Signs that RBS shares are becoming interesting

Our chartist examines the levels where future tumultuous drops could prove to be difficult.

4th July 2019 09:11

by Alistair Strang from Trends and Targets

Our chartist examines the levels where future tumultuous drops could prove to be difficult.

RBS (LSE:RBS)

We'd tried to skip RBS (LSE:RBS) in our retail bank analysis recently. Essentially, it proved difficult to whip up enthusiasm for a month's price moves which frankly make the UK PM contest seem exciting and vibrant.

However, there are slight signs things with RBS are about to become slightly interesting.

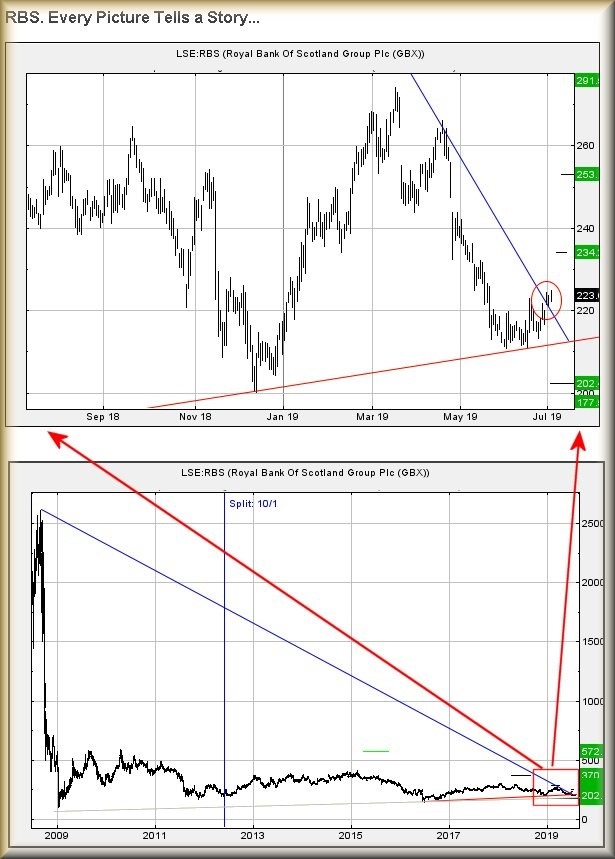

Movements now above 225p indicate the prospect of some recovery in the near future with 234p calculating as an immediate prospect. If this ambition appears, there's a fairly firm suggestion we've spent the last year scanning movements against the wrong trend!

What alarmed us this week was how the share price opened on Monday. The market opted to gap the price up, suggesting "they" were skipping over a trend. If this proves the case and 234p makes an appearance anytime soon, our secondary, if bettered, calculates at 253p.

We have considerable doubts regarding this and the lower chart gives a fairly straightforward visual excuse. It appears the market is asking us to believe RBS share price was jumped across a downtrend which started in 2008!

We're just a little sceptical about this, if only due to RBS previously triggering what seemed a solid movement down to 202p.

In theory, our 202p target level is now void but on this occasion, our inclination is to distrust software and instead fear the worst. After all, we've identified a market strategy when a share price is magically gapped up, then gapped down a few days later. This tends to indicate a price is about to be roasted.

For RBS, this will mean weakness below 212p should propel the share down to 202p initially with secondary, if broken, at 177p.

In fact, it could easily tumble to 149p eventually with the correct blend of toxic news and market conditions polluted by UK politics.

For now, we shall watch carefully for the price actually closing above 234p as this should make future tumultuous drops difficult.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.