Lloyds Bank shares: a short-term forecast and long-term outlook

After running his software for this popular high street bank, independent analyst Alistair Strang has uncovered a 'quite fascinating scenario'.

19th January 2026 07:54

by Alistair Strang from Trends and Targets

As the writer is loaded with a particularly unpleasant cold, it was tempting to be exceedingly brief in our outlook for Lloyds Banking Group (LSE:LLOY). We could say now above 104p should bring gains to an initial 113p with our secondary, if bettered, at 122p. And we’ll be back in three weeks, without a stinking cold, hopefully able to write something more interesting. However, we like searching for straws to clutch.

- Invest with ii:Open a Stocks & Shares ISA | Top ISA Funds | Transfer your ISA to ii

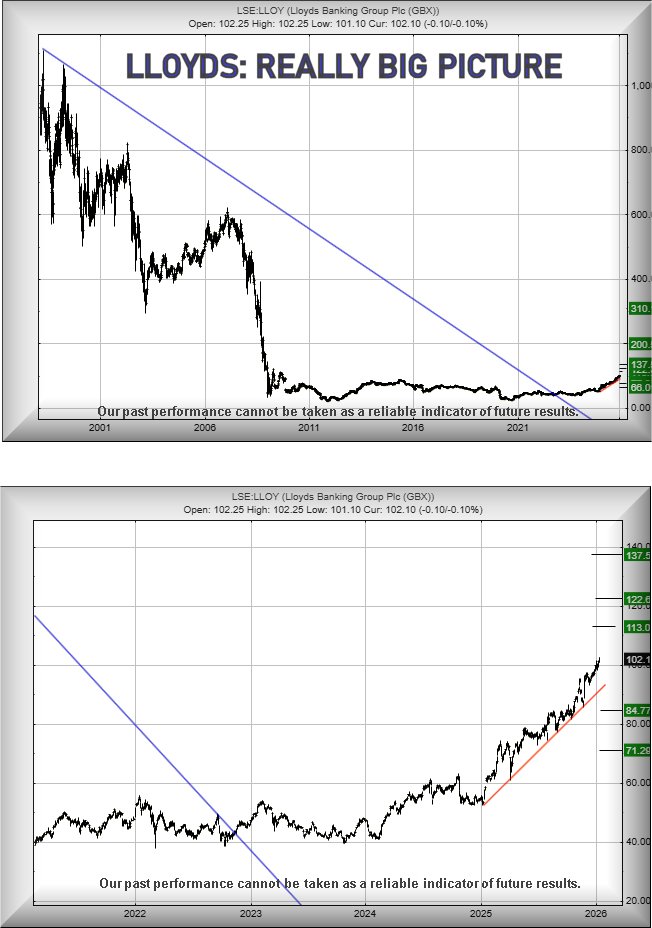

Blue on the chart delineates a downtrend since April 1998. If we extend this downtrend to the current period, it seems Lloyds' share price needs to dwindle below 40p to indicate the onset of big trouble.

Otherwise, a quite fascinating scenario exists and, if we pretend this Big Picture is important, apparently above 104p should – for the terminally patient – suggest a cycle has commenced to a future 200p with our very long-term secondary, if bettered, at 316p.

In fact, we can calculate quite a bit higher but dreams of Lloyds turning into an eight-quid share are probably best left on the shelf.

Our lower chart is probably more realistic, with its suggestion of above 104p triggering some real recovery within conventional timeframes, effectively proposing the potential of a future 122p provoking some hesitation in a rising cycle.

An inevitable alternate scenario suggests weakness below 91p risks promoting reversal to an initial 84p with our secondary, if broken, at 71p. Visually, there’s quite a strong suggestion any visit to the 84p level shall doubtless provoke a rebound.

Source: Trends and Targets. Past performance is not a guide to future performance. Important: Trends and Targets charts only incorporate official share count consolidations, ignoring rights issues where investors have a choice as to whether to participate.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.