Investment trusts vs active ETFs

A Kepler analyst considers a new fund structure, active ETFs and investment trusts, and the model of modern fund management.

28th November 2025 14:00

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Discussion circulated last week on social media about a potential new open-ended fund structure, the proposal being to ‘tokenise them’.

If the language of crypto leaves you cold, don’t turn away now; the effect would be quite simple. The idea would allow the manager to trade shares in funds with investors and so make a market in them.

Investors would be able to buy or sell shares from the manager, or from each other, without having to deplete the pool of assets. The manager will make a spread on any buys or sells they do with investors, and there will be no guarantee that the shares will trade in line with the net asset value (NAV).

The argument is it will provide liquidity and scale and democratise access to the funds. To me, it sounds like they have invented the investment trust.

In reality, when you dig into the details, the proposal isn’t quite the same, but my point is to highlight that a lot of the attractive features of the new instruments that the great minds of Silicon Valley, or the CIA, or whoever it was, have come up with in blockchain-enabled crypto tokens are already present in the investment trust sector: intraday dealing, liquidity in illiquid assets, trading spreads to benefit loyal investors, liquidity without diminishing the pool of assets or hampering management of them.

A similar claim could be made about active exchange-traded funds (ETFs), which are being widely touted at the moment and are more likely to feature in the portfolio of the average Kepler Trust Intelligence reader than bitcoin (we think!).

Many of their purported benefits are already provided by trusts. In fact, I think the average investor is going to be better served by an investment trust than an ETF for active investment, and indeed than crypto.

Morningstar recently published data on the managed portfolios run for retail clients by professionals in the UK. These are model portfolios, built to risk and return targets which multiple clients are invested in, more like a fund of funds model than a bespoke portfolio run for an individual.

The data highlights a couple of the issues with ETFs, which currently make up only around 7% of model portfolios, passive and active combined.

One of the reasons for low take-up is that adviser platforms struggle to fractionalise shares, which is necessary to ascribe the investment to each individual investor. This is a technical feature, and it may be resolved in future, but the upshot is that there isn’t necessarily the pool of institutional money to come into the active ETF market that one might expect.

The argument for active ETFs is that they are going to take in the flows that went to investment trusts (or open-ended funds) from wealth managers in past cycles, but in reality, there are currently constraints on this, just as investment by professional investors into trusts is hampered by their need for trusts to be larger and larger.

Morningstar data shows that active ETFs still make up a truly tiny amount of the total assets in model portfolios: 1.5% of the 7.5% allocation to ETFs, or 0.11% of the total assets under management. Looking at the names highlights that some of the ETFs currently being marketed as ‘active’ are not like the typical active fund used by a retail investor.

The top holding is the First Trust Vest US Equity Buffer UCITS ETF. It tracks the S&P 500, but uses derivatives to protect against the first 10% of losses, and consequently gives up some of the upside. It’s the sort of thing that used to be called a structured product.

Perhaps this approach could be considered semi-active rather than active, but whatever the nomenclature, it is not a stock-picking approach, and it is also much harder for a retail investor to understand.

Many of the active ETFs being marketed at the moment have similar, semi-active characteristics, such as the JPMorgan Japan Research Enhanced Index Equity Active UCITS ETF, which also appears on the list of the most-held active ETFs. This is a member of a suite of funds which aim to outperform but with a low tracking error, and so explicitly target index-like returns.

There’s nothing wrong with taking such an approach, but it is very different from what an active investment trust typically aims to do, and the typical view that the more active a fund, the more likely the chance it will outperform, a view based on academic research that we have covered in the past.

It makes sense to me that professional investors are using these sorts of funds as building blocks in models they can analyse and back-test, but I would question whether this is something the typical retail investor is going to be persuaded into.

Indeed, the typical retail investor is very different from the typical ETF investor. The Investment Association (IA) recently hired Opinium to survey investors about their use of ETFs and their other behaviours and beliefs about investing.

They found that active ETF investors are far more likely to be frequent traders. For example, nearly two-thirds of active investors place a trade at least every two months compared to just 26% of retail investors who don’t use ETFs.

