Stockwatch: Venezuela, oil stocks, gold and China

With geopolitics continuing to significantly impact global stock markets into 2026, analyst Edmond Jackson gives his view and an outlook following America’s latest moves.

6th January 2026 11:28

by Edmond Jackson from interactive investor

Ousted leader of Venezuela Nicolas Maduro and his wife are escorted by federal agents at a Manhattan helipad in New York on 5 January. Photo: XNY/Star Max/GC Images.

Despite a breakdown in international law implying that risk assets just got riskier, the initial response of global stock markets was to brush aside America’s involvement in Venezuela. US indices yesterday hit further record highs and the FTSE 100 joined in.

- Invest with ii: Top UK Shares | Free Regular Investing | Open an investment Account

It’s fair enough how, in an economic sense, Venezuela does not constitute a global oil supply risk like the Middle East. While supposedly enjoying the world’s largest reserves, it is heavy oil backed by weak industry infrastructure, hence only accounts for around 1% of global production.

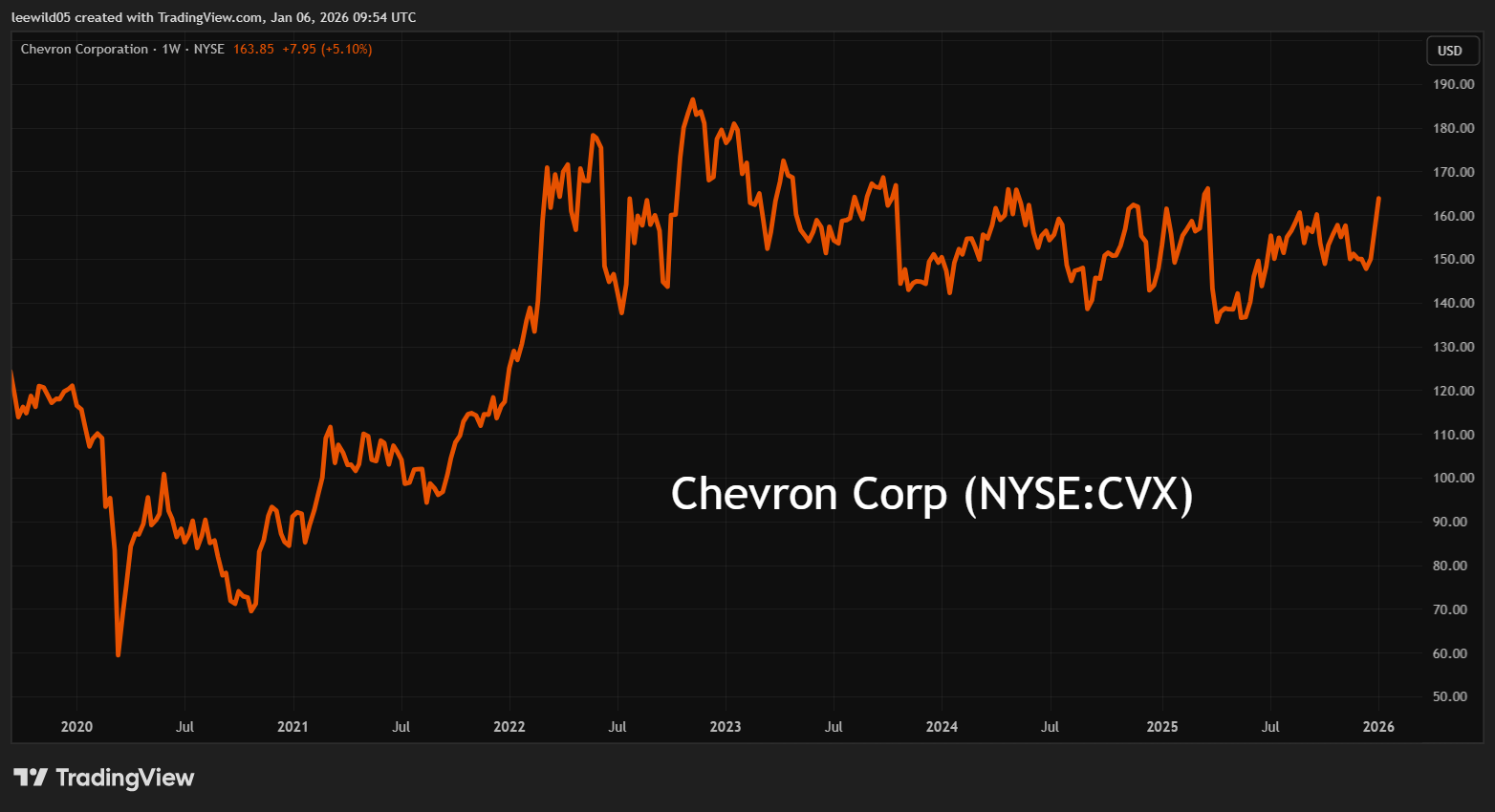

Yet investors were quick to assume a boom ahead for the US oil industry, like US President Donald Trump indicated. Chevron Corp (NYSE:CVX) - seen as best-placed to benefit – saw its stock rise 5% to $164, but it is nothing special in a five-year context:

Source: TradingView. Past performance is not a guide to future performance.

Despite a UK report citing a potential bonanza ahead for Shell (LSE:SHEL), its shares rose only 1% to 2,785p, whereas BP (LSE:BP.) was flat at 438p.

If the Trump administration’s hopes can be achieved, the oil story remains mixed for producers given that higher global production would temper prices. This would be years ahead and, in the meantime, would arguably be a risk premium that should apply for the security risk.

Multinationals probably would want to see sanctions against Venezuela removed and assurances that they’ll get paid. Lessons have been bitter: Venezuela nationalised the industry in the 1970s, and in the 2000s appropriated joint ventures into the state oil company. Most foreign companies left.

