Saltydog: when almost everything falls, one fund keeps rising

Saltydog looks at one investment fund bucking the trend.

24th November 2025 14:29

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

It has been a difficult three weeks for investors. After a strong run throughout the summer and early autumn, market conditions have swung sharply. Sentiment has weakened, volatility has increased, and the number of funds making positive progress has collapsed.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

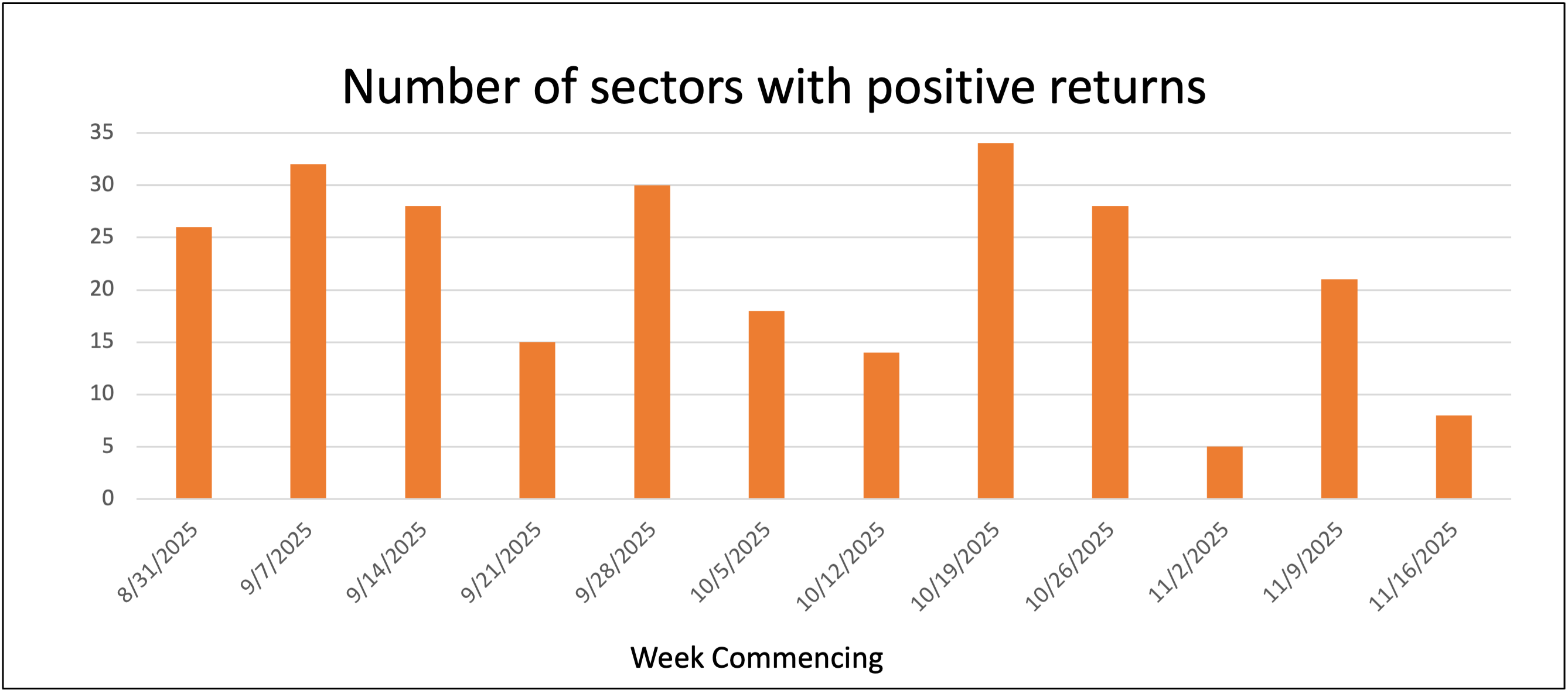

Before doing our detailed weekly sector and fund analysis, it’s useful to get an overview of how the markets have been performing. One indicator is how many of the 34 sectors that we regularly track have gone up each week.

The chart below shows that in the first week of November only five sectors went up. They were Standard Money Market, Short Term Money Market, Latin America, China/Greater China, and UK Direct Property.

Past performance is not a guide to future performance.

The following week was better, with 21 sectors making headway, but last week the number dropped to eight. Only the two money market sectors have risen in each of the past three weeks.

