This stock does Blockchain, crypto and mining – where’s the catch?

The company’s share price has rocketed, but now looks twitchy.

19th January 2021 08:41

by Alistair Strang from Trends and Targets

The company’s share price has rocketed, but now looks twitchy.

Argo Blockchain

We've received a lot of emails regarding the share price of Argo Blockchain (LSE: ARB), some from folk dazzled by the confluence of Blockchain, cryptocurrency and mining on the company website.

We would urge caution and thorough research when viewing anything to do with unregulated cryptocurrency, especially with the current hype around Blockchain.

But we think we understand the reason for the quantity of emails over the last couple of sessions. Argo Blockchain’s share price is currently looking more nervous than a UK government minister.

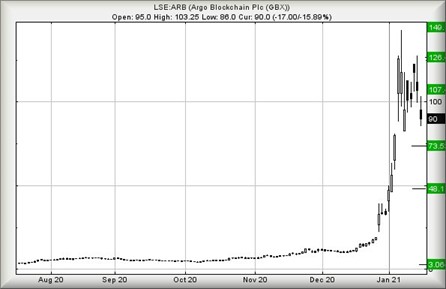

Presently trading around 90p, the share price needs only slip below 85p to exhibit the potential of a reversal cycle to an initial 73p.

- Ruffer’s bitcoin investments are up more than 100%

- Regulator sounds warning on cryptoassets

- Why reading charts can help you become a better investor

If broken, our secondary calculation gives 48p as a potential bottom. We'd advocate extreme caution should 48p break, as our ultimate bottom works out at 3p, turning recent Argo price movements into a spectacular 'pump & dump' exercise.

However, the share price does not require a great effort to inject hope for the future. Above 97p calculates with an initial ambition of 107p with secondary, if exceeded, a longer term (or sometime in the next few minutes) 126p. Above 126p, things get quite interesting as we can present 149p as a future ambition, if things go nuts.

For now it's fingers crossed time. From the point at which Argo closed on 18 January, we fear reversal toward 48p lies ahead.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of interactive investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.