Pros name 10 diamond-in-the-rough UK stocks

Which sectors or companies are fund managers eyeing to take advantage of low valuations for the UK stock market? In this article we examine views from several professional investors.

23rd April 2024 13:03

by Kyle Caldwell from interactive investor

There’s plenty of debate, which we recently covered, about a potential catalyst to boost investor demand for our home market.

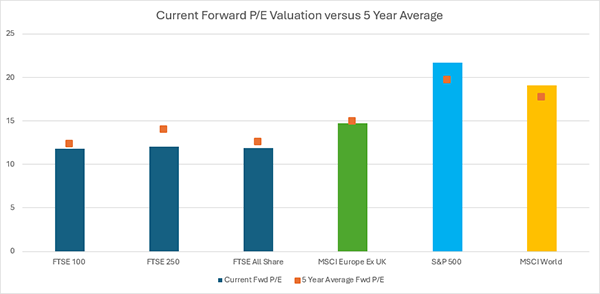

What is undeniable is that the UK market is cheap compared to its history and other markets, particularly America’s biggest companies.

The below chart shows how the UK market looks cheap on the forward price-to-earnings (P/E) valuation measure.

Source: Morningstar as at end of March 2024.

But which sectors or companies are fund managers eyeing to take advantage of low valuations? In this article we examine views from several professional investors.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Rightmove

Online property advertiser Rightmove (LSE:RMV) has recently been attracting the attention of Nick Train. The investor, who seldom buys and sells, said he started building a position in Rightmove last summer on the back of its share price being flat over the past five years.

Train continued adding to Rightmove in the first three months of 2024, and the company now has a 3.5% position in the Finsbury Growth & Income (LSE:FGT) investment trust. It is also held in WS Lindsell Train UK Equity, one of interactive investor’s Super 60 fund ideas.

The stock has many of the qualities Train likes to see in a business, including a strong brand and competitive position that other companies struggle to replicate. The firm advertises around 90% of all homes for sale via estate agents across the UK.

- ii view: Rightmove profits improve but risk to customer number in 2024

- DIY Investor Diary: becoming an ISA millionaire was like completing a marathon

While rising interest rates have been a headwind for the property sector, Train says that Rightmove has weathered the storm well.

“We have been able to build this position easily, because there are ready sellers at current prices,” Train says. “Those sellers are concerned that UK interest rates [being] higher for longer will continue to retard the UK housing market and, in addition, that new competition may challenge Rightmove’s market share and profitability.

“As to the former worry, we note that 2023 saw the lowest number of housing transactions in the UK, one million, in a decade. Nonetheless, revenues for 2023 were up 10%, as the company develops new products and services which help its customers close more deals, more efficiently in a difficult market.”

Ascential

For Alex Wright, fund manager of Fidelity Special Values (LSE:FSV), an investment trust that is also one of our Super 60 ideas, there are plenty of opportunities. He says that: “The strength of US equities, led by the Magnificent Seven tech-related stocks, has continued to dominate the market narrative in the opening months of 2024. Meanwhile, there has been no change in the generally weak sentiment towards UK equities that has marked the asset class since the Brexit referendum in 2016.”

A recent purchase is B2B media company Ascential (LSE:ASCL). Wright explains that the firm is a conglomerate of three different businesses and a little over 12 months ago it announced that it was to sell one, and list another, to focus on its core events business.

He added: “The stock initially went up around 20% on that announcement. But a high proportion of the shareholder base were UK equity funds that were seeing redemptions, so the shares retraced their gains, despite the fact nothing had changed.

“There was a plan in motion, which made strategic sense, and the valuation looked very attractive compared to similar businesses listed overseas. We started buying the stock in the summer of 2023 and our thesis played out very quickly, with Ascential announcing in October that it had found buyers for their two assets and the stock performed very strongly.

“This is a good example of what we are seeing with several UK stocks, where overseas corporates and private equity firms are seeing the value and taking advantage of those attractive valuations.”

- The investment outselling US tech and Fundsmith Equity

- Funds and trusts four professionals are buying and selling: Q2 2024

TT Electronics

James Gerlis, co-manager of TM Tellworth UK Smaller Companies, describes TT Electronics (LSE:TTG) as offering “exceptional value” due to trading on a price-to-earnings (P/E) ratio of less than 8x and a dividend yield just shy of 5%. The company designs and manufactures electronic components and sensors, selling into a range of industrial markets, including aerospace, healthcare and defence.

Gerlis says: “Emerging from a period of subdued global demand and a de-stocking headwind, the outlook for revenue is starting to brighten. Beyond a cyclical recovery, TT Electronics has also been busy making improvements internally, with management guidance for operating margin to increase to 10% in 2024, driven by ongoing progress around restructuring and efficiency.”

He adds that a new company target of 12% in 2026, announced at its capital markets event earlier this month, suggests that profitability can continue to rise.

Gerlis also points out: “With component-maker peer discoverIE Group (LSE:DSCV) currently commanding a PE of 20x, having gone on its own journey of margin enhancement, we see potential for TT Electronics to follow a similar path and re-rate meaningfully from a very modest starting point.”

