Stockwatch: still time to buy this FTSE 100 defence share?

It’s been one of the best-performing sectors over the past year and the world remains a dangerous place. Analyst Edmond Jackson studies the investment case for this industry giant.

9th January 2026 12:04

by Edmond Jackson from interactive investor

Yesterday’s rally in European arms-making shares – many to record highs – raises a classic question about stock strategy. Is it better to buy those rising in the context of a bullish story, being tolerant of rather full earnings valuations, or should you ignore the siren call of stock market fashion, stick steely to value and prioritise a margin of safety like Warren Buffett implores?

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

BAE Systems (LSE:BA.) is a prime example. With the US getting close to half of group revenues and growing relatively faster, it offers the best play on President Donald Trump saying last Wednesday to US senators that the military budget should be boosted 50% to $1.5 trillion (£1.1 trillion). When BAE last reported results, it cited a 30 June backlog (work in progress) in excess of £75 billion relative to a £60.7 billion market valuation and with the shares currently near 2,060p.

I would be careful about assuming too much from backlog comparisons where contractors are involved. Some are sustained much higher than you would readily assume versus revenue, for example £30.5 billion as consensus for BAE in 2025. Petrofac had an enticingly huge backlog, as if it were a blue-chip company in oilfield services, but its shares were still wiped out by debt.

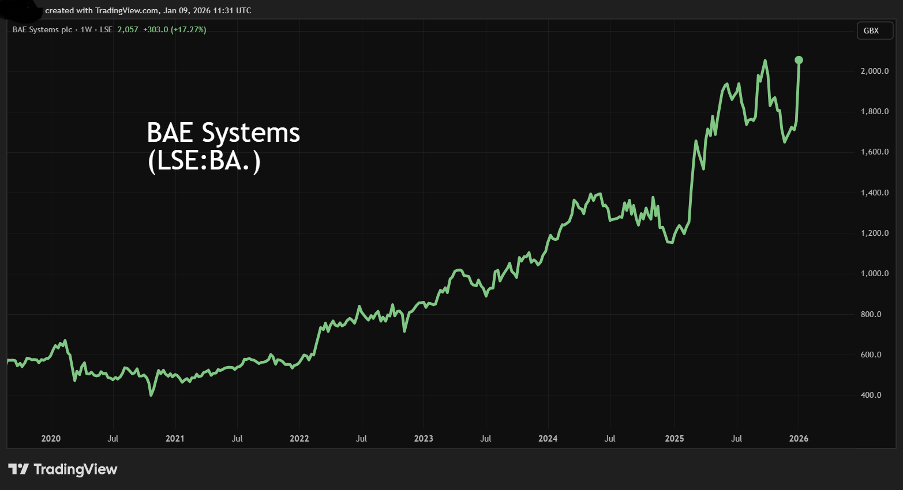

However, it could be that Trump’s behaviour is signalling a return to superpower “spheres of influence”, which begs the question of whether the US president is setting up a good few years of serial upgrades to defence company earnings. It happened before with BAE following Russia’s invasion of Ukraine in early 2022 which re-defined defence spending:

Source: TradingView. Past performance is not a guide to future performance.

After a circa 20% rise this year, BAE’s share price is virtually back to its 2,073p all-time high achieved last October, the top of a sideways’ trading range since April.

Venezuela, and arguably now Greenland, crystallised what Trump meant when he rebranded the US Department of Defense as a Department of War “to protect strength and resolve”. According to X, the spoiler is the risk to defence stocks that Trump is impeached as soon as March by Democrats in concert with moderate Republicans. But that kind of thing has manifested serially with Trump and, as with furore over the Minneapolis shooting, this administration seems to bludgeon on with iron control.

- Investment outlook: expert opinion, analysis and ideas

- Stockwatch: Venezuela, oil stocks, gold and China

A more realistic caveat is whether the mooted $1.5 trillion US defence budget can happen versus $38.4 trillion of public debt already, around 100% of gross domestic product. Trump obviously believes so and will do his best to appoint a Federal Reserve governor intent on cutting interest rates.

It’s unclear where it all ends or simply evolves towards, without triggering some kind of financial panic.

In arithmetic terms, BAE is fully valued

You do have to assume upgrades for there to be any “value” case for BAE shares, at least in the relative near term. At near 2,060p, the forward price/earnings (PE) ratio is 27x consensus earnings per share (EPS) forecasts of nearly 75p based on 2025 net profit expected to be around £2,270 million. The valuation falls to 24x if profit rises above £2,510 million this year.

Given a strong free cash flow profile in excess of earnings since 2021 (see table), buybacks are enhancing a near 15% profit rise pencilled in for 2025 into 17% EPS growth. Similarly, 10% profit growth expected in 2026 could be reflected in 12% EPS growth. That implies a near-term PEG ratio (PE-to-growth) of 1.6x, rising to 2.0x next year, which theoretically is pricey. Value exists below 1.0x, although possibly you might buy up to 1.5x if the story is good, implying earnings growth momentum.

