Still the land of the rising fund?

Saltydog Investor examines a leading market’s success and why this could continue.

16th February 2026 14:42

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Just over two years ago, the main Japanese stock market index, the Nikkei 225, closed above 39,000 for the first time, finally breaking through its December 1989 peak – a record that had stood for more than three decades.

Since then, it has continued to move higher and is now trading closer to 57,000. That represents a gain of more than 40% in little over two years.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

The backdrop to that rise is interesting, and not always obvious from a Western, developed-markets perspective. Japan remains one of the world’s largest economies, yet its market cycle has often been out of step with the US and, to a lesser extent, Europe.

Japan was a dominant force during the 1980s and early 1990s, and for a time justified two Investment Association (IA) sectors – Japan and Japanese Smaller Companies. Since then, the focus of many investors has shifted further west. In November 2023, the IA dissolved the Japanese Smaller Companies sector, citing an insufficient number of funds to keep it viable.

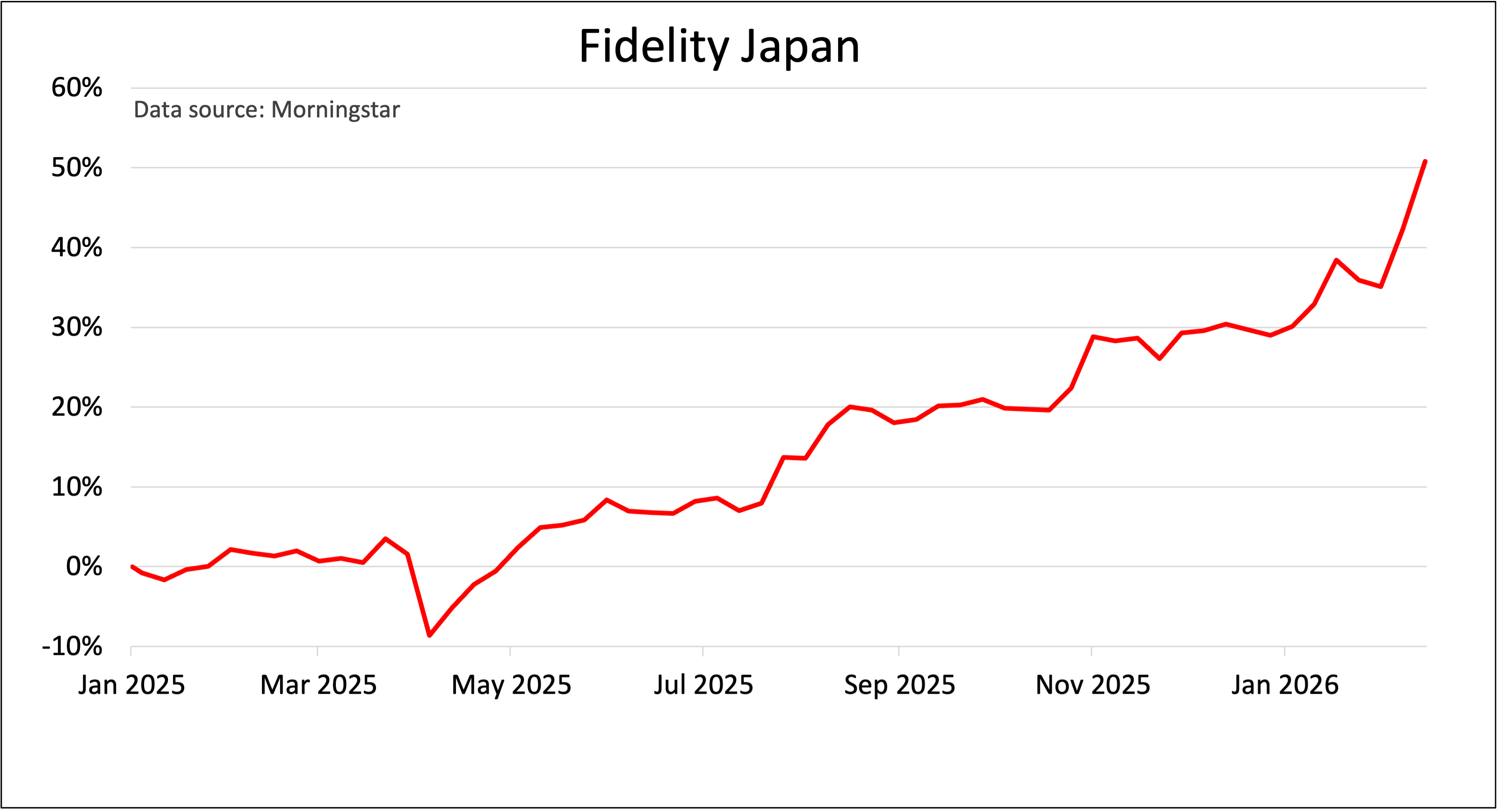

That makes the recent performance of the remaining Japan sector all the more notable. Last year, it rose by more than 17%. While a handful of other sectors did better, that was still a strong result. This year has been even more encouraging.

In Saltydog’s latest analysis, Japan was the best-performing sector over four weeks, up 4.5%. The Fidelity Japan W Acc fund, which we have held in one of our demo portfolios since August last year, was showing a six-month gain of more than 25%.

Past performance is not a guide to future performance.

The latest upturn has probably been driven by the election earlier this month, but the forces shaping Japan’s recovery have been building for years.

When the final tallies were confirmed, the scale of the Liberal Democratic Party’s victory left little room for doubt. With a commanding lower-house supermajority, voters endorsed not just a new prime minister, but a policy direction that has been developing for more than a decade. Although the February 2026 election was formally a snap poll, the economic ideology behind it was anything but sudden. Instead, it reflected the continuation of an approach that can be traced back to the return of Shinzo Abe in 2012.

- Fund Focus: beware this investment trust ‘silver bullet’

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

When Abe returned to office, Japan had endured almost two decades of weak growth, falling prices, and declining confidence. His response, quickly labelled “Abenomics”, was designed as a shock rather than a fine adjustment. The combination of aggressive monetary easing, flexible fiscal policy, and structural reform was intended to break the country’s deflationary mindset and restore confidence among households, companies, and investors.

