Share Sleuth: spoilt for choice, but here’s why I’ve added to this holding

Richard Beddard is finding plenty of value opportunities at the moment. Here, he explains how he whittled down a shortlist of eight companies to just one.

6th September 2023 09:37

by Richard Beddard from interactive investor

Like last month, when I sat down on Tuesday 23 August to decide which share to trade this month (if any), my Decision Engine presented me with an embarrassment of riches.

Thirty companies scored seven or more out of nine, which may be unprecedented. If I were to start the portfolio again, all these would be in the frame, but I have long-established rules that restrict the size of each holding and deter me from trading if I have not evaluated a share recently, or if I have already traded that share since the last evaluation.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

In practice, eight shares were available to add, as shown in the table below.

Share | Score | Holding as a % of portfolio |

Churchill China | 9 | 4.9 |

Porvair | 8 | 3.1 |

Macfarlane | 8 | 0.0 |

Quartix | 8 | 1.3 |

Bunzl | 8 | 3.0 |

Auto Trader | 7 | 0.0 |

Anpario | 7 | 1.3 |

D4t4 | 7 | 1.6 |

Unsurprisingly, since they score so highly, the table-topping shares, Churchill China (LSE:CHH) and Porvair (LSE:PRV), are two of my favourites, but they are also much bigger holdings than all the other contenders apart from Bunzl (LSE:BNZL).

Churchill China, which makes tableware for the hospitality industry (including the estimable House of Spice in my own village), Porvair, which makes filters and laboratory equipment, and Bunzl, a distributor of consumables to businesses and large organisations, all score 8 or more out of 9. That makes them very attractive.

There are two other shares in that group of super-high scorers: Macfarlane Group (LSE:MACF) and Quartix Technologies (LSE:QTX). They are much less well represented in the portfolio, which makes them even more attractive on paper.

Macfarlane, which is ranked eighth out of 40 shares in the Decision Engine, is a leading packaging distributor in the UK with a smaller manufacturing business.

Quartix is ranked 10th. It sells its own brand of low-cost vehicle tracking system. My gut says Quartix.

You might think Macfarlane would diversify the portfolio as it would be a new holding, but the Quartix holding is very small and Macfarlane has similarities with other businesses in the portfolio. It is a distributor with a leading position in the UK, like Lathams, it is a roll-up, using acquisitions of smaller rivals to grow faster, like a handful of companies in the Share Sleuth portfolio including Bunzl, which also sells packaging.

- Shares for the future: four more shares I think are good value

- ii view: blue-chip distributor Bunzl back in favour

- Stockwatch: I still say buy this quiet turnaround play

Furthermore, Share Sleuth is not in desperate need of diversification. Before I made my decision it had 29 holdings, which apart from shares like Macfarlane are a pretty diverse bunch.

There are other vehicle-tracking companies, obviously, but I think Quartix's focus on a cheap generic device that can be self-installed, software that can be self-configured, direct sales, and its new strategy to develop add-ons, is unique and coherent.

There are a couple of factors I am trying to keep out of my judgement.

An investor I respect is championing Macfarlane. His advocacy encouraged me to investigate the company, as well as two other Share Sleuth portfolio holdings: Judges Scientific (LSE:JDG) and, coincidentally, Quartix. While I think it is fine to get ideas from other investors, we have to make our own minds up.

