How volatile currencies could force fund portfolio changes

After a quick profit on gold and weak pound boosting other assets, Saltydog analyst is ready to tinker.

29th July 2019 12:45

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

After a quick profit on gold and weak pound boosting other assets, Saltydog analyst is ready to tinker.

Falling pound boosts overseas investments

Benjamin Disraeli, the Tory leader who twice served as prime minister, said "One secret of success in life is for a man to be ready for his opportunity when it comes".

I wonder if Boris Johnson is feeling that his opportunity has now come as he picks up the reins from Mrs May. He has got quite some task to lead the country through this Brexit ordeal, and towards a socially acceptable, and economically flourishing future.

I guess it is excusable if he likens his own situation to that of Winston Churchill at the start of the Second World War. Certainly, in one sense, with politics as it has now become it must be more difficult today to tell friend from foe. He's already formed a new cabinet, and, at the moment, they appear united in the quest to deliver Brexit on the 31st October – no ifs, no buts.

After his first few days in No.10, the FTSE 100 index has remained relatively flat. This isn't really a surprise as he was the firm favourite and markets would have anticipated his victory.

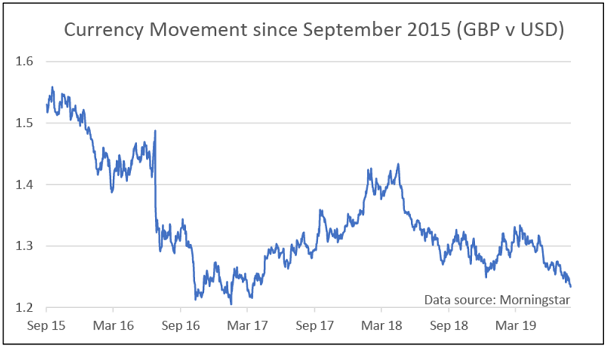

Over the last few months we've seen the pound fall in value. It's not quite down to the levels that we saw after the EU referendum in 2016, but it's getting close. Here's how it's moved relative to the US dollar.

At the beginning of the year, one pound was worth around $1.27. It then strengthened and peaked in March at $1.33. Since then, it's fallen by 7.5% and it is currently trading at just over $1.23.

Over the last few years, the pound has strengthened when it looked like the UK would leave the EU with a deal and fallen when a 'no deal' outcome appeared more likely.

When the pound weakens it gives a boost to any funds holding assets valued in foreign currencies. This has helped with our investments in the US, Global and Technology sectors. It has also given the gold fund that we are holding in our Saltydog portfolio a boost. The price of gold (in dollars) has been going up for the last couple of months. At the beginning of June an ounce was worth $1,306, it’s now above $1,400. The currency movement will have made it even more profitable for UK Investors.

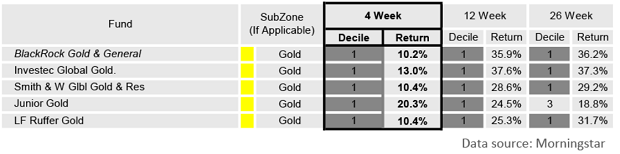

Each week we look at the performance of a wide range of funds. The 'gold' funds, which tend to invest in gold mining companies, have been at the top of the specialist table for some time. Here's an extract from last week's data.

We invested in the Investec Global Gold fund in June and it's currently showing a gain of 18.5%.

Over the next three months we are expecting to see further currency movements and are prepared to make changes to our portfolios if necessary.

If the EU softens its approach, and the prime minister manages to negotiate a deal, then sterling is likely to strengthen. This would be bad news for many of our current holdings and we should look at investing in some of the UK sectors.

On the other hand, if it decides to play hardball, and we crash out without a deal, then sterling could fall further. This would help the funds with exposure to overseas income and assets valued in foreign currencies.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.