Saltydog Portfolio: Why it is time to snap up UK smaller companies funds

7th July 2017 09:56

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Politicians are the same all over. They will build a bridge when there is no river, and when they can see the light at the end of the tunnel they acquire more tunnel.

Recently, we appear to have inhabited a world of referenda and elections, all of which are accompanied by excited press and media comment. Some of that coverage is considered and accurate, but much is guesswork and rot.

After Brexit, the media gave much prominence to the fall in the value of the pound, saying that in the UK it would lead to inflation, starvation and a new Ice Age. Since mid-January, however, the pound has strengthened by 6% against the dollar. I wonder whether these same commentators will offer a political explanation and report this as a positive event?

A pack of wolves

During the next two years we are going to get a first-hand demonstration of democracy, European Union-style. It could be like a pack of wolves with one lamb, deciding what to eat for dinner. Hopefully, though, this will not be the case, and the lamb will survive, grow into a sheep and be stronger for the experience.

It could be said that with the exception of the initial fall in the value of the pound, the Brexit experience has so far been successful. Stockmarkets are steady, real foreign investment into the UK is rising, exports are increasing, and the number of people in work continues to expand.

Although it may be showing signs of slowing, the UK economy has actually grown by 2% over the last year; we were told that leaving the EU would inevitably lead to a recession.

You can probably tell that I believe the UK will be better off outside the EU. But how will the EU survive without the UK; and what could happen if other members choose to leave? Let us hope that Europe would not revert to the nationalism we have seen in the past.

Still this is all speculation, and it’s for the future. So what investment opportunities are we seeing in the Saltydog numbers as of today? The strongest visible positive trend amongst unit trusts is without question in the UK smaller companies sector, with the Investment Association (IA) UK all companies sector following closely along behind. That trend is also backed up by the number of UK investment trusts now at the top of their range.

We also track on a weekly basis the amount of money that is being invested into each of the IA sectors. Not surprisingly, over the last six months, with the exception of a couple of weeks, there has been a continuous inflow into these UK sectors.

Hopefully, going forward, this positive trend should continue. This is a very strong positive trend, exactly the sort of thing that we are looking for, and it makes for enjoyable investing. After all, what is there not to like about four-weekly gains of 4%, 12-weekly gains of 10% and half-yearly gains of 25%?

What is more, there are not just one or two funds achieving these returns, but many. With the correct information, your choice can be made wearing a blindfold and using a pin.

A look at one of our recent weekly reports showing one -, three - and six-month performance of a number of funds from the UK smaller companies sector is revealing.

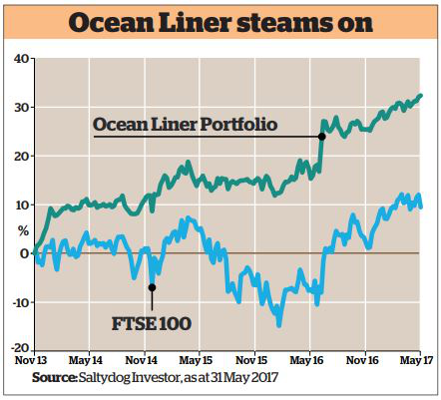

Immediately after the Brexit decision last June, the value of the leading funds in this sector dropped by around 10% - but they soon started to pick up. This was clear from our numbers, and in August our Ocean Liner portfolio invested in the ; it's now showing a gain of 26%.

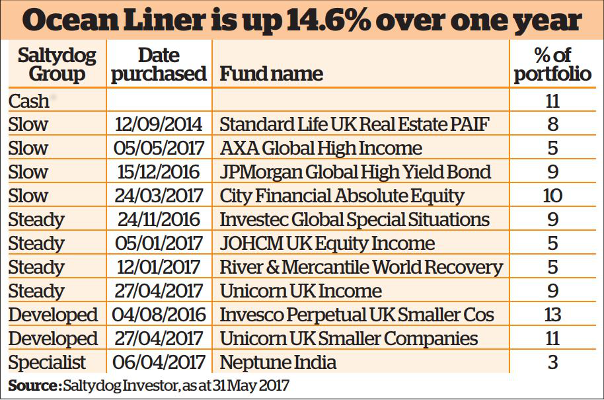

More recently we have increased our exposure to this sector by investing in the fund. The funds currently in the Ocean Liner portfolio are listed below. In the past 12 months it has gone up by 14.6%, and it's up by over 32% since it was launched in November 2013.

This article was originally published in our sister magazine Money Observer. Click here to subscribe.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.