- Stockwatch: an outlook for sectors and stocks in 2026

- Investment outlook: expert opinion, analysis and ideas

More positively, if the US can ensure a peaceful transition, then in five years or so oil production could rise and the heavy crude could work well in US Gulf Coast refineries, blended with lighter oil from fracking. The benefits will be well past Trump leaving office, but will accord with a long-term strategy towards fossil fuels and preventing China exercising much influence in South America. Something has to pick up the slack as the fracking boom fades.

Halliburton as the more intriguing play

An 11% rise yesterday in Halliburton Co (NYSE:HAL), the largest US oil services provider, is logical and, interestingly, also affirms a chart uptrend since a double bottom last April/May:

Source: TradingView. Past performance is not a guide to future performance.

The lesson of the mid-19th century Californian Gold Rush – better to invest in picks and shovels than miners – clearly rings true today.

Halliburton shares are not exactly my cup of tea, valuation wise, being a cyclical stock on a growth price/earnings (PE) ratio of around 20 and a slender 2% yield. However, that is frequently the case in US equity valuations, leaving it a question of whether the wider market breaks.

Yet my initial sense is to rate Halliburton a long-term “speculative buy” – more investigation is needed – with the caveat that this US intervention needs to be seen to work rather than chaos unfolding. The shares could also give back some of this 11% initial rise in the near term if the surprise element recedes. But if the Trump administration does achieve what it promises for US oil, Halliburton is at an inflection point.

Unsurprising rises in defence shares

BAE Systems (LSE:BA.) rose 5% to 1,834p and Babcock International Group (LSE:BAB) similarly to 1,329p at around an all-time high reached last September. Both are nowadays on “growth” PE’s around 22x, although the share price is twice the expected earnings per share growth rate, hence expensive PEG ratios of at least 2x. Obviously, that could change if earnings growth kicks in, but for now both seem fairly priced.

