant on a well-stuffed pension alone to see you through your later years.

- Invest with ii: What is a SIPP? | Are SIPPs worth it? | SIPP Portfolio Ideas

The rest of us, however, need to take a realistic view of how much we can save over time, and what kind of a lifestyle it will provide over what could amount to four or even five decades.

To put that into some perspective, the pension Lifetime Allowance - the most you can have in your pension without paying a hefty tax penalty – sits at £1,073,100 and will stay at that level until 2025/26. So let’s assume that’s the cap we’re looking at.

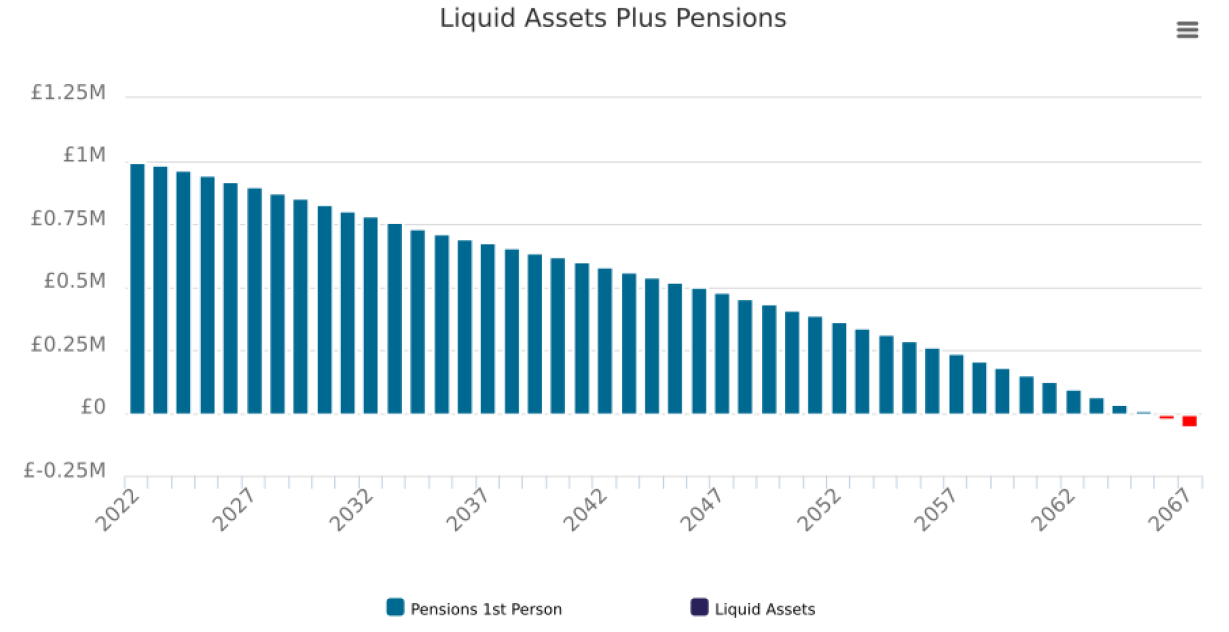

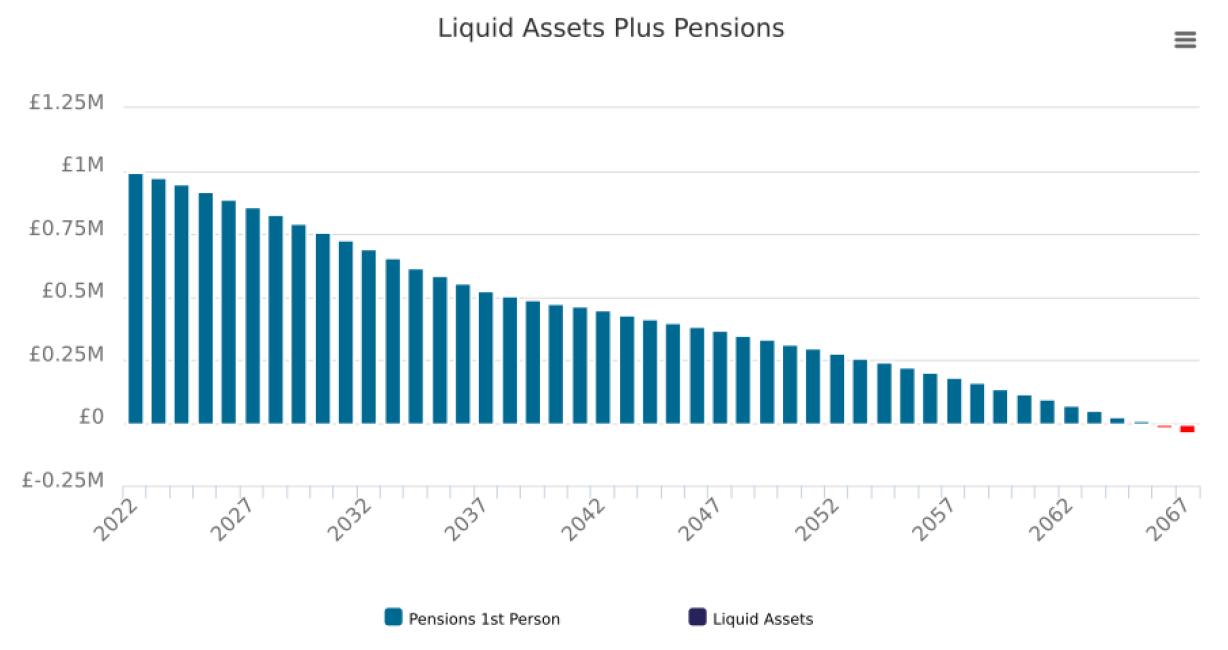

Nick Onslow, a chartered financial planner with the RU Group, has run some models to illustrate what kind of income a £1 million pension might deliver if it was structured to run out altogether at age 100 (disregarding the 25% tax-free element, for simplicity’s sake).

