Stockwatch: potential for more special dividends here

This small business has a solid track record and could be a beneficiary of climate change, argues analyst Edmond Jackson who rates the shares a buy.

19th August 2025 10:34

by Edmond Jackson from interactive investor

I’ve lost count of heatwaves in the UK this summer, which ought to be providing a boost to specialist hirer Andrews Sykes Group (LSE:ASY).

This £215 million AIM-listed group seems mainly to derive its revenue from water pumps as well as air conditioning, chillers, ventilation and cooling fans. Together with heating equipment, it performs ideally given cold wet winters and long hot summers - extremes of climate change we may, overall, be moving towards.

- Invest with ii: Top ETFs| Top UK Shares | Open a Trading Account

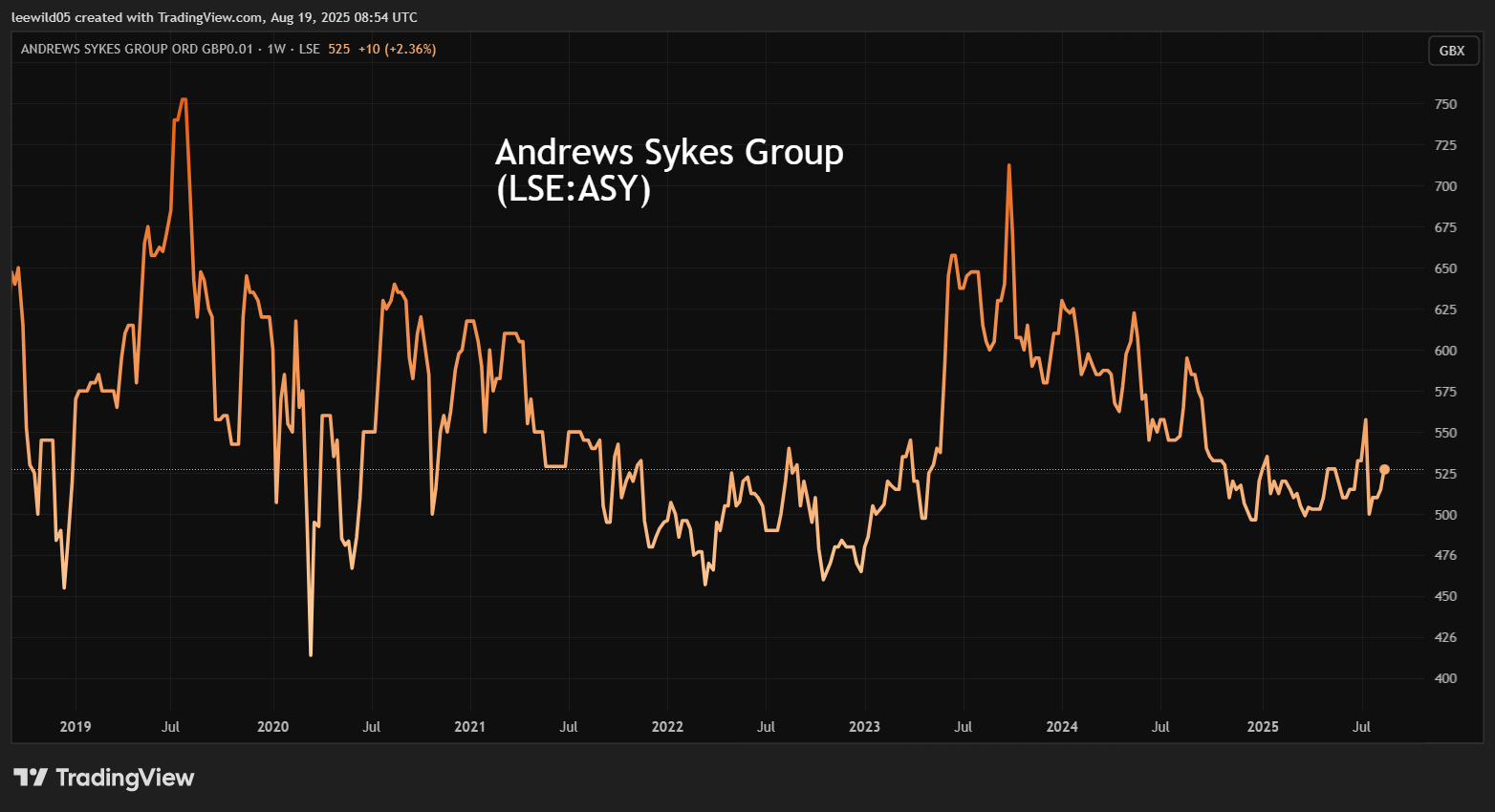

A sideways-volatile chart for the last five years suggests a classic, somewhat cyclical, share lacking near-term growth appeal and priced for yield, currently around 5% if a 29.5p ordinary dividend is maintained.

