The six top tech funds

After a prosperous half year for stocks, the Saltydog analyst reveals the best sectors and funds to own.

7th May 2019 10:43

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

After a prosperous half year for stocks, the Saltydog analyst reveals the best sectors and funds to own.

The Tech & Telecoms sector leads the 2019 recovery

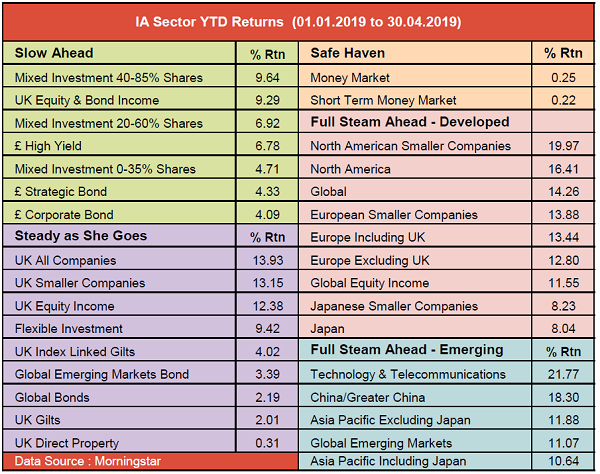

In the last four months all of the Investment Association sectors have made gains.

Data source: Morningstar. Past performance is not a guide to future performance

This is in stark contrast to their performance last year.

When we reviewed the 2018 figures at the beginning of this year, nearly all of the sectors had made losses in the previous 12 months. The only exceptions were the Money Markets (which didn't keep up with inflation), Global Bonds (up 0.23%), Tech & Telecoms (up 1.05%), and UK Direct Property (up 2.86%). The worst performing sector was the European Smaller Companies sector, which lost over 15%.

So far this year most sectors have more then recovered the losses from last year. It's only the Global Emerging Markets, Global Emerging Markets Bonds, European Smaller Companies and the Japanese sectors that still have some catching up to do.

The best-performing sector has been Tech & Telecoms, which is up 21.77%.

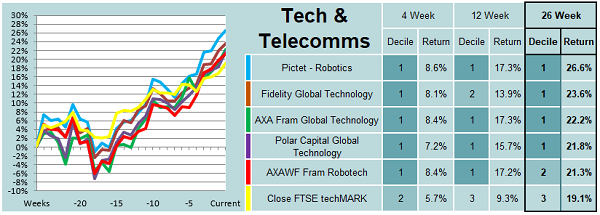

Here's our analysis from last week, showing the leading funds over the last 26 weeks.

Data source: Morningstar. Past performance is not a guide to future performance

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.