Two bank shares for different risk appetites

Whether you want boring or high-risk, this pair of lenders have something for all investors.

12th February 2020 09:34

by Rodney Hobson from interactive investor

Whether you want boring or high-risk, this pair of lenders have something for all investors.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Turmoil is swirling around Swiss banking giant Credit Suisse (XETRA:CSX); its soon to depart chief executive Tidjane Thiam has been a controversial figure in his time. This could be an opportunity to get back to the solid, boring but lucrative lifestyle that Swiss banking was once famous for.

Thiam’s downfall came after one of the more spectacular banking scandals this side of the millennium. Credit Suisse hired private investigators to spy on its former head of wealth management Iqbal Khan, who had joined deadly rivals UBS (XETRA:0UB). Khan is regarded as a top banker and there were fears that he would take Credit Suisse staff and clients across with him.

Unfortunately, Kahn realised he was being followed, confronted the investigators and became embroiled in a brawl with them in the middle of Zurich. The resulting internal Credit Suisse inquiry found that it had previously spied on another of its executives.

- Lloyds and the UK bank sector: Full-year results preview

- Want to buy and sell international shares? It’s easy to do. Here’s how

Thiam has now resigned, though it may well be that the other members of the board, who unanimously agreed to let him go, made it clear that he was carrying the can despite his insistence that he personally knew nothing of the surveillance. Major shareholders have pointed a finger at chairman Urs Rohner as fighting an acrimonious battle to get Thiam out.

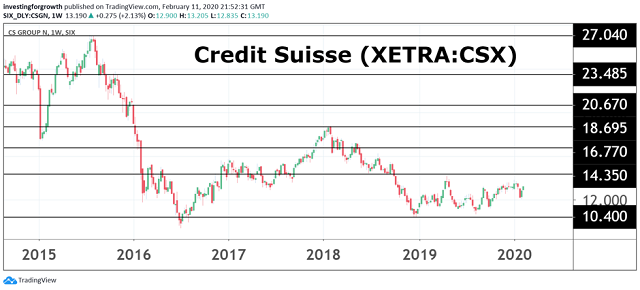

Source: TradingView Past performance is not a guide to future performance

At least there will be a smooth handover, despite the apparent suddenness of Thiam’s departure, and it is to someone who knows the ropes. The new boss is Thomas Gottstein, who has been with Credit Suisse for more than 20 years and is currently head of the Swiss operations.

However, that is not entirely the end of the upheaval that last year saw Pierre-Olivier Bouee resign as chief operating officer before the bank tore up the resignation and fired him instead. Rohner himself is departing in April next year and some shareholders may press him to go sooner to allow the bank to make a clean break.

Thiam is probably best known in the UK for a spectacular rise and fall at his previous employer, insurer Prudential (LSE:PRU), where he was promoted after only a year as chief financial officer to chief executive. He then blotted his copybook with an unsuccessful and wildly overambitious $35 billion bid for US rival AIA. He leaves Credit Suisse on Friday immediately after presenting full-year results for 2019.

We shall see whether they bear out his claim that he has “turned Credit Suisse round”. Analysts believe that they will in fact provide a pleasant surprise. The final quarter could turn out quite well.

UBS has already reported that operating profits almost doubled in the three months to 30 December 30 compared with the same period of 2018. That is a big improvement on the previous nine months, which saw profits fall, and allowed UBS to edge up its dividend for the full year.

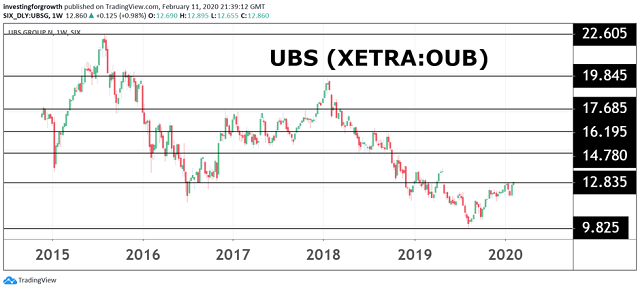

Source: TradingView Past performance is not a guide to future performance

Hobson’s Choice: Since the stock market valuation of Credit Suisse has halved in the five years that Thiam has been at the helm, a new incumbent could do quite a bit better. The shares currently trade at around SFr13.20, having recently topped last April’s high of SFr12, and are possibly heading back to their peak of SFr16 at the start of 2018. Buy up to SFr14.14, the 12-month high. The downside looks limited to SFr12.

UBS is an attractive alternative for those with a lower appetite for risk. At SFr12.90, its yield at 2.75% is more attractive than the 1.9% on offer at Credit Suisse. Buy up to its 12-month peak of SFr13.80 set last April. At worst, the shares should not slip below SFr12 and if they do fall back they will recover before this year is out.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.