Latest ISA statistics: Cash ISA sales slump as savers turn to the stock market

There has been a notable uptick in savers opting for stocks and shares ISAs.

9th May 2019 09:20

by Tom Bailey from interactive investor

There has been a notable uptick in savers opting for stocks and shares ISAs.

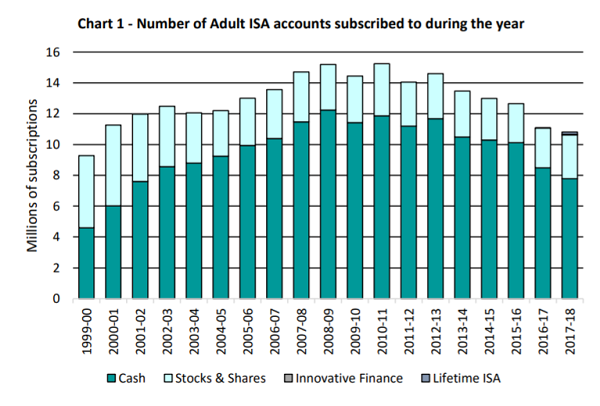

The latest ISA statistics released yesterday (30 April) show that while the number of individuals who put money into ISAs in the last financial year has fallen, there has been a notable uptick in savers opting for stocks and shares ISAs.

The statistics show that there was a total of 10.8 million adult ISA subscriptions in 2017-18, down from 11.1 million in 2016-17.

Overall, the number of cash ISAs fell by 697,000, while the number of stocks and shares ISAs, which allow savers to invest in shares, fund and investment trusts, rose by 246,000.

The share of cash ISA subscription as a proportion of all ISAs fell by 77% in 2016-17 to 72% in 2017-18.

One of the drivers behind this is that for several years now savings rates have been at historically low levels.

According to Rachel Griffin, a tax planning expert at Quilter, savers have become fed up with savings rates persistently being below the rate of inflation. She adds:

"Savers are punishing the low rates on cash offered by banks and building societies, and taking advantage of the opportunity to invest their ISA savings in the stock market."

Another factor at play has been the introduction of the personal savings allowance, which allows basic rate taxpayers to receive £1,000 of cash interest tax-free each year (£500 for higher rate taxpayers and £0 for additional rate taxpayers).

Since the personal savings allowance came into effect in April 2016, the cash ISA tax break has become less relevant. Savers can now have £100,000 in a taxable account offering 1% interest and will not have to pay a single penny of tax.

There's still a substantial difference in uptake of different types of ISAs between men and women. Men, the statistics showed, were more likely than women to have a stocks and shares ISA, while women were more likely to have a cash ISA.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.