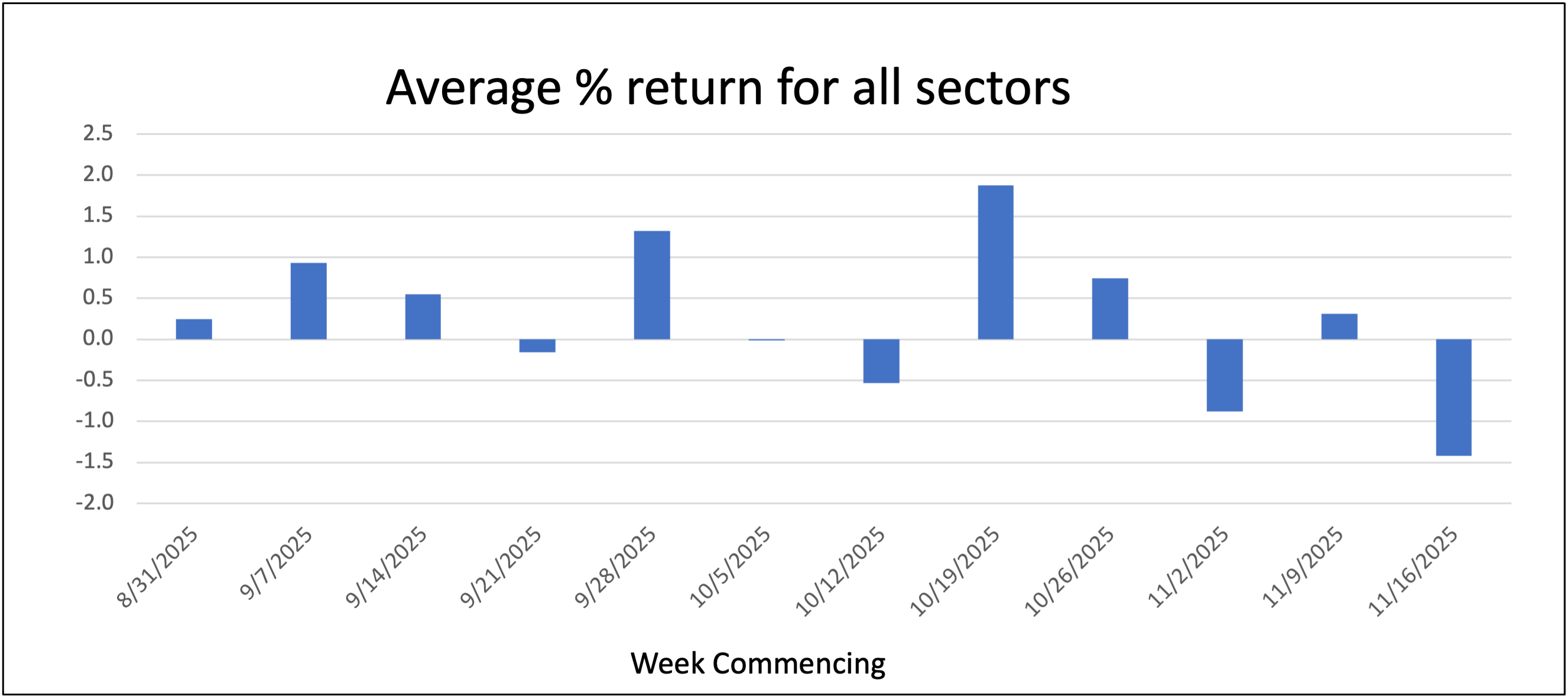

It’s also helpful to look at the magnitude of the rises and falls. The next chart shows the average sector return each week.

Past performance is not a guide to future performance.

Last week was the worst that we have seen for several months, and the past few weeks have been the toughest since the volatility following the Liberation Day tariffs earlier this year.

There are several reasons behind the sudden deterioration. Concerns about overextended valuations, especially in the high-growth technology companies that have led the rally this year, have resurfaced.

The 100% tariff threat announced by President Donald Trump at the start of November rattled confidence across Asian and European markets. At the same time, investors are dealing with a slower than expected path to lower interest rates, stickier inflation data, and renewed geopolitical tensions.

As often happens, the sectors that enjoyed the largest gains earlier in the year have been hit the hardest during the latest downturn. The Technology and Technology Innovation sector has been particularly weak. Having risen by 6.4% in September and 8.3% in October, it is currently down 8.9% in November.

The more cautious sectors have also provided less shelter than usual. The High Yield and Corporate Bond sectors have come under pressure as credit spreads have widened. They are down 0.2% and 0.6% respectively. Strategic Bonds are somewhere in the middle, down 0.3%.