- Watch our ii expert tips’ videos for 2026

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

A response was inevitable given this breakdown in international law includes the post-Second World War order of international trade and co-operation. It is being replaced with a return to superpower “spheres of influence” where President Trump has already tweaked the 19th-century Monroe doctrine to “Donroe” – implicating an arms race.

Europe has had a further and sharp reminder that it cannot trust or rely on America. If Trump does try to take Greenland, how can the US not be expelled from NATO given that both countries are members?

Gold rallied but turned volatile intra-day

In morning trading yesterday, the price of gold rose from around 0.5% to 1.5%, which attracted selling before closing up 0.7% at $4,471/ounce.

Source: TradingView. Past performance is not a guide to future performance.

The price action can be seen as affirming that gold’s valuation has got frothy to the extent that it is now teasing out sellers, even when global uncertainty has just shot up.

Yet this US intervention could still go horribly wrong, in which case, and if confidence erodes in the dollar, its inverse pricing relationship with gold would support the metal. What is effectively a US coup d’etat of Venezuela (Trump has made plain the existing regime has no choice but to comply) is likely to underline the case for gold as a hedge in international portfolios.

Yes, gold has become riskier due to its extended valuation in a historic context, but unless central banks change their recent behaviour to sell, and it then drops like it did in late December, it could continue to get bought.

Overall, this ought to be comforting to holders of precious metals mining shares.

Wider potential risk factors for equities

US equities were showing their euphoric side on Monday, considering the near-term challenge to justify US action in Venezuela.

If the situation does prove troublesome and chaotic, coinciding with higher US inflation in the months ahead, markets will definitely become more volatile.

As yet, investors have been reassured on how the annualised US inflation rate was 2.7% in December, the lowest since July and 3% reported for September, also well below consensus for 3.1%. Chief contributors to the rise were energy and food. Annual core inflation was 2.6%, the lowest since March 2021 and versus consensus for 3%.

Inflation, therefore, appears an outlier risk, although I would still be alert to the possibility of a delayed effect from tariffs working their way through. If this were to come as a surprise amid difficult news on Venezuela, equities will sell off.

Second, and with genuine shock potential, is whether China feels emboldened to invade Taiwan in a perceived “window of opportunity”. The US is now focused on Venezuela, has lost credibility as a global hegemon, and an $11 billion (£8.2 billion) weapons package just approved for Taiwan will in due course bolster its defences.

At yesterday’s emergency meeting of the United Nations regarding Venezuela, China denounced the US action for breaking international law, but its military harassment of Taiwan implies that it believes in a sphere of influence.

- China stock market outlook 2026: problems at home

- Experts name fund and trust opportunities at start of 2026

Over Christmas, China engaged military drills around Taiwan, simulating seizure and blockade of the island’s key areas - Taiwan cited 89 military aircraft and 28 warships were involved. This can be regarded chiefly as a show of might against “separatist forces”, according to the Chinese foreign ministry, and also as a rebuke to the US declaring a bumper arms package. Yet it seems to me complacent to assume that China will never act, similarly as during a build-up of Russian weaponry and troops towards the Ukrainian border in early 2022.

“Any sinister schemes to obstruct China’s reunification are doomed to fail”, its foreign ministry says, while Taiwan’s president cites the need to “keep raising the difficulty so China can never meet the standard”.

Overall, an invasion seems less likely to happen given the catastrophic economic impact on China. Severe sanctions would be imposed, decoupling China from the West, and the disruption of the Taiwan Strait would substantially halt Chinese goods exports. China is around 60% reliant on Taiwan for semiconductors, so its technology, electronics and vehicle industries would be crippled.

Economically, it would appear that the West/Taiwan already hold a nuclear weapon against China. Politically the timing could not be better to invade. Obviously, Britain voted to leave the European Union in 2016, aware of likely economic damage, but enough decided that sovereignty was paramount. 2026 will be an interesting test of China’s priorities.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.