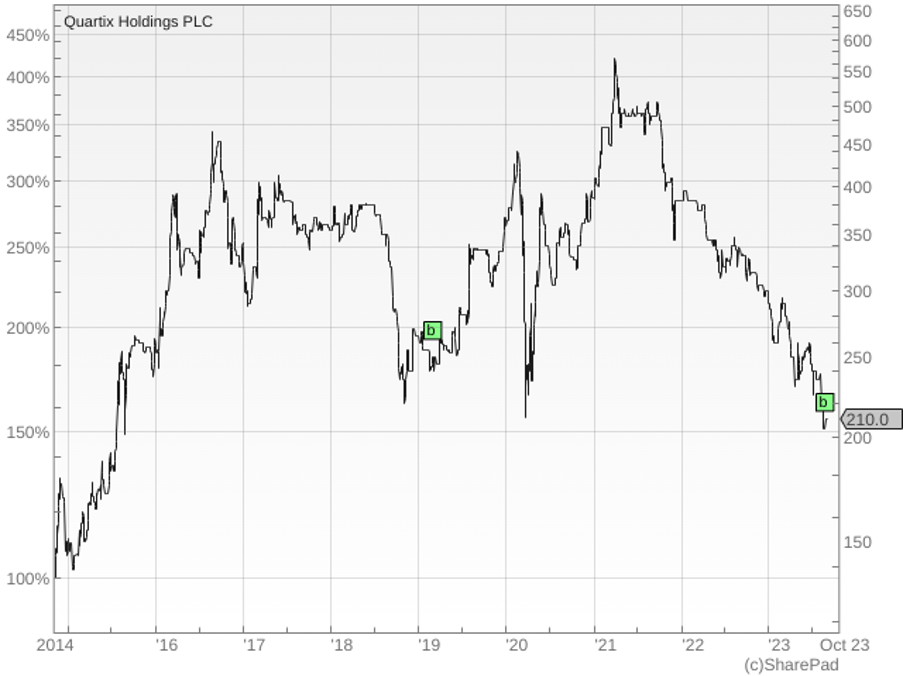

Also preying on my mind is the dramatic 65% fall in Quartix's share price since 2021. While I do not consider the direction of the share price when evaluating shares, that kind of move is difficult not to ignore.

Source: SharePad, “b” indicates an addition to the Share Sleuth portfolio. Past performance is not a guide to future performance.

I cannot put myself in the mind of other traders, my default assumption is that they are thinking in a different time frame and I buy shares when my scores tell me to do [so].

There are factors weighing on the company's performance currently, rising wage costs and investment in overseas expansion to name two.

To my mind, the long-term impact of both should be positive. Rising costs will be more troublesome for less-efficient rivals and investment overseas is already delivering more revenue.

Adding Quartix

This is not a high-stakes decision. Both shares have been through my scoring process and come out well, and I only put 2.5% of the portfolio at risk at a time.

To rationalise my conflicting thoughts I slept on the matter, and re-read my most recent write-ups (you can read Quartix here, and Macfarlane here).

My brain agreed with my gut and on Thursday 24 August I added 2,200 Quartix shares to the Share Sleuth portfolio. The price was £2.04 per share, making the cost including £10 in lieu of broker fees £4,498, about 2.5% of the total value of the portfolio.

Like Auto Trader Group (LSE:AUTO), also a regular candidate for inclusion in the portfolio, Macfarlane is always a bridesmaid.