Being strongly cash generative, this group has also paid special dividends in at least the past three years, seemingly when the cash balance passes £30 million. Unfortunately, in 2024, a poor summer in the UK and Europe checked revenue and profit but year-end cash still grew 16% to £23.2 million.

Source: TradingView. Past performance is not a guide to future performance.

Pump hiring does, however, dial into construction work, hence it relates to infrastructure trends, and a new venture in Saudi Arabia intended to capitalise on a construction boom there could add a growth angle.

Essential valuation yardsticks tend to convey a sense of fair pricing - a price/earnings (PE) multiple around 13.5x and 510p market price reflecting nearly 5x net asset value despite no goodwill or intangibles on the balance sheet. Yet Andrews Sykes has performed better in the past, hence I am inclined to look beyond its 2024 lull in group performance.

A current lack of broker forecasts is not helping the shares, although Andrews Sykes does have Houlihan Lokey as its AIM-nominated adviser. Without being too cynical, most solitary small-cap forecasts tend to reflect guidance from a CFO to their corporate broker. Andrews Sykes does also have limited liquidity given that it is around 90% owned by the Anglo-French Murray family.

- Shares for the future: speculative small-cap with a compelling model

- 10 hottest ISA shares, funds and trusts: week ended 15 August 2025

I recall attending a shareholder meeting in the 1990s when Jean Jacques Murray wrested control as a 30% shareholder and subsequently transformed performance. The decorated war hero had been one of France’s most successful post-war businessmen in services industries. I regard this family as having high ethical business standards, although a lack of interest in the shares may partly reflect concern – as per a wider trend – that they cannot avoid considering if listing costs confer genuine benefit nowadays. I doubt, however, that this could result in a lowball offer to take them private.

Evolution from 1980s acquirer of service businesses

Braithwaite Plc acquired Sykes pumps (founded by Henry Sykes in 1857) then Andrews air conditioning, merging both operations in the late 1980s. A 1990 milestone was Sykes assisting de-watering a quarry in Dartford as part of construction of the Bluewater shopping centre; this being the classic application for Sykes in the Middle East.

The long-term financial record since 2013 shows a sound, if somewhat volatile, record, typical of a relatively cyclical business. “Stagflation” worries and a weak German economy have therefore also contributed to the shares being at the lower end of their five-year trading range, although they did ten-bag from around 60p in the 2009 recession to over 600p by 2019.

Andrews Sykes Group - financial summary

Year ended 31 Dec

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 61.1 | 56.4 | 60.1 | 65.4 | 71.3 | 78.6 | 77.2 | 67.3 | 75.2 | 83.0 | 78.7 | 75.9 |

| Operating margin (%) | 24.0 | 20.1 | 22.0 | 24.2 | 24.7 | 26.3 | 25.0 | 24.4 | 26.7 | 25.9 | 28.9 | 30.5 |

| Operating profit (£m) | 14.7 | 11.3 | 13.2 | 15.8 | 17.6 | 20.7 | 19.3 | 16.4 | 20.1 | 21.5 | 22.7 | 23.2 |

| Net profit (£m) | 11.5 | 9.3 | 10.8 | 14.5 | 14.1 | 17.0 | 15.0 | 13.0 | 15.5 | 17.0 | 17.8 | 16.8 |

| Reported earnings/share (p) | 27.3 | 22.0 | 25.6 | 34.2 | 33.4 | 40.3 | 35.6 | 30.9 | 36.8 | 40.4 | 42.2 | 40.1 |

| Normalised earnings/share (p) | 26.3 | 21.5 | 24.7 | 33.3 | 32.4 | 39.2 | 34.6 | 26.7 | 34.9 | 39.4 | 40.6 | 38.1 |

| Earnings per share growth (%) | 3.1 | -18.3 | 14.9 | 35.2 | -2.8 | 20.8 | -11.6 | -22.8 | 30.7 | 12.9 | 2.9 | -6.0 |

| Operating cashflow/share (p) | 33.6 | 25.1 | 28.7 | 35.8 | 42.3 | 45.2 | 43.9 | 52.8 | 55.9 | 65.4 | 59.3 | 48.6 |

| Capex/share (p) | 10.4 | 8.8 | 12.4 | 12.8 | 13.7 | 16.9 | 14.7 | 9.9 | 6.0 | 5.8 | 9.7 | 12.9 |

| Free cashflow/share (p) | 23.2 | 16.3 | 16.3 | 23.0 | 28.6 | 28.3 | 29.2 | 42.9 | 49.9 | 59.6 | 49.7 | 35.7 |

| Dividends/share (p) | 17.8 | 23.8 | 23.8 | 23.8 | 23.8 | 23.8 | 23.8 | 33.9 | 24.4 | 25.9 | 25.9 | 25.9 |

| Covered by earnings (x) | 1.5 | 0.9 | 1.1 | 1.4 | 1.4 | 1.7 | 1.5 | 0.9 | 1.5 | 1.6 | 1.6 | 1.6 |

| Net asset value/share (p) | 108 | 100 | 103 | 114 | 126 | 140 | 151 | 133 | 151 | 154 | 96.7 | 110 |

Source: historic company REFS and company accounts.

Very good operating margins have risen from the mid-20% level to over 30%, aiding very strong numbers and returns on both capital employed and equity, up to near 40%. The trend in earnings per share (EPS) – which growth investors are typically influenced by – has been mixed, however.

Annual results to 31 December 2024 were announced on 7 May, which is relatively late in general context, and the 17 June AGM added nothing further to the executive chair’s outlook about how “positive momentum has continued into the current year...overall performance in line with the board’s expectations”.

But given that the air conditioning hire side – even if it is financially smaller than pumps – should be benefiting from a record hot summer, I doubt Andrews Sykes is being afflicted by the recent weakness that advertisers and recruiters have cited.

Exchange rates can take the edge off numbers, mind. 2024 group revenue was around 4% easier at £75.9 million, partly due to closing loss-making French operations, but also stronger sterling. Operating profit still managed to edge ahead 2% to £23.2 million, although net cash from operations fell 18%, if still substantive at £20.3 million.

- eyeQ: the seasonal trap and US equities

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

There is no actual breakdown of hiring activity revenue and profit, but that could involve sound reasons of confidentiality, say if high margins in one area attracted competition.

Showing the aspect of weather sensitivity; in 2024 UK revenue saw a 3% overall slip to £43.1 million, yet operating profit still firmed 3% to £15.4 million. It was a similar story in continental Europe, where revenue fell 12% to £23.6 million equivalent due to weather and a stagnant German economy. European operating profit unfortunately fell 6% to £8.2 million.

More positively, the smaller Middle East operation saw a 38% hike in revenue to £7.7 million with operating profit up 175% to £1.1 million. New local management achieved a strong turnaround, and a Saudi Arabian subsidiary was formed early this year which looks one to watch for 2026 onwards.

The businesses are free from the influence of US tariffs unless any aggregate effect builds to temper the global economy.

Culture of special dividend payouts may return

It is an upside of having one of Europe’s wealthiest families in firm control. Since Murray elder passed in 2023 aged 103, his son has become executive chair, and while he owns over 3% directly, the family also owns 87% via a Luxembourg company.

When group net cash rose to over £30 million in the 2021 financial year, a 23.7p per share special dividend returned £10 million to holders, taking the overall payout to over 48p per share – equivalent to a 9.4% yield around the current share price.

After interim results in 2022 cited £31 million net cash, a 16.6p special dividend returning £7 million, was declared. At £39 million in the first half of 2023, a 59.4p per share special dividend returned £25 million. That took the total payout in respect of 2023 to 85.3p, near a 17% equivalent yield now.

While the AGM renewed authority to buy back up to 12.5% of the issued share capital, the last announcement of such was August 2023, and the recent lack of such would appear to imply that the Murray family is content to run the group for (hopefully) growth and income rather than steadily taking full ownership.

The end-2024 balance sheet showed cash up 16% to £23.2 million – just over 50% of net assets. There is no financial debt beyond £16 million lease obligations, which generated just over £1 million finance costs, albeit offset by the same interest on the cash balance. So this year’s interim results (published on 26 September last year) will be interesting, partly to see if cash is similarly accelerating towards this halo of £30 million which has previously triggered special payouts.

- Four climate change winners and one big loser

- What to consider before gifting your pension to swerve IHT

The flip side, however, is bumper payouts implying the business lacks remarkably attractive growth propositions – barring the Saudi Arabian start-up. On a 10- to-20-year view, however, you would think that climate change – searing temperatures and rising sea levels – ought to provide a bonanza for air conditioning and pumps, so perhaps the family is acting wisely to sit with the current strategy rather than diversify.

Generally, hire company shares tend to be cyclical, so if the UK faces economic challenges given the likelihood of another tax-raising Budget this autumn – then such shares hardly look a defensive choice.

Interim results will be a test of whether the climate side of the company’s story prevails, versus the traditional sense of a cyclical business affected by the general economy.

All things considered I still believe a “buy” stance is justified at around 510p given the essential nature of Andrews Sykes’ services and good oversight by the Murrays. This group exemplifies long-term virtues of family business ownership, available in a listed share.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.