Tapping the AI boom beyond the US

Saltydog Investor looks at October’s top funds and finds one backing a lesser-known AI ‘winner’.

3rd November 2025 15:00

by Douglas Chadwick from ii contributor

Young woman using smartphone while standing against a pink digital display in a city in China. Credit: d3sign/Getty Images.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

October got off to a reasonable start, with most global stock markets continuing to make headway after a broadly positive September.

However, when President Donald Trump announced that the US would impose an additional 100% tariff on Chinese goods, effective from 1 November, sentiment quickly reversed. On 10 October, the Dow Jones Industrial Average fell by 1.9%, the S&P 500 lost 2.7%, and the Nasdaq dropped by 3.6%. Other stock markets suffered smaller losses.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

As we have seen before, negotiations then began to defer or avoid the sanctions, and markets started to recover. Later in the month, after trade discussions with Chinese President Xi Jinping in South Korea, Trump agreed to pause the threatened tariffs and reduce some existing ones, signalling a temporary thaw in the trade conflict.

After emerging from the closed-door talks, Trump spoke to reporters and delivered a characteristically upbeat assessment, rating the meeting “12 out of 10” and declaring it a great success, even though no concrete agreements were signed.

During the final week of October, the Dow, S&P 500, and Nasdaq all set new all-time highs, along with other stock markets, including the FTSE 100. In Japan, the Nikkei 225 rose by over 16% during the month, breaking through 50,000 for the first time.

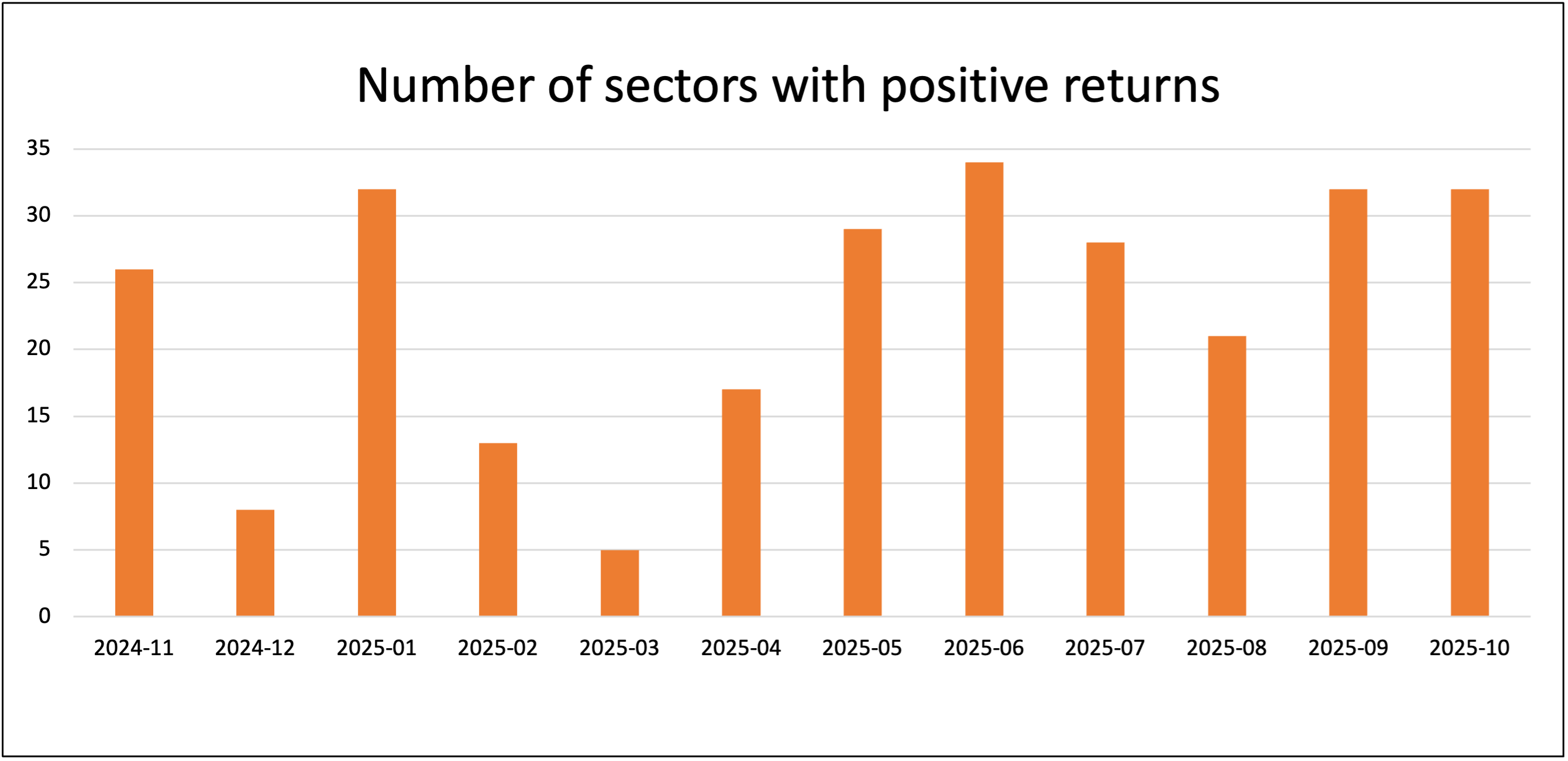

Nearly all the Investment Association (IA) sectors also went up. Of the 34 that we monitor each week, 32 posted gains in October.

Data source: Morningstar. Past performance is not a guide to future performance.