XPS Pensions Group

Ken Wotton, lead manager of Strategic Equity Capital (LSE:SEC), makes the case for XPS Pensions Group (LSE:XPS), which he says offers “a compelling entry point for investors seeking value” due to it trading on a discount to peers.

The firm, which operates in pensions consultancy and administration, has an “impressive balance sheet”, says Wotton.

In addition, he says the firm has “secure revenue streams and exceptional earnings visibility, and a generous and growing dividend. Recent performance reflects this success, with revenue increasing significantly.”

He added: “We anticipate ongoing high demand for XPS’ services, as the current yield environment encourages corporates to explore pension risk transfer solutions. This is bolstered by favourable market trends, supportive regulations, and a strong brand reputation.”

Kitwave

In Octopus Investments’ Dividend Barometer, which champions the lesser-known dividend credentials of small and mid-cap income stocks, two cheaply valued stocks with great prospects were highlighted.

For the first stock, food and drink wholesale business Kitwave (LSE:KITW), Octopus says that it is performing well operationally, but sitting on a low valuation.

It says: “In the latest update for the full year to end October 2023, the group delivered revenue growth of 20% in the year, and profit growth of 40%.

“Despite this performance, the stock remains attractively valued. It is trading on a P/E multiple of 11.4x and is expected to deliver an attractive dividend yield of circa 4%.”

- Where to invest in Q2 2024? Four experts have their say

- Gold’s hitting new highs – why it’s rising and how to invest in it

Galliford Try

Construction company Galliford Try (LSE:GFRD) was the second stock selected by Octopus as an attractive valuation opportunity.

It pointed out: “Since the group reset earnings in 2021 under the tenure of the current management, the business has seen excellent progress in profits and dividends over the period.

“Considering the fantastic operational and dividend performance, the stock remains attractively valued around an 11x p/e multiple and is expected to deliver a dividend yield of around 5.8% this year.”

Prudential

Another cheap stock tipped as a bargain buy is Prudential (LSE:PRU), which sells protection products including life assurance, along with providing asset management services across both Asia and Africa.

Jonathan Unwin, UK head of portfolio management at Mirabaud Wealth Management, says its share price decline over the past year (down -36% to 22 April 2024) is “largely due to the dual headwinds of being listed on the out-of-favour UK market and negative investor sentiment towards Asia - specifically the Chinese economy”.

He adds that “conversely Prudential’s strong franchise in Hong Kong is what makes the stock attractive following the realigning of distribution channels into China, while the border has reopened with the number of mainland visitors greatly increasing”.

Unwin thinks with a forward p/e of 9x, the stock is attractively valued. He says: “Prudential is cheaper than both the UK index and the wider European insurance sector”, while adding “for investors willing to look past the regional risks, there could be an opportunity to benefit from the current discounted valuation”.

- What needs to happen for fund investors to buy back into the UK?

- Stock secrets of high-yielding UK income funds

UK-listed investment trusts

Investment trusts offer another way to play the cheap UK. Nick Greenwood, co-manager of MIGO Opportunities Trust (LSE:MIGO), picks out three catching his eye at the moment: Georgia Capital (LSE:CGEO), Aquila European Renewables (LSE:AERI) and Tufton Oceanic Assets (LSE:SHIP).

As the name suggests, Georgia Capital, trading on a discount of -50%, invests in the nation that has a boarder with Russia. Greenwood says the trust is tapping into Georgia’s “increasing wealth” due to its “booming economy”. However, the strategy is proving to be a hard sell, which is reflected by its big discount.

But even if demand for the shares does not pick up, Greenwood still sees upside in the event of the investment trust restructuring or winding up. He says: “Should the managers eventually decide that generating a following as a UK investment trust is just too tough, and another structure made more sense, the shares could materially increase in value without any move in the value of the portfolio.”

- A glaring opportunity to snap up these cheap investment trusts

- Andrew Pitts’ trust tips: winners and losers so far in 2024

Greenwood’s next pick is Aquila European Renewables, which owns wind farms in Scandinavia and Greece, as well as solar plants in Iberia. It is trading on a discount of -26.7%. Investing in alternative assets that pay an income has become less attractive given interest rate rises, as this has increased the income on offer from lower-risk areas, such as money market funds and bonds, including gilts.

While that headwind will likely remain until interest rates are cut, Greenwood says “the second-hand market for wind and solar plants is quite buoyant”. In addition, he says a New York-based hedge fund has built up a stake, which could help to spark a re-rating.

Tufton Oceanic, which owns a portfolio of commercial ships, is Greenwood’s third cheap trust choice. It is trading on a discount of -25.4%.

Greenwood points out that “there is a shortage of supply developing as much of the global fleet is aged and replacements will be hard to source as shipyard order books are already full”.

He adds that a further strain on capacity comes from more stringent environmental restrictions, which dictate that ships must travel more slowly to reduce emissions.

Greenwood says supply shortage and strain on capacity are positive for Tufton, explaining that “in order to move the same amount of freight, more boats are needed, boosting the value of existing ships”.

He adds that Tufton recently published proposals to return some cash to shareholders and adopt a mandate focusing on eco-friendly vessels, which the managers believe will be in demand. In addition, Greenwood says: “Post 2028, the trust is expected to commence liquidation and return proceeds to investors, thus wiping out the discount.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.