Tern shares: analysing the recent price surge

Up one-third already this week, Tern shares are flying, but what does the future hold?

11th May 2021 08:08

by Alistair Strang from Trends and Targets

Up one-third already this week, Tern shares are flying, but what does the future hold?

We reviewed venture capital firm Tern (LSE:TERN) a year ago, finishing our report with the words “For now, the share looks almost ready to fly”. Alas, with the dampening effect of a pandemic, the share price spent the year waffling around. But now, this Tern appears to be attempting to leave the nest and head upward.

Starting the week with a 27% upward surge, some considerable hope remains viable, especially as the share price closed at a level not seen since 2018.

- Tern Plc: here's why this price level is important

- Why reading charts can help you become a better investor

Tern’s speciality is to invest in companies who are involved in the “internet of things”. Wiki’s explanation is probably as succinct as it gets: “The Internet of Things describes a network of physical objects (aka things) which are embedded with sensors, software, and other tech for the purpose of connecting and exchanging data with other devices and systems over the Internet.”

In reality, most of us are exposed to this sort of thing with our cars, everything constantly monitored with high end vehicles even communicating directly to the factory, if a serious fault occurs. The rest of us need to tolerate a mechanic plugging in a cable from a laptop, before making the traditional sharp intake of breath.

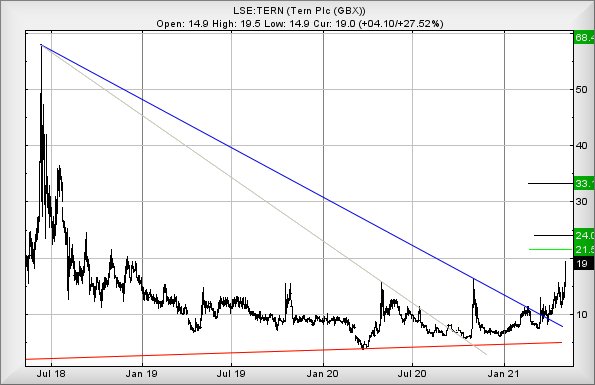

Returning to the share price, whatever has provoked the rise looks interesting, and when we extrapolate price movements since the downtrend was broken in March, we can calculate further gains exceeding 19.5p should make an attempt at 21.5p.

This scenario for a 2p rise is pretty tame, concealing something important. If the price manages to exceed 21.5p, our view regarding price influences changes dramatically. We’re now projecting above 21.5p should attempt an initial 24p with secondary, if exceeded, a longer term 33p along with almost certain hesitation.

Another facet of this acceleration potential gives a long-term calculation of 68p, something which shouldn’t be taken seriously unless the share price manages to close above 33p.

Visually, if it all intends to go wrong, the price needs to crash below 10p. This would be a really bad thing as we cannot calculate an ‘ultimate’ bottom.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and 'top secret' software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know 'how it worked' with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.