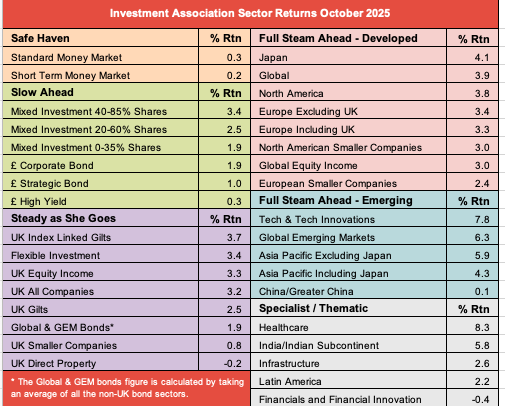

In September, only two sectors went down: UK Direct Property and India/Indian Subcontinent. Last month, the Indian sector recovered, gaining 5.8%, but UK Direct Property continued to drift lower, losing a further 0.2%. The only other sector to fall in October was Financials & Financial Innovation, which ended the month down 0.4%.

The best-performing sector was Healthcare, up 8.3%, followed by Technology & Technology Innovation, which rose by 7.8%.

Data source: Morningstar. Past performance is not a guide to future performance.

In September, the best-performing sector was China/Greater China, up 8.5%, followed by Latin America, up 6.5%, and then Technology & Technology Innovation, up 6.4%. However, the top funds that month were the gold funds from the Specialist sector. Leading the way was the SVS Sanlam Global Gold & Resources fund with a one-month return of 28.6%.

Last month, technology funds dominated. Four of the top 10 funds came from the Technology & Technology Innovation sector. Three came from the Specialist sector but had a strong bias towards technology, as did the fund from the Global sector. The remaining two funds were from the Asia Pacific excluding Japan sector.

Saltydog’s top 10 funds in October 2025

| Fund | Investment Association sector | Monthly return |

| Barings Korea | Specialist | 20.5 |

| Polar Capital Global Tech I Inc GBP | Technology & Technology Innovation | 14.0 |

| Pictet-Biotech | Specialist | 14.0 |

| AXA Framlington Biotech | Specialist | 13.2 |

| Pictet - Robotics | Technology & Technology Innovation | 12.1 |

| Polar Capital PLC-Artfcl Intllgnc I Acc GBP | Global | 11.7 |

| T. Rowe Price Global Tech Eq | Technology & Technology Innovation | 11.6 |

| L&G Global Technology Index I Acc | Technology & Technology Innovation | 10.6 |

| Royal London APAC ex Jpn Eq Tilt | Asia Pacific excluding Japan | 10.4 |

| HSBC Pacific Index | Asia Pacific excluding Japan | 10.4 |

Data source: Morningstar. Past performance is not a guide to future performance.

At the top of the table is the Barings Korea fund.

This fund aims to achieve capital growth by investing at least 70% of its assets in Korean equities or companies that derive most of their revenue from South Korea. Its benchmark is the Korea Composite Stock Price index (KOSPI), which it seeks to outperform over rolling five-year periods, after fees.

It currently has more than 30% of its assets in information technology companies and around 20% in industrials, with additional exposure to financials, consumer cyclicals, and healthcare. Its two largest holdings are SK Hynix and Samsung Electronics Co Ltd DR (LSE:SMSN), both globally significant businesses.

SK Hynix is one of the world’s leading memory-chip manufacturers, producing DRAM and NAND flash products used in AI and data-centre applications. It is now the largest supplier of high-bandwidth memory (HBM), with a roughly 60% global market share.

In the third quarter of 2025, SK Hynix reported a 62% year-on-year rise in operating profit to 11.4 trillion won (£6.7 billion), driven by demand for AI-optimised memory from major clients. This was primarily through sales of HBM3E chips powering NVIDIA Corp (NASDAQ:NVDA)’s AI graphics processing units (GPUs).

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Seven standout funds beating rallying markets

SK Group, SK Hynix’s parent, is also developing South Korea’s largest AI data centre in partnership with Amazon Web Services (AWS) in Ulsan. SK Hynix surpassed Samsung in global DRAM market share in early 2025, capturing roughly 36%, compared with Samsung’s 34%.

Samsung Electronics, Korea’s largest company, is another global technology powerhouse. Its operations span smartphones, semiconductors, displays, and consumer electronics. In the third quarter of 2025, Samsung reported revenue of 86.1 trillion won (£45.9 billion).

The semiconductor business, particularly the Device Solutions Division, was the main profit driver, recording revenue of 33.1 trillion won (£17.6 billion), with a 13% year-on-year increase and an operating profit rise of 79.5% to 7 trillion won (£3.7 billion).

The memory business set an all-time high for quarterly sales, led by strong demand for HBM3E and server SSDs. Samsung confirmed mass production of HBM3E and the shipment of next-generation HBM4 chip samples to key customers.

The Device Experience Division, which includes smartphones and consumer electronics, also performed well, with an 11% quarterly revenue increase driven by successful new foldable phones and flagship launches.

- Top 10 most-popular investment funds: October 2025

- China’s flying: should you go all in or invest across emerging markets?

While many investors focus on US names such as Apple Inc (NASDAQ:AAPL), Nvidia, and Microsoft Corp (NASDAQ:MSFT), there are major technology players across the globe that are just as critical to the digital economy. Companies such as Taiwan Semiconductor Manufacturing Co Ltd ADR (NYSE:TSM), ASML Holding NV (EURONEXT:ASML), and SK Hynix form the backbone of the hardware and semiconductor supply chain that underpins global innovation.

The recent performance of the Barings Korea fund is a reminder that South Korea’s technology giants are not merely supporting acts but key contributors to global progress. They may not dominate headlines, but they play an essential role in the world’s digital infrastructure and have delivered exceptional returns for investors in 2025.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.