A quarter of ETF investors trade more often than monthly compared to just 8% of non-ETF investors. Of those who don’t use ETFs, 38% made no trades at all over the past year, compared to 96% of ETF investors.

I think this more frequent trading has negative consequences for fellow shareholders. The first is that the ETFs are at greater risk of disappearing from under you, as a rush for the exits could easily see the ETF wound up by the provider. While this possibility exists with open-ended funds, the shorter time horizon of the average EFT investor and greater propensity to trade means the risks look higher to me.

Second, fear of this rapid run for the exits could create extreme pressure on the fund manager to focus on the short term, distorting investment decisions and boosting style bias and trading costs. This would make it much harder for an active manager to stick to a strategy and add value.

I think these dynamics mean that the structures might not be as appealing to fund managers too – even if they are relatively easy and cheap to set up, it is harder to build a business when it could be whisked away so swiftly.

In this light, it’s worth thinking about the purported selling point of ETFs that they trade intraday. Investment trusts already have this, of course, but this facility is offset by the fact that the shares can trade away from the NAV, which disincentivises rash decisions and creates the opportunity for those with a longer-term view to provide liquidity and buy shares cheaply, plus creating the conditions for larger returns of capital via buybacks or tenders, which also benefit continuing shareholders.

It also means that panic selling can be accommodated without affecting how the manager runs the portfolio – they can stay focused on their more reasonable investment horizon rather than on the headlines.

Buoyant markets over the past year have given plenty of examples of investors being rewarded for providing liquidity to those keen to sell even well below NAV.

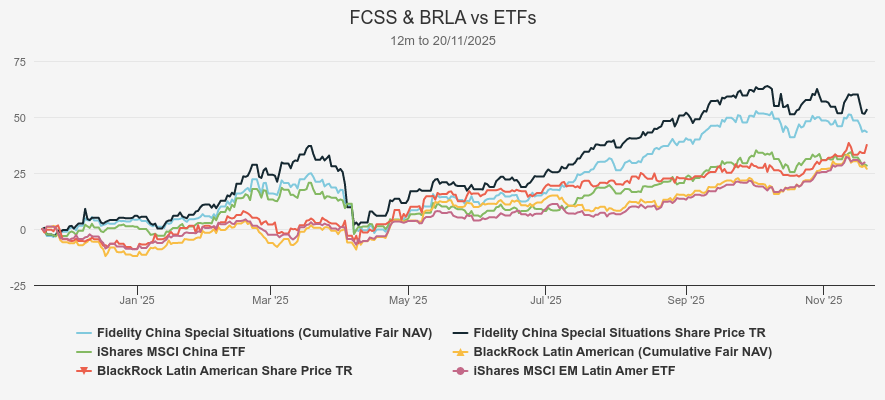

The chart below shows how shareholders in Fidelity China Special Situations Ord (LSE:FCSS) and BlackRock Latin American Ord (LSE:BRLA) have enjoyed significant gains well in excess of their regional benchmarks and the NAV returns.

FCSS has delivered a share price total return of 53% to 20 November 2025 and BRLA 37.5%; the ETFs tracking the relevant indices are up just 28.3% and 29.7% respectively.

An active ETF would have absorbed the selling by running down the assets, and the returns from the narrowing discount would have been impossible. Continuing shareholders would have been left with a smaller fund paying higher costs in percentage terms, and quite possibly would have seen the management of the fund hampered by providing daily liquidity to sellers.

TRUST PERFORMANCE OVER 12M

Source: Morningstar. Past performance is not a reliable indicator of future results

So, investment trusts trade intraday, providing instant liquidity. Their shares can be traded between investors without the fund managers’ involvement. The structure allows managers to hold new and sophisticated asset classes, including the unlisted equity of the world’s most exciting growth companies. They also provide leverage, allowing investors to boost their exposure to an asset class to above 100% of their capital.

They demonstrate the attractive features of the most modern fund management products like ETFs and even crypto-fuelled, tokenised funds. Perhaps the problem trusts have, in the light of these new products and innovations, is a marketing strategy focused on heritage and history, which is running out of road.

Perhaps boards and managers should be keener to focus on the future and stress the attractive features that, in my view, look definitively modern and still can’t be beaten.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.