- Bond Watch: what fixed-income investors are watching ahead of the Budget

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

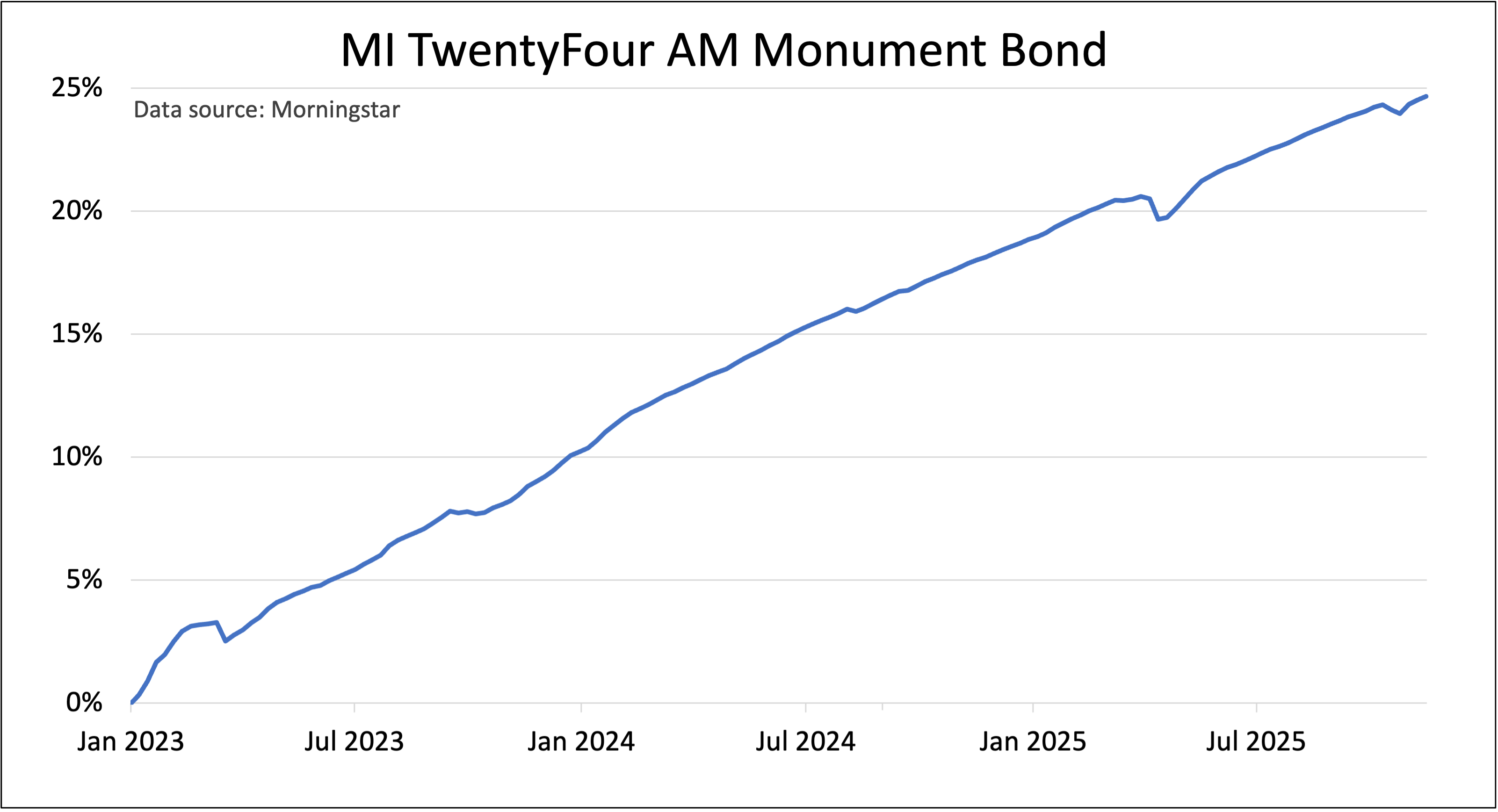

When we reviewed our demonstration portfolios last week there was one fund that we hold which had continued to make week-on-week gains - the MI TwentyFour AM Monument Bond I Acc fund.

This is a fund that we have held for a couple of years. It specialises in short-dated, high-quality European asset-backed securities and mortgage-backed securities.

It is a niche part of the fixed-income market with distinct characteristics, including limited sensitivity to interest-rate movements, strong collateral backing, and low correlation with mainstream government and corporate bonds.

It has risen in each of the past three weeks, something that almost 99% of the funds that we monitor have failed to do.

This doesn’t mean the fund is risk-free or that it never goes down. It briefly dipped in April and again in October.

However, overall it has made steady progress during the period that we’ve held it. We wouldn’t expect it to compete with the more volatile funds when they are performing well, but it’s far more stable and has consistently outperformed the money market funds.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.