- Don't be shy, ask ii…am I saving enough for a decent retirement?

- Be frugal at 40 and prioritise your pension

- ‘No one wants to work til 70’, a student’s view of pensions

- What is a SIPP?

The models assume a medium-risk retirement investment (60% equity, 40% fixed income) growing at a conservative 5% a year after fees. Onslow also builds in inflation at 3% a year, and income tax.

Including the state pension from state retirement age, he calculates you could count on an income of £36,000 a year (in today’s terms) after tax, for life.

Alternatively, the pension could be front-weighted to provide a higher net income of £42,500 during your more active years up to age 70, falling to £30,000 thereafter.

Of course, you might be able to supplement this with ISAs and other taxable investments or rental income. But the point is that, while it might provide a very comfortable retirement lifestyle, your pension income is unlikely to be in line with what you might have been earning - particularly if you want to leave a significant chunk to the next generation.

So it’s important to adjust your lifestyle expectations in line with the kind of income you can realistically look forward to.

Start early

You have a much better chance of early retirement if you make it a goal at an early stage in your 20s. There are two advantages to starting early.

The money you save into your pension, even if it’s not very much at this stage, can build for several decades. But least as importantly, you can adopt your investment strategy from the outset to help you meet your goal.

Maximise pension contributions

The obvious place to start is by saving as much as you can into your pension. Early on in life, you’ll probably have other financial goals – a first home, a family – that make it hard to focus on building your pension.

But there are practical strategies you can follow. First, channel at least part of any bonus or other windfall into your pension fund.

- 22 little-known pension tips and tricks

- Visit our Pensions and Retirement Hub

- Pension stories: examine the saving habits and goals of investors at different life stages

- Pensions: is 12% the new 8%?

Second, while the amount paid in will rise automatically with any salary increase, you could use pay rises as a painless opportunity to push up the percentage of your pay that you contribute, even if only by half a per cent.

There may be an added benefit to this, in that some employers will match any increase you make in contributions. It’s worth asking your employer up to what salary percentage it will match contributions, and aiming for that yourself, to make the most of that corporate generosity!

Use carry forward allowances

Annual pension contributions are capped at £40,000 (or 100% of your earnings if you earn less than £40,000); there’s nothing to stop you paying in more than that in a year, but you won’t receive tax relief on the extra.

However, if you receive a windfall, inheritance or large bonus that would take you over the annual limit, you can utilise unused pension allowance from the past three tax years - a process known as carry forward. You will need to do this through a self-assessment form.

Embrace risk

Perhaps the greatest strength of investing for the very long term is that you can afford to take more risk, and in return enjoy better returns over the long term - even though you may have to put up with more short-term ups and downs.

If you’re a member of your employer’s workplace pension, that means at the very least moving your investment out of the low risk, modest return default fund (where it will be automatically invested if you have not chosen an alternative fund).

- Pensions versus ISAs: a beginner’s guide

- Dinah Wolf: what a 21-year-old really thinks of pension saving

- ii Top 10...things to keep in mind when managing your own SIPP

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Ideally, you’ll invest your pension in equity-focused funds, including exposure to more volatile but potentially rewarding sectors such as smaller companies and developing markets.

Get more choice through a SIPP

Workplace pensions generally have quite limited fund ranges available. If you are keen to broaden your portfolio into less mainstream holdings or just want to choose from the very best investment options across the whole market, consider setting up a self invested personal pension (SIPP) such as that from interactive investor.

Be clear: a SIPP is just a tax wrapper, so you do have to be prepared to select and manage your investments yourself or pay an adviser to do it for you. But it opens the doors to a much broader range of investment types, including individual equities, investment trusts and ETFs as well as conventional funds.

Some employers will allow you to build your workplace pension – including employer contributions – in your own SIPP, so it’s well worth asking your HR department if that’s a possibility.

Even if it’s not, you can still use a SIPP to hold other pension investments (maybe pensions from previous jobs, occasional earnings from freelance work, or regular spare ‘end of month’ cash) and get full tax relief on anything you put in.

Be disciplined

If you’re investing for the very long term, you can afford to be a buy and hold investor - but not a ‘buy and forget’ one. Some obvious sensible measures include:

- aiming for a broad spread of different equity capitalisations, sectors, regions and investment styles, plus some alternative assets;

- reviewing your portfolio maybe a couple of times a year, making sure that if there are notable underperforming funds in there you can pinpoint a good reason (for example if that investment style is ‘out of favour’), and taking action if you have more serious concerns;

- rebalancing every year to some extent by trimming the most successful holdings and adding to those that have done less well but could be due a comeback;

- resisting the urge to panic and sell if the market crashes. Remaining invested through the ups and downs has been shown to be much more rewarding over the long term than trying to time market exits and entrances.

- Your pension: think about it earlier and more often

- State pension shock: how you can make up the shortfall

Be sure the time is now

You are not allowed to touch your pension until you reach 55 (57 from 2028). That might be your target retirement age, but do be sure you have the resources to fund the kind of retirement you want.

If you decide at that point that you need or want to continue earning, but on fewer hours, or in a less high-pressure role, or doing something totally different, resist the temptation to draw an income from your pension to supplement your reduced earnings.

That’s because once you start to take a taxable income from your pension fund, your annual pension contribution allowance will be slashed from £40,000 to just £4,000, making it much harder to continue to build the pot meaningfully.

Supplementary income - if you need it – could come instead from the 25% tax-free lump sum that you can take from your pension pot from 55 onwards, or from other investments such as an ISA if you’ve built one up.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.