Abe also reshaped the institutional framework. The government and the Bank of Japan aligned around a clear inflation target, while corporate governance reforms began to change behaviour inside Japan’s listed companies. While progress was uneven, these changes laid the foundations for the market dynamics investors recognise today, including higher buybacks, rising dividends, and a stronger focus on return on equity.

The policy framework did not evolve in a straight line. Under Prime Minister Fumio Kishida, the emphasis shifted towards wage growth, income distribution, and human capital. At the time, this was often portrayed as a break with Abenomics. In hindsight, it is more accurately seen as an attempt to address one of its shortcomings – that higher corporate profits had not consistently translated into rising household incomes.

That agenda was constrained by political fragility, and Kishida’s successor, Sanae Takaichi, initially faced similar challenges. After taking office in late 2025, she led a minority government, limiting the scope for decisive action. The recent February 2026 election changed that dynamic. By restoring full control of the lower house, it removed a key source of political friction and provided greater policy clarity.

- Ian Cowie: follow the BAHJI trade for income and growth

- Is it time to move on from money market funds?

Takaichi has positioned her programme, often referred to as “Sanaenomics”, as a continuation of the Abe-era framework rather than a departure from it. Where Abe focused on escaping deflation, her emphasis has been on resilience – economic, industrial, and strategic – in a more fragmented global environment. That includes aggressive fiscal support, substantial investment in areas such as semiconductors and defence, and targeted measures to cushion households from inflation.

For equity investors, the result has been a clearer and more supportive policy backdrop. The Nikkei 225 moved to a 30-year high last year and has gone on to set further records in recent months. That strength reflects more than short-term sentiment. Expectations of rising capital expenditure, continued governance reform, and political stability have all played a role.

Bond markets, by contrast, have been more cautious. Rising yields reflect lingering concerns about debt sustainability and the implications of continued government spending in a higher-rate environment.

Seen in this context, the 2026 election was less a break with the past than a vote for continuity. By granting a strong mandate, voters signalled a preference for an assertive, growth-focused approach over the uncertainties of premature tightening. For investors, that policy consistency has helped reinforce the supportive backdrop for Japanese equities.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.