More drama to come at Metro Bank?

11th August 2021 09:42

by Alistair Strang from Trends and Targets

Charts expert Alistair Strang examines the share price movements of the high street bank after a dramatic few years.

There's something about Metro Bank (LSE:MTRO) we find attractive, perhaps the lack of corporate baggage held by other retail banks.

It's refreshing, when the first retail high street bank in over 100 years describe their outlets as "stores" or "shops" in a real attempt to soften perception away from the intimidating facade once propagated in Mary Poppins and Harry Potter.

However, other banks have long tried to alter public perception, if only with lower counters in their branches.

But Metro Bank remain the dog friendly chain of outlets and more recently, appear to be experimenting with hosting childrens craft weeks in a few of their stores.

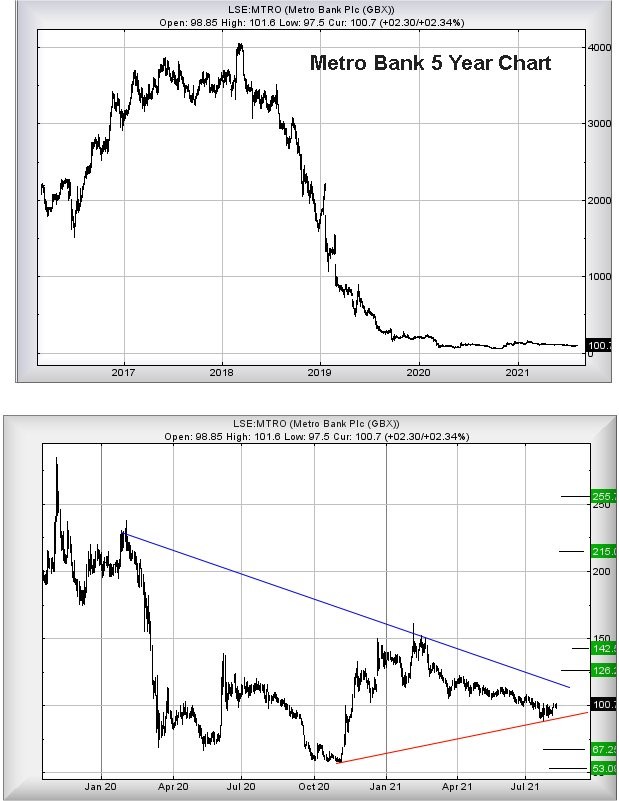

If only the company hadn't experienced their little whoopsie with an accounting error back in 2019, causing their share price to drop 39% in a single day. This event has overseen a period of rot for the company share price, diminishing from 2200p to a low of 58p toward the end of last year. In 2018, the bank share price had peaked at just over £40!

Such has been the level of drama, we cannot display a meaningful 5 year chart as scaling forces price movements since the start of the pandemic to appear as a virtually flat line.

However, there are early signs something is brewing in the recovery aisle for this retail shop and we'd suggest paying attention, should the price manage above 112p. At time of writing, the share is trading around 100p, so perhaps this isn't such a distant trigger level.

Above 112p calculates as capable of driving price recovery toward an initial 126p with secondary, if bettered, working out at a longer term 142p. At this secondary level, the all important signal for the longer term shall arrive depending on where the price manages to close a session.

In the event the share manages to actually close above 140p, some quite surprising longer term expectations become available as we can project future movement to 215p, along with a possible glass ceiling.

This is due to such a calculation also challenging the share price pre-Covid high last year and other shares, when reaching this level, are tending to pause for thought for a while prior to any further movements northward.

For alarm bells to ring, the share needs to fall below 88p as this risks a very real threat of matching last years lows.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.