Share Sleuth performance

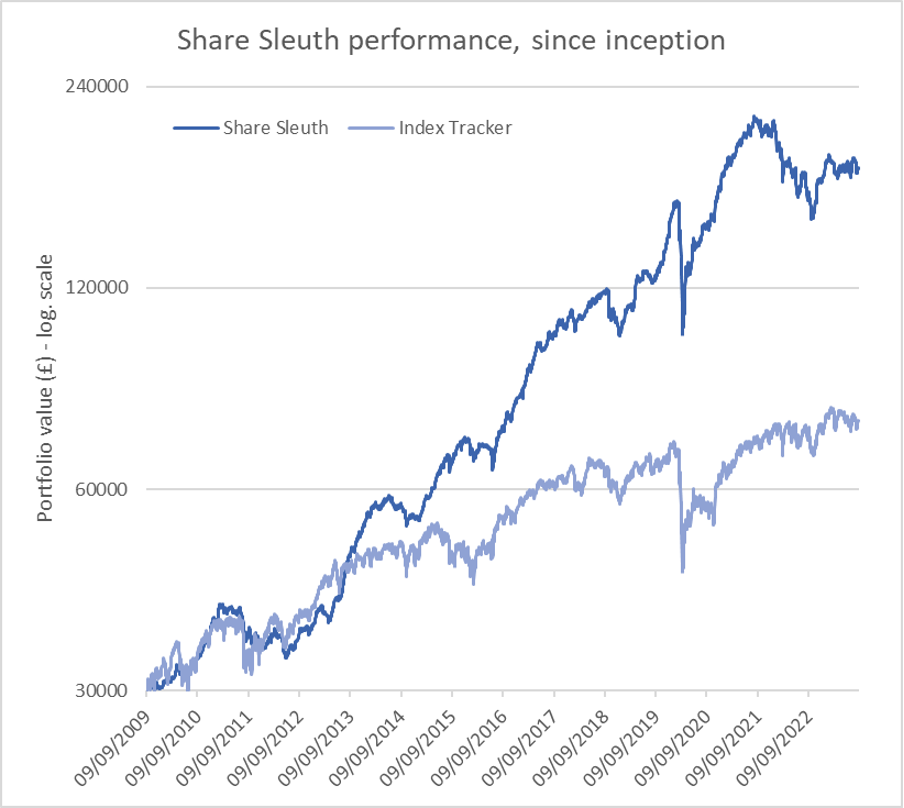

At the close on Friday 1 September, Share Sleuth was worth £181,327, 504% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £76,104, an increase of 154%.

Past performance is not a guide to future performance.

After the Quartix trade and dividends paid during the month from Bloomsbury Publishing (LSE:BMY), D4t4 Solutions (LSE:D4T4), Dewhurst Group (LSE:DWHT), Latham (James) (LSE:LTHM), Porvair, Next (LSE:NXT), and Treatt (LSE:TET), Share Sleuth has £1,675 in cash.

The minimum trade size, 2.5% of the portfolio’s value, is £4,500. If there is a trade next month, it will be to reduce or remove a holding.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 1,675 | ||||

Shares | 179,652 | ||||

Since 9 September 2009 | 30,000 | 181,327 | 504 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 2,389 | -41 |

BMY | Bloomsbury | 1,681 | 5,915 | 6,917 | 17 |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,913 | 9 |

BNZL | Bunzl | 201 | 4,714 | 5,729 | 22 |

CHH | Churchill China | 682 | 8,013 | 8,764 | 9 |

CHRT | Cohort | 1,600 | 3,747 | 7,936 | 112 |

D4T4 | D4t4 | 1,528 | 3,509 | 2,827 | -19 |

DWHT | Dewhurst | 532 | 1,754 | 4,549 | 159 |

FOUR | 4Imprint | 190 | 3,688 | 9,766 | 165 |

GAW | Games Workshop | 100 | 4,571 | 10,720 | 135 |

GDWN | Goodwin | 266 | 6,646 | 12,475 | 88 |

GRMN | Garmin | 53 | 4,413 | 4,447 | 1 |

HWDN | Howden Joinery | 2,020 | 12,718 | 14,807 | 16 |

JDG | Judges Scientific | 34 | 833 | 3,216 | 286 |

JET2 | Jet2 | 456 | 250 | 4,834 | 1,834 |

LTHM | James Latham | 750 | 9,235 | 8,438 | -9 |

NXT | Next | 106 | 6,071 | 7,450 | 23 |

PRV | Porvair | 906 | 4,999 | 5,527 | 11 |

PZC | PZ Cussons | 1,870 | 3,878 | 2,996 | -23 |

QTX | Quartix | 3,285 | 7,296 | 6,899 | -5 |

RSW | Renishaw | 92 | 1,739 | 3,292 | 89 |

RWS | RWS | 2,790 | 9,199 | 6,746 | -27 |

SOLI | Solid State | 356 | 1,028 | 4,664 | 354 |

TET | Treatt | 763 | 1,082 | 4,242 | 292 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 7,700 | 249 |

TSTL | Tristel | 750 | 268 | 2,494 | 830 |

TUNE | Focusrite | 1,050 | 9,123 | 5,460 | -40 |

VCT | Victrex | 292 | 6,432 | 4,395 | -32 |

XPP | XP Power | 240 | 4,589 | 5,064 | 10 |

Notes

Aug: Added more shares in Quartix

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £181,327 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £76,104 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, 4 September 2023.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Quartix.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.