Saltydog Portfolio: With Brexit underway, it's important to stay alert

18th April 2017 16:49

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog's momentum style responds to political changes. Written before news of the snap election, Douglas Chadwick looks at the portfolio and its current position.

"It serves no purpose to wrestle with a pig. First, you will get dirty, and secondly the pig likes it."

This is an expression that my grandmother used to say to me when she felt that an argument we were having was turning foolish and going nowhere (I believe I was the pig).

I cannot help but feel that David Davis and his team, negotiating a trading arrangement with 27 different nations to achieve an acceptable Brexit trading solution, are in such a situation. It is argued that the UK will lose out by not being able to negotiate future trading arrangements with all the members of the EU, and that's not forgetting the minor states in Belgium. If that were to be the way it played out, it would be a nightmare.

Perhaps it would be simpler and cause less aggravation to simply say to the ladies and gentlemen in Brussels that when they have all agreed on what they want, they should let us know, and then we can say whether we accept their offer or would prefer to trade under the World Trade Organisation rules in a similar way to the US, China, Japan and many other countries. They seem to be able to accept tariffs of around 3% without an adverse effect on their ability to sell huge quantities of goods into the EU, so why not the UK?

I hope that Theresa May and her colleagues will keep the pressure on Brussels by keeping the pace of negotiations nice and slow. Patience is going to be a virtue over the next couple of years. She should let boiler pressure for settlement rise inside the exporters in Europe, and not here at home. In the coming months, it will be interesting to see what pressure is brought to bear upon the EU heads of state by their own manufacturing and agricultural industries, eager to continue with the status quo!

Brexit talks could impact market performance

During this period of negotiation, it is going to be important to stay alert as to where your investments are placed. Currency movements, in particular the dollar and euro rates relative to the pound, will have an impact on the performance of the market sectors and the value of funds.

With the Saltydog Investor system, all of this can be clearly observed in our weekly numbers and graphs. We can identify the upward and downward trends, and adjust our portfolios accordingly.

For instance, the UK smaller companies sector has been on a steady climb during the last few months and we have observed for the last 12 weeks a continuous uninterrupted flow of money into it.

This is a momentum trend in its purest state; our 'Ocean Liner' portfolio has carried the Invesco Perpetual UK Smaller Companies fund since August last year, and it's now up over 16%.

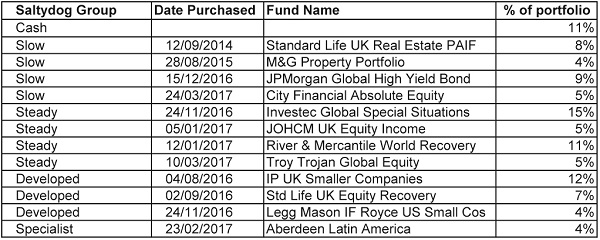

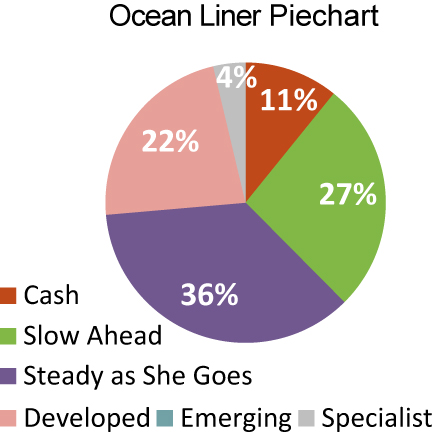

Here's a list of the current holdings in the 'Ocean Liner' portfolio.

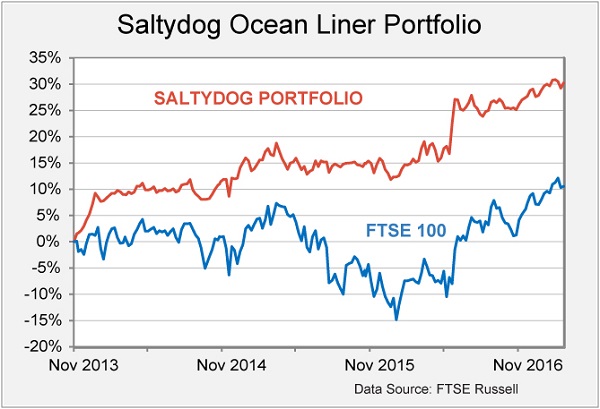

And a graph showing its performance since launching in November 2013.

This article was originally published in our sister magazine Money Observer. Click here to subscribe.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.