BAE Systems - financial summary

Year-end 31 Dec

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 17,790 | 17,224 | 16,821 | 18,305 | 19,277 | 19,521 | 21,258 | 23,078 | 26,312 |

| Operating margin (%) | 9.8 | 8.2 | 9.5 | 10.4 | 10.0 | 12.2 | 11.2 | 10.2 | 9.9 |

| Operating profit (£m) | 1,742 | 1,419 | 1,605 | 1,899 | 1,930 | 2,389 | 2,384 | 2,573 | 2,685 |

| Net profit (£m) | 913 | 827 | 1,000 | 1,476 | 1,299 | 1,758 | 1,591 | 1,857 | 1,956 |

| Reported earnings/share (p) | 28.7 | 24.1 | 31.1 | 46.1 | 40.5 | 54.7 | 50.5 | 60.4 | 64.1 |

| Normalised earnings/share (p) | 28.8 | 33.3 | 35.6 | 43.4 | 38.4 | 41.6 | 47.9 | 58.8 | 63.8 |

| Operating cashflow/share (p) | 38.6 | 59.3 | 37.5 | 49.9 | 36.3 | 76.2 | 90.0 | 122 | 129 |

| Capital expenditure/share (p) | 15.4 | 14.9 | 15.5 | 14.7 | 14.9 | 14.4 | 22.0 | 31.2 | 38.1 |

| Free cashflow/share (p) | 23.2 | 44.4 | 22.0 | 35.2 | 21.5 | 61.8 | 68.0 | 90.8 | 90.9 |

| Dividend/share (p) | 21.3 | 21.8 | 22.2 | 23.2 | 23.7 | 25.1 | 27.0 | 30.0 | 33.0 |

| Covered by earnings (x) | 1.4 | 1.1 | 1.4 | 2.0 | 1.7 | 2.2 | 1.9 | 2.0 | 1.9 |

| Return on capital (%) | 11.0 | 9.2 | 10.4 | 11.5 | 10.6 | 13.0 | 11.0 | 12.2 | 10.4 |

| Cash (£m) | 2,973 | 3,360 | 3,398 | 2,797 | 2,957 | 3,111 | 3,359 | 4,272 | 3,590 |

| Net Debt (£m) | 1,452 | 723 | 901.0 | 1,954 | 3,723 | 3,245 | 3,499 | 2,259 | 6,563 |

| Net assets per share (p) | 110 | 148 | 174 | 169 | 144 | 235 | 364 | 348 | 386 |

Source: historic company REFS and company accounts.

It illustrates a dilemma with PEGs of how a year or two’s perspective easily distorts the picture. If EPS is heading to 100p or better in the next two to five years, it represents a more typically growth PE around 20x – this is arguably fair if defence is gearing up for superior earnings growth. The “spheres of influence” doctrine replacing international law arguably justifies this.

Conversely, what if Trump actually was to get a drubbing at the 2026 mid-term elections, especially if stubborn inflation starts to bear down on consumer confidence like it is in the UK? Republicans currently hold a narrow five-seat majority in the House of Representatives, and supposedly Democrats have a near 80% chance of taking control in November. It’s unclear whether a divided government can pass very much thereafter, but that could apply more generally than if Trump soon nails down what he wants for 2026 defence – sorry, war – spending.

From a macro angle then, risk and reward look pretty well balanced even if you assume two to five years of superior earnings growth. BAE is going to remain sensitive to the US, but holders can take comfort that Europe, including the UK, represents 35% of group revenue and European defence spending is a cert to ratchet up.

Are order book dynamics of much significance?

In 2024, order intake actually fell 10.6% to £33.7 billion, although the backlog rose 11.5% to £77.8 billion. That 2025 revenue growth is expected to be around 16%, moderating to 7%, possibly shows how intake has an 18-month or so follow-through to revenue, but a more thorough evaluation is needed.

While the stock market probably would take encouragement from a bullish order book, headlined with annual results due in mid-February, I would not be swayed simply by its scale at around 2.5x revenue.

An aspect not wholly consistent with a growth PE is BAE’s modestly declining operating margin – from 12.2% in 2021 to just below 10% in 2024, taking it back to 2020 levels. My sense is usually to expect a higher margin for earnings quality besides momentum.

With the dividend expected to rise 8% in 2025 and 11% in 2026 to about 40p while maintaining just over twice earnings cover, the prospective yield is around 2%, hence the shares appealing chiefly for total return.

Mixed perspective from recent director deals

On 5 December, a non-executive director bought a substantial £167,800 shares at 1,678p despite two executive directors selling £556,500 worth at 1,855p and £656,500 at 1,875p, respectively, at the end of October.

It summarises how two-way opinion on BAE is now possible, but perhaps greater weight should be attached to the non-executive director cash purchase given the executives have share option bonuses as well, which means they can uniquely manage their risk exposure.

There has been no disclosed short selling since 0.6% was made public just before the Ukraine invasion and none has started to materialise yet. Obviously, as a now £60.7 billion company, meeting the disclosure threshold of 0.5% of issued share capital would imply a high-risk focused bet for an individual hedge fund.

Momentum ‘buy’ if not exactly a balanced value investment

BAE Systems currently defines one’s approach to risk. If you believe US defence spending can and will rise at least 30%, with Europe also re-rating upwards, and that Trump will not be de-railed in 2026, then yes “buy”, especially on any drop in price.

There is also a “Space” element to the growth story by way of the early 2024 acquisition of Ball Aerospace – a specialist supplier of satellite systems, geospatial intelligence and multiple antennas – for $5.6 billion. If this is shown to be performing well at the annual results, like it should, it could help. Management had proclaimed that it was “an excellent strategic fit”, with revenue growth around 10% over the next five years and to be earnings-enhancing in 2025.

A 1.7% rise for the share price in early dealings Friday morning affirms BAE’s momentum tag, and traders need to time any entry cannily. For long-term investors, the objective